[ad_1]

Key Takeaways

Volatility briefly rose in crypto markets last month but is back near all-time lows

Capital flight out of the space has been enormous, with liquidity also at multi-year lows

Trading volume continues to decline, with Binance’s volume down 95% from the peak in 2021

Ethereum is now trading at a similar volatility to Bitcoin

A combination of tight monetary conditions in the economy, as well as crypto-specific scandals and a regulatory crackdown, have all made their mark on the space

Volatility in the crypto markets is back to multi-year lows. After a brief pickup amid the positive ruling on the Grayscale ETF case last month, markets are back to the placid state we have become familiar with this year.

Looking at 90-day annualised volatility, both Bitcoin and Ethereum are close to the lowest levels we have seen. The chart below shows that, aside from three isolated episodes, we have seen volatility in a near-constant state of decline since Q1 of 2022. That marks the infelxion point for the wider economy, when we transitioned to a tight monetary environmen, kicking off what would prove to be a gruesome time in crypto.

The three episodes of reprieve with regard to volatility were the Terra collapse and subsequent summer of bankruptcies (from May 2022), the FTX collapse in November 2022 and, most recently, the banking contagion in March 2022. Otherwise, it has been a downhill ride.

The muted state of the once-volatile asset class is hurting market makers and liquidity. While the entire ecosystem has been ravaged, it is important to note that the macro environment has also pared down in volatility this year, as can be seen on the below chart where we have included the 90-day volatility of the Nasdaq for reference.

However, the scale of the decline in crypto has gone above and beyond. While digital assets remain highly correlated with risk assets (the tech-heavy Nasdaq being the classic example), the capital flight and drain of both volatility and liquidity form the blockchain sector have been unmatched elsewhere.

Such is the lack of volatility that we are now even seeing Ethereum trade with similar volatility to Bitcoin (for a brief period, Ethereum’s volatility was even even lower than Bitcoin’s), despite the former traditionally operating at volatility levels above the world’s biggest crypto.

On the one hand, this is positive for Ethereum and demonstrates a growing maturity. On the other hand, the convergence is emblematic of the drain in overall volatility from the space at large.

Yet, in the context of what is happening across the space, the drawdown is not surprising. We keep mentioning the capital flight and dearth of liquidity; in looking at the numbers, the chasm compared to previous years is enormous.

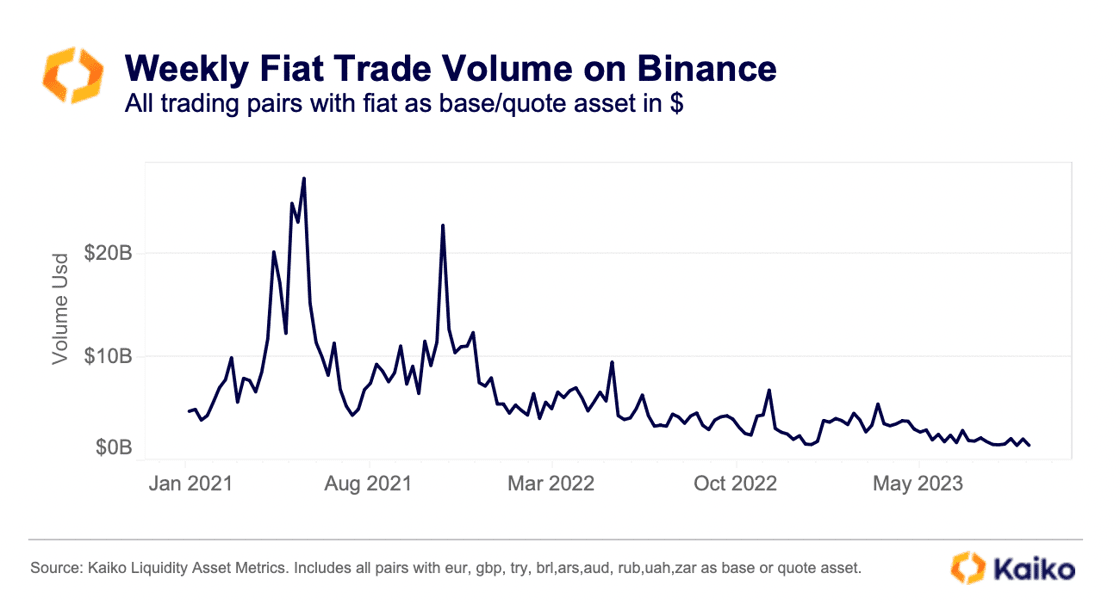

Fiat trade volume on Binance, the world’s biggest exchange with an approximate two-thirds market share of total volume, is down to its lowest level in more than two years. Fiat trade volume on Binance has declined by more than 60% since early January and is down 95% relative to its 2021 peak, according to data from Kaiko.

While Binance is facing myriad issues which may have exacerbated the decline, the underlying fact remains: liquidity has fled the space at the speed of light, to the extent which has surprised perhaps even the most bearish of crypto analysts’ predictions. Not to mention, one of the many accusations levelled against Binance through several lawsuits is an alleged manipulation of trade volume, so perhaps the dropoff is even worse than those above numbers imply.

Given volume and volatility go hand-in-hand, the subsequent drawdown in the latter is, therefore, not surprising. Crypto resides as far out on the risk spectrum as can be, and in a world that has seen interest rates jump from 0% to above 5% – and at a pace among the fastest in modern economic history – the fallout makes sense. And that is without even layering in the numerous scandals and crypto-specific episodes which have pushed market makers and investors alike away.

[ad_2]

Source link