[ad_1]

For the first time since March 16, 2022, the value locked in defi has fallen below $200 billion.

While the cryptocurrency market lost billions this week, the total value locked (TVL) in decentralized finance protocols fell below $200 billion, to $196.6 billion. The TVL in defi has declined 3.16 percent in the last day and stands around $196.6 billion at the time of writing, down 3.16 percent in the last 24 hours.

Bloodbath for Defi protocols

Except for Anchor, all ten of the leading defi tokens have shown significant 30-day TVL percentage decreases. Since the previous month, Curve Finance has lost 11.74 percent, Lido has lost 13.73 percent, Makerdao has lost 16.81 percent, and Convex Finance has lost 10.59 percent.

The Aave Protocol has lost the most in the last 30 days, losing 21.98 percent since last month. Curve Finance is the most used defi protocol, with a market share of 9.56 percent and a TVL of roughly $18.8 billion.

The TVL, which is built on Ethereum-based defi protocols, continues to dominate the roost today, with a 55.55 percent market share worth $109.21 billion. With 14.36 percent of the $196.6 billion in defi TVL, Terra blockchain is the second largest. Terra’s TVL is currently $28.23 billion, with $16.48 billion in Anchor.

Blockchains such as BSC ($12.04 billion), Avalanche ($9.38 billion), and Solana ($6.09 billion) are behind Ethereum and Terra in terms of defi TVL size.

Curve, Lido, Anchor, Makerdao, and Convex Finance are the top five defi protocols in terms of defi TVL size. Last month, Terra’s Anchor Protocol experienced a 4.15 percent increase in 30-day TVL.

Despite the original shedding 21.98 percent, Aave version three (v3) has seen a considerable gain in the last 30 days. Today, Aave v3 has a TVL of roughly $1.38 billion, up 2,711% from last month.

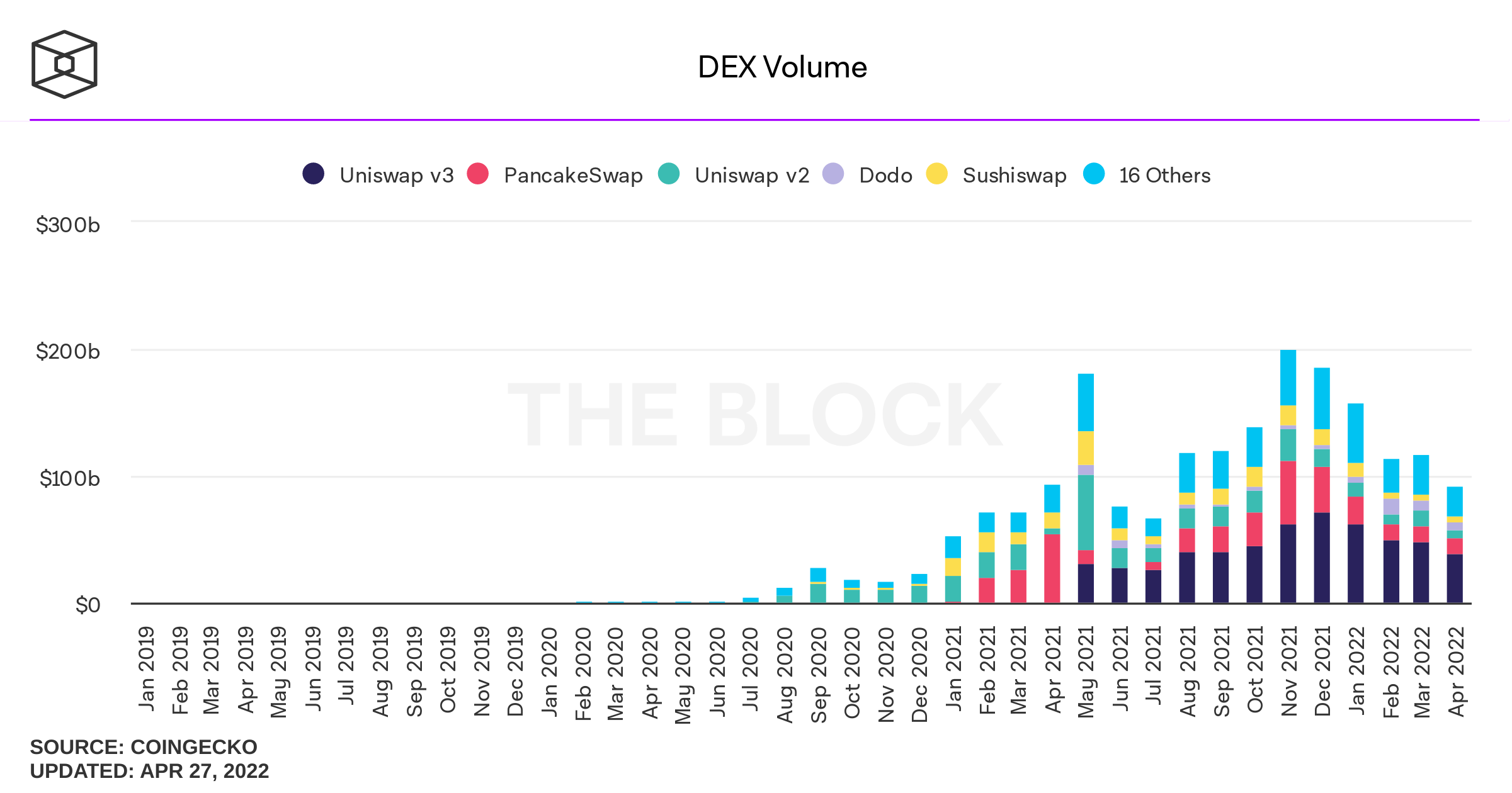

According to statistics, there will be 428 decentralized exchange (dex) platforms with a combined TVL of $61.44 billion by Saturday, May 1, 2022. There are also 142 defi lending protocols with a total value of $48.87 billion.

The volume of dex trades also decreased in April, according to the data. Dex volume was around $117 billion in March, while figures suggest that it was just around $92.18 billion in April.

[ad_2]

Source link