[ad_1]

The Ethereum (ETH) price has fallen since July 3. The price is likely completing a short-term correction in response to the previous increase that began on June 15.

The ETH price created a bearish candlestick the same day it reached a high, confirming that a local top is in place. This initiated the current correction, which could potentially continue for two more weeks.

Ethereum Price Falls After Rejection From Fib Resistance

ETH, the native token of the Ethereum blockchain, was created by Vitalik Buterin. The daily time frame outlook for Ethereum is mixed, owing to both the price action and indicator readings.

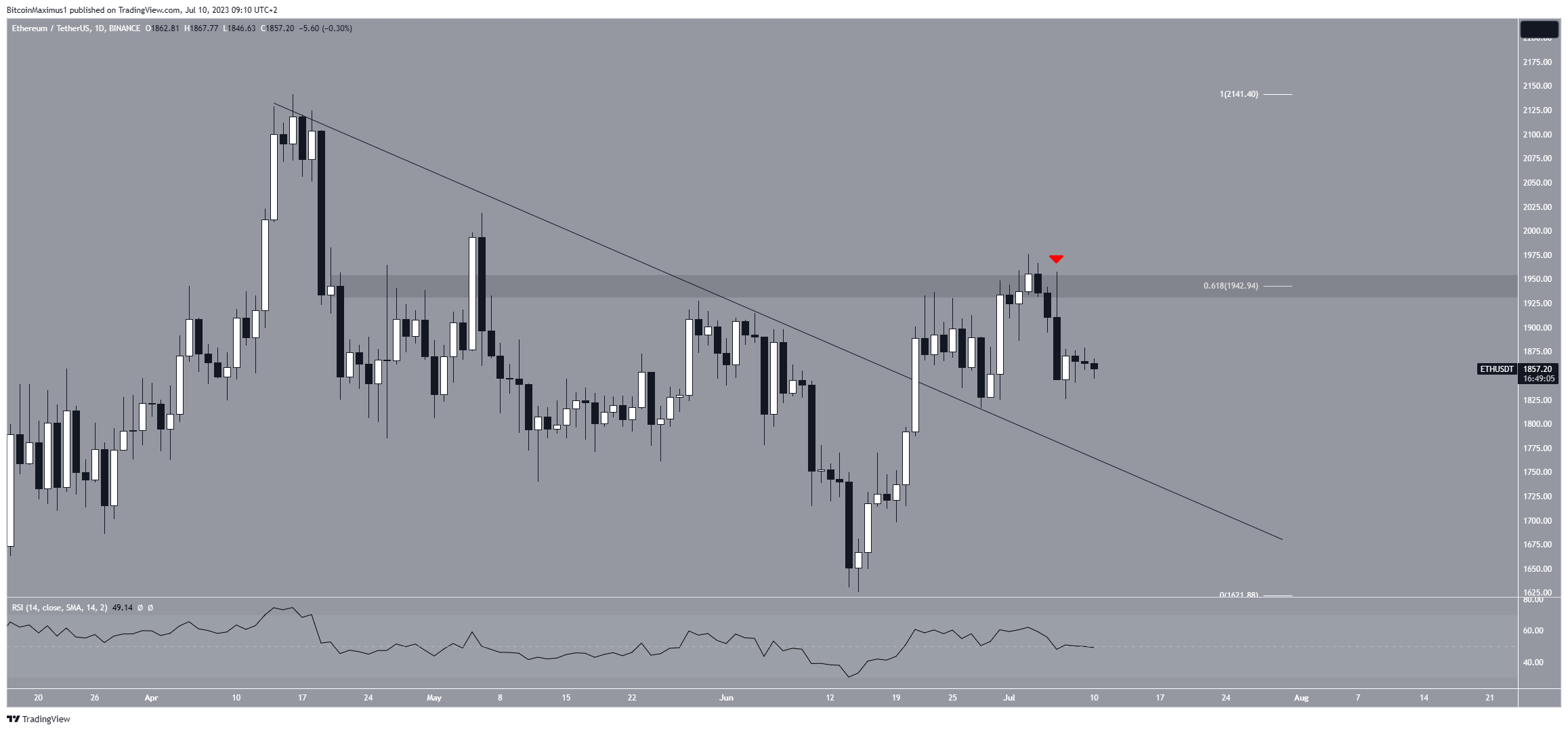

The ETH price broke out from a descending resistance line on June 21, reaching a high of $1,976 on July 3. However, it was rejected by the $1,940 area afterward. This is both a horizontal resistance area and the 0.618 Fib retracement resistance level.

The principle behind Fibonacci retracement levels suggests that after a considerable price movement in one direction, the price will retrace partially to a previous price level before continuing in its original direction. So, the reaction to the 0.618 Fib is crucial to determine the direction of the future trend.

At the time, the price had just bounced at the $1,650 horizontal support area. The ensuing long lower wick (green icon) validated the $1,650 support area and indicated that buyers are taking over.

On July 6, the ETH created a bearish candlestick (red icon), accelerating its rate of decrease. This supports the possibility that the price is in a short-term downtrend.

Technical indicators are undecided. The daily Relative Strength Index (RSI), a tool traders use to assess market conditions, gives an undetermined reading.

The RSI value above 50 and an upward trend indicate a favorable position for the bulls, whereas a value below 50 suggests the opposite.

While the RSI is decreasing, it still holds above 50, meaning that the trend’s direction is undetermined.

ETH Price Prediction: Conflicting Long and Short-Term Readings

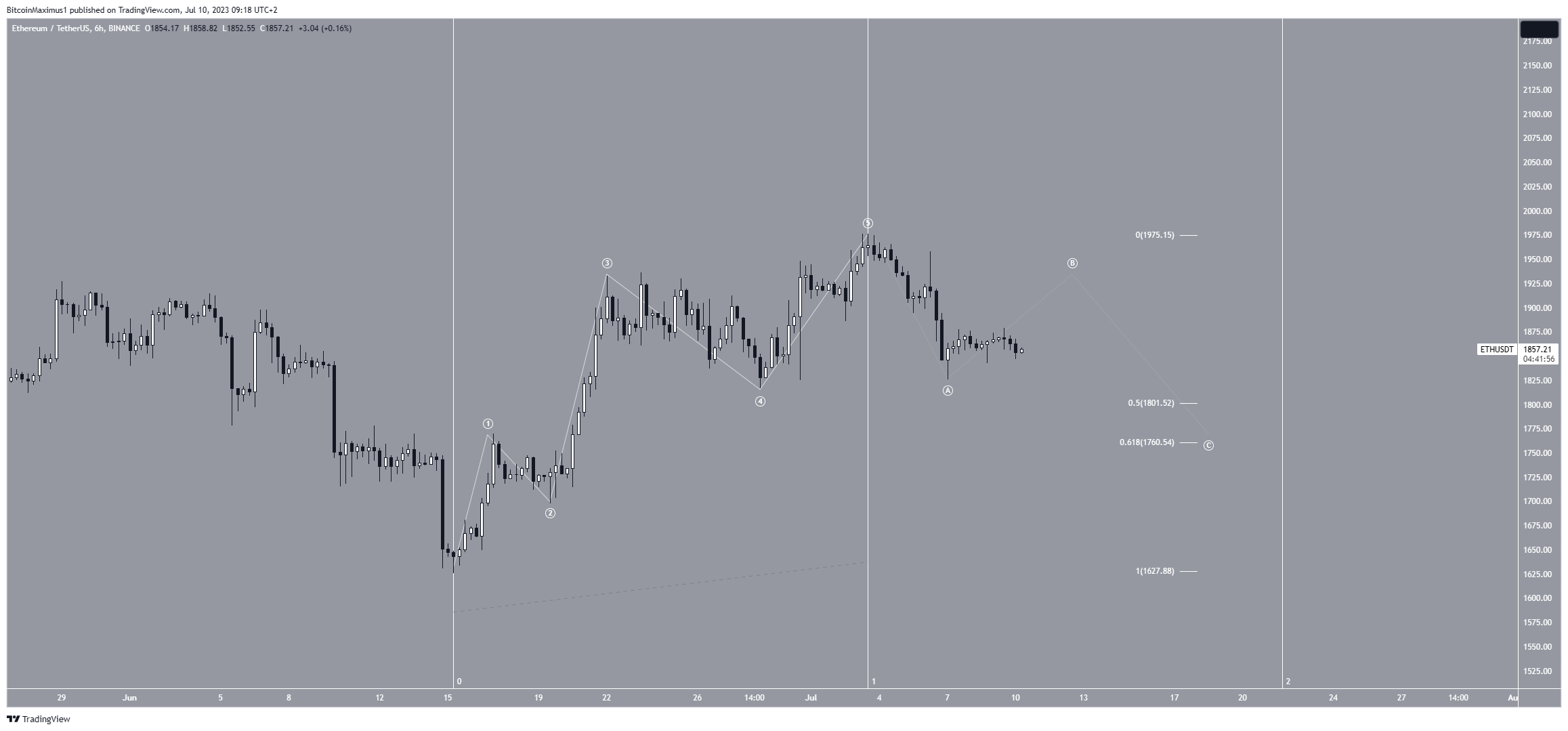

The short-term daily six-hour analysis presents a bullish long-term Ethereum price prediction but a bearish short-term one. This forecast is primarily based on the analysis of price action and Elliot Wave patterns.

The most likely wave count suggests the ETH price began a five-wave upward movement (white) on June 15, preceding the breakout from the resistance line. This led to the July 3 high. So, since there is a five-wave increase, it is likely that the price began a bullish trend reversal.

However, since the movement is complete, the most likely short-term outlook is an A-B-C corrective structure.

Due to the length of the preceding upward movement, this correction could continue up until July 22. The most likely area to complete the correction will be between $1,760 and $1,800, created by the 0.5-0.618 Fib retracement support levels.

Despite this bearish short-term ETH price prediction, moving above the wave five high (red line) at $1,975 will mean that the correction is complete. The ETH price can increase to the next resistance at $2,300 in that case.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link