[ad_1]

Ethereum (ETH) has gained 3% in the last seven days. After a see-saw performance in May 2023, bullish Ethereum whales now appear in control. Will they garner enough momentum to push for the $2,000 price target?

Ethereum (ETH) whales took a cautious approach in the first half of May. However, the positive news allaying fears of a systemic US debt crisis has made investors bullish on ETH and other Layer-1 coins again.

As June 2023 unfolds, can the bullish crypto investors can push for the $2,000 ETH price prediction?

Once Again, Crypto Whales Are Betting Big On ETH

Crypto whales are growing bullish on Ethereum again, according to on-chain data compiled by Santiment. After a lackluster performance earlier in May, the chart below illustrates how ETH whales have almost doubled their trading activity in the past week.

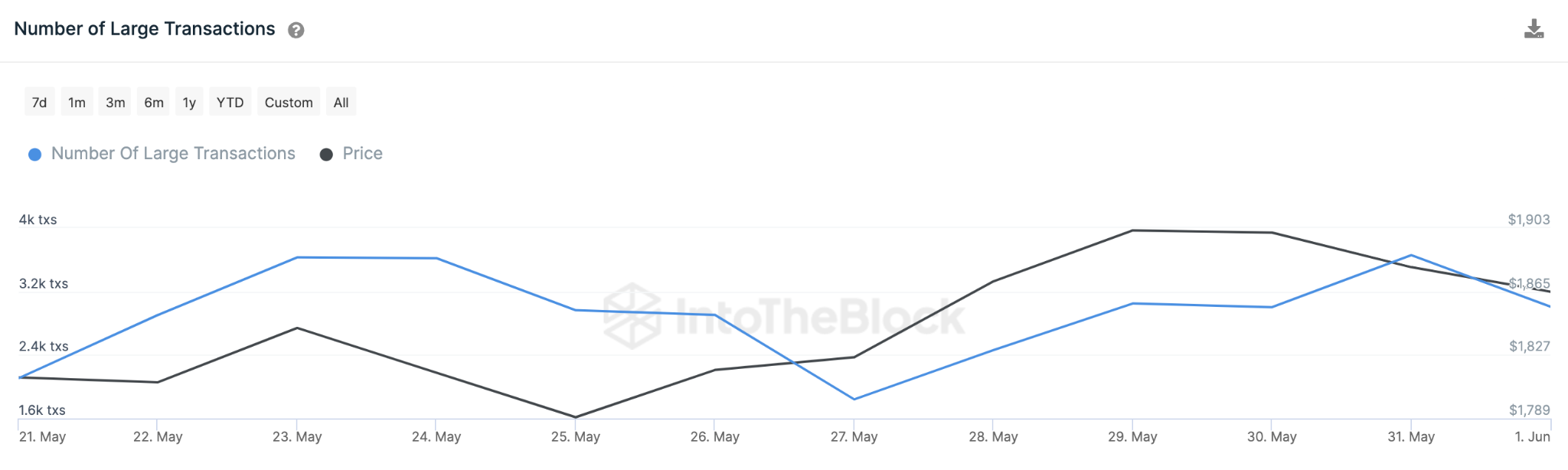

Between May 27 and June 2, the number of Large Transactions involving ETH has nearly doubled.

Specifically, 1,840 Large Transactions were recorded on May 27. And by the close of June 1, the figure rose to 3,660. This represents a 99% surge in whale trading activity over the past week alone.

As the name implies, the Large Transactions metric sums up daily transactions exceeding $100,000. When it rises, it indicates that whales are increasing their bets on the underlying cryptocurrency.

Since whales are usually large institutional investors or high net-worth individuals, they wield significant influence. If other strategic investors decided to mirror the whales’ bullish trading activity, it could cause ETH to enter a prolonged rally,

Ethereum Holders Are Moving Coins Off Exchanges

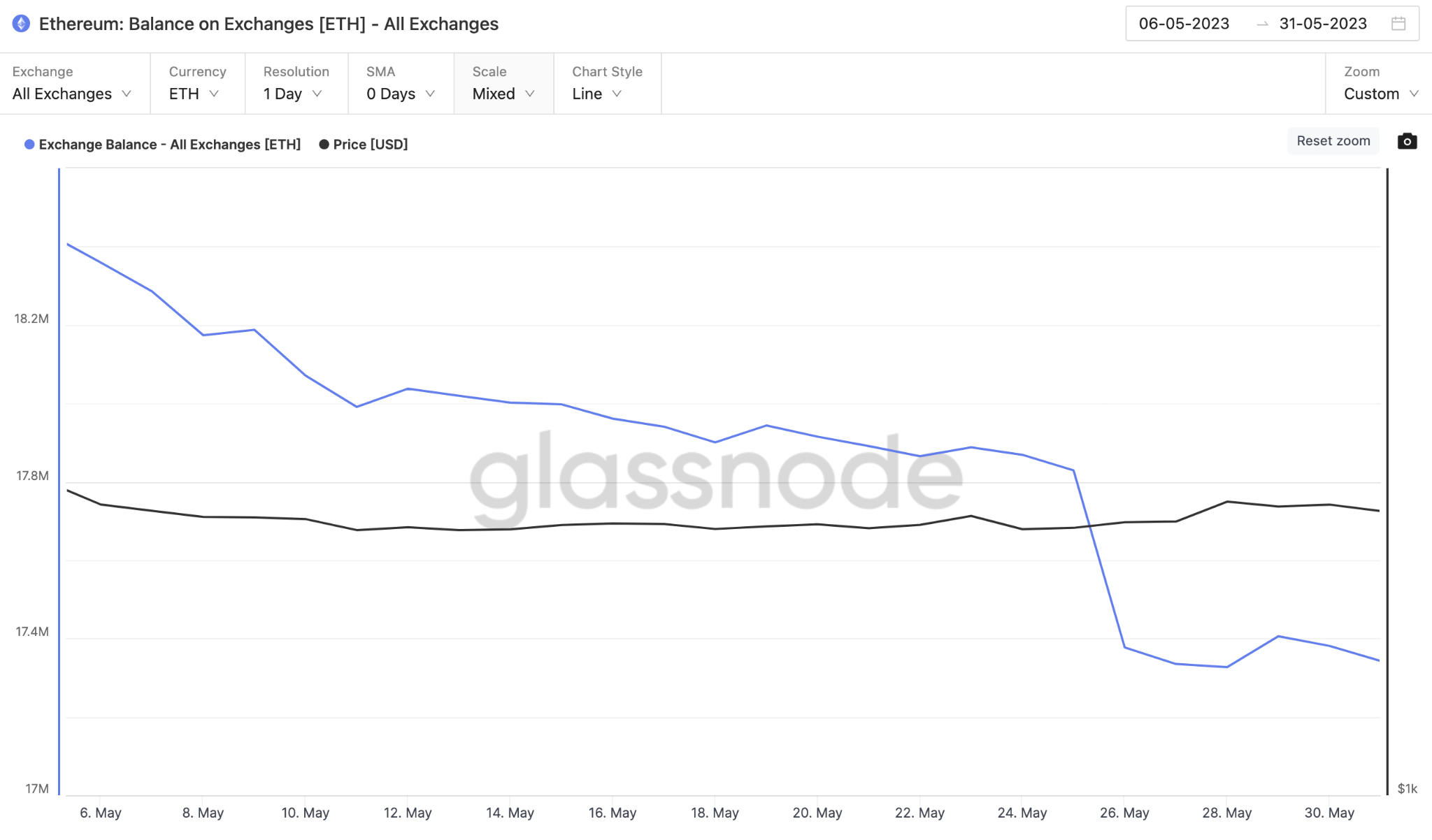

Despite the recent uptick in price, ETH holders have continued to move their assets off exchanges. The Glassnode chart below illustrates how they have moved another 486,000 ETH between May 25 and June 2.

Balance on Exchanges evaluates the number of coins holders have deposited on crypto exchanges. Typically, when it rises, it indicates that investors could be looking for short-term trading opportunities.

Conversely, when the Balance on Exchanges declines considerably, as seen above, it temporarily reduces market supply.

In conclusion, the renewed optimism among Ethereum whale investors and the drop in exchange balance could result in some bullish price action for ETH.

ETH Price Prediction: Potential Break Out Towards $2,300

Considering the bullish activity among the whale investors, ETH price might rise toward $2,300 in the coming weeks.

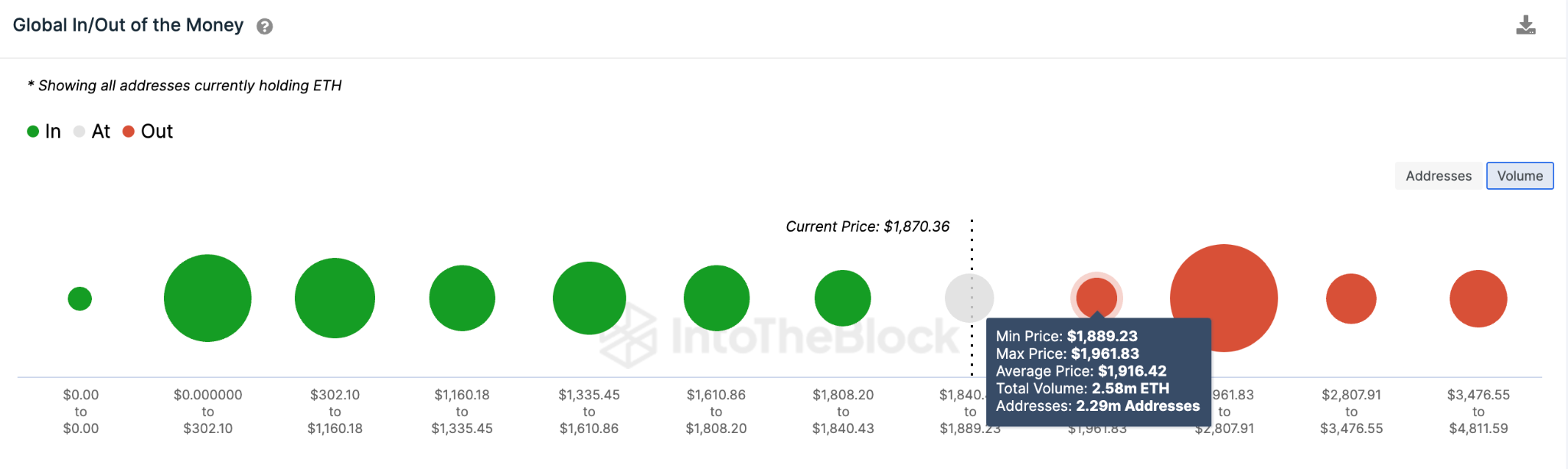

However, IntoTheBlock’s Global In/Out of The Money Around Price (IOMAP) data suggests that ETH will face an initial resistance around the $1,900 mark.

As highlighted below, 2.29 million investors that bought 2.58 million ETH at an average price of $1,916 could mount a sell-wall.

However, if the bulls prevail, as expected, the price could rise further toward $2,300

On the other hand, the bears could invalidate the bullish ETH price prediction if it unexpectedly drops below the critical $1,800 support zone.

But, the 1.86 million investors that purchased 5.86 million ETH at a minimum price of $1,808 will likely prevent that. Although unlikely, ETH could retrace further toward $1,700 if that support level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link