[ad_1]

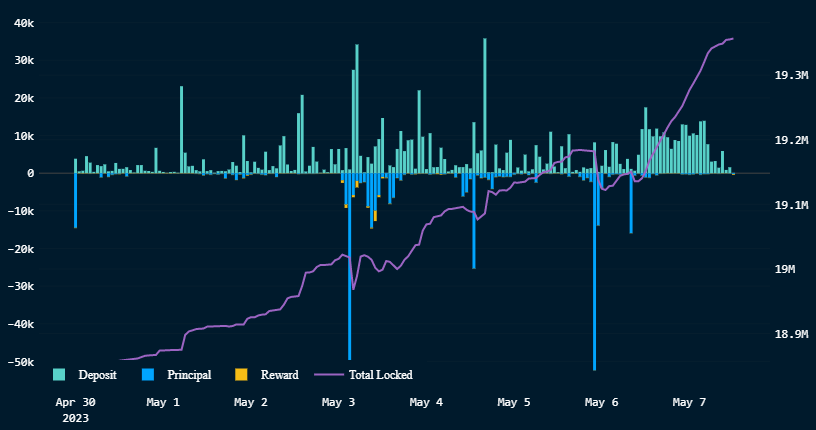

The total amount of ETH deposited on the Ethereum Beacon Chain since the Shanghai upgrade has now exceeded the withdrawals made during the period.

Since the Shappella upgrade was completed on April 12, 2.32 million ETH has been deposited on the Beacon Chain, while 2.28 million ETH has been withdrawn.

ETH Staking Sees Growth

This means there is a positive net flow of 32,000 ETH, pushing the total amount of staked ETH to 19.3 million — roughly 15% of ETH supply.

BeInCrypto previously reported that staked Ethereum deposits have consistently outpaced withdrawals during the past week. According to the Nansen dashboard, over 200,000 ETH was deposited in the last 24 hours — while less than 10,000 ETH were withdrawn during the same period.

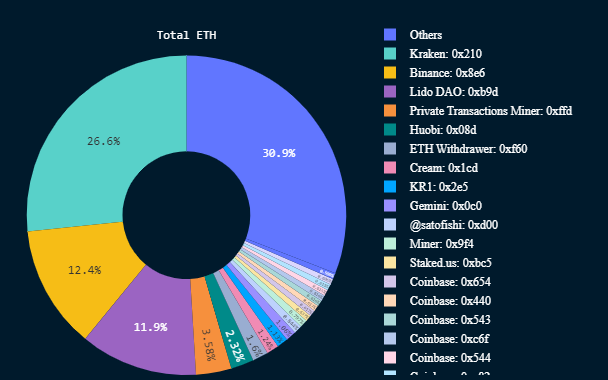

Centralized Exchanges Dominate Staked Ethereum Withdrawals

A breakdown of the entities withdrawing staked Ethereum shows that centralized exchanges like Kraken, Binance, and Coinbase dominate it.

According to Nansen’s dashboard, these firms are responsible for over 50% of withdrawals, amounting to around 1.2 million. Kraken alone has withdrawn 609,410 of all the ETH, while Binance and Coinbase have withdrawn 624,650 ETH.

Other centralized entities with large withdrawals include Huobi, Gate.io, and Gemini, which removed 53,040 ETH, 36,560 ETH, and 24,200 ETH, respectively. Bankrupt crypto lender Celsius has also withdrawn over 6,000 staked Ethereum.

While most offshore exchanges have withdrawn only their rewards, regulatory troubles have made U.S.-based exchanges to make full withdrawals.

The U.S. Securities and Exchange Commission (SEC) fined Kraken $30 million over its failure to register its staking services. Coinbase and Gemini are also facing legal actions from the financial regulator.

Liquid Staking Protocols TVL Rises

Meanwhile, liquid staking protocols are the major gainers as the total value of assets locked (TVL) on them has risen to $16.40 billion — making it the largest DeFi category, according to DeFillama data.

Nansen’s dashboard shows that these protocols are responsible for most of the staked Ethereum deposits since the Shanghai hard fork.

According to DeFillama data, Lido remains the dominant player in the space. Its TVL rose 10.56% in the last 30 days to $12.23 billion.

However, its growth pales significantly against rivals like Rocketpool and Frax Ether which increased 27.88% and 43.82% to $1.55 billion and $345 million, respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link