[ad_1]

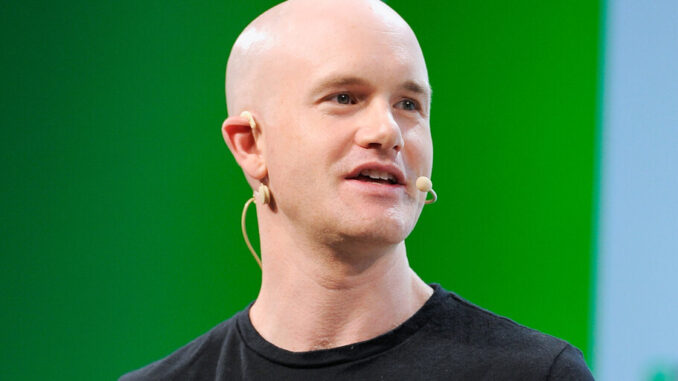

Coinbase CEO Brian Armstrong believes “flatcoins” are the next iteration of stablecoins.

“It’s a new thing on the horizon,” Armstrong said in a recent interview discussing the future direction of the exchange. “There’s a couple teams working on it. We’re not building something in that realm yet, but we’re interested in it,” he added.

Flatcoins, a term first mentioned on Twitter by ex-Coinbase CTO Balaji Srinivasan in 2021, are designed to move in line with inflation, instead of being pegged to a currency or asset.

It’s not the first time the Coinbase CEO has discussed the technology. In a Twitter thread in late August, Armstrong placed flatcoins top of a list of 10 crypto ideas he was most excited about.

1/ I’m sharing the 10 ideas I’m most excited about in crypto right now. If you’re building something in crypto or thinking about doing so – check it out.

We’re building lots at Coinbase, but we don’t have time to tackle everything. So I figured I’d share these. Bear markets are… pic.twitter.com/XKzCkMaOOT

— Brian Armstrong 🛡️ (@brian_armstrong) August 30, 2023

What are flatcoins?

Flatcoins are a type of stablecoin designed to track with inflation, as opposed to stablecoins, which are pegged to the nominal value of a currency or asset.

By tracking inflation, it is argued, flatcoins offer better retention of value than stablecoins, offering a better return on their investment.

Global inflation has risen sharply in the last two years, according to the World Bank, meaning the purchasing power of a currency has declined.

Instead of fiat currency, projects typically try to follow a basket of assets to collateralize the coin.

In examples seen by Decrypt, developers use a public cost-of-living index such as the Consumer Price Index (CPI) or a proprietary cost-of-living index such as Truflation to calculate the value of the flatcoin on a daily basis and adjust the supply of the coin accordingly.

Examples of flatcoins

There are a number of projects currently building flatcoins. Nuon, which claims to be the first true flatcoin, is an inflation-proof coin built on Ethereum.

Spot, meanwhile, is pegged to the cost of living in the United States, whereas Solana-based International Stable Currency (ISC) is pegged to a mixed bag of assets including bonds, treasuries and gold. Others, like Collypto, track real estate and commodities for collateral.

“Existing US Dollar-pegged stablecoins are not only inflationary, but they are also border-line predatory,” Richard, the pseudonymous co-founder of ISC, told Decrypt.

He added that current stablecoins take customer deposits and invest them at their discretion. “When market conditions are good, they make billions in profit. When market conditions are bad, users are holding depegged stablecoins. This means users are taking all the risk while the big boys are taking all the returns on that risk,” he explained, adding that the “best-case scenario” is that “nothing blows up, but their purchasing power gets eaten away by inflation.”

What makes flatcoins attractive, Richard said, is that, “Not only do they protect purchasing power, but they also reward users for the risk they take.”

He added that he expects to see a “long tail” of non-collateralized debt position (non-CDP) flatcoins follow ISC onto the market. A CDP stablecoin is one that uses smart contracts to mint stablecoins and liquidate positions if the underlying collateral drops; non-CDP stablecoins don’t use smart contracts to mint and collateralize.

Flatcoin challenges

As with any coin in crypto, there are challenges to overcome. To track an inflationary rate or basket of assets, the flatcoin creator must hold enough assets to compensate for losses incurred when investors pull out funds or assets depreciate.

Some projects use yield farming to achieve this, but decentralized finance (DeFi) platforms can and have been targets of hacks, making them potentially risky.

Although Armstrong is excited about the prospect of flatcoins, they face an uncertain regulatory environment. In February this year, the Canadian Securities Administrator announced plans to prohibit non-fiat-backed stablecoins, meaning flatcoins could face further hurdles.

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link