[ad_1]

Singapore investment firm Temasek has implemented compensation cuts for the employees behind the investment in FTX. The company had invested $275 million in the crypto exchange and related entities.

Employees of Singapore investment firm Temasek who were responsible for the firm’s investment in FTX, have seen their salaries reduced. Bloomberg reported that the state-owned investment firm’s employees behind the investment were given the pay cut as a result of “collective accountability.”

Temasek Wrote Off $275M FTX Investment

The total investment that Temasek put into Sam Bankman-Fried-led entities amounted to $275 million. Chairman Lim Boon Heng said in a statement,

“As alleged by prosecutors and as admitted by key executives at FTX and its affiliates, there was fraudulent conduct intentionally hidden from investors, including Temasek. We are disappointed with the outcome of our investment, and the negative impact on our reputation.”

Temasek owned a 1% stake in FTX International and a 1.5% stake in the U.S. arm of the exchange. The firm emphatically stated later that the investment was not one in cryptocurrencies specifically. In any case, Temasek appears far more cautious of the industry at this point.

Temasek has already dismissed the FTX investment, writing the $275 million it put into it off in November 2022. At the time, it said that it was writing it down “irrespective of the outcome of FTX’s bankruptcy protection filing.”

It was a big loss for Temasek, but it was far from the only or biggest figure to have been affected by the exchange’s bankruptcy. The firm did not that it had executed a due diligence process for FTX and that a review of the latter’s financial statement showed that the exchange was profitable.

Temasek Denies Rumors of New Investment

Temasek has been making headlines in the crypto industry for other reasons. The firm recently rejected the rumor that it was making a $10 million investment in the algorithmic currency system Array. It outright called the information fake news.

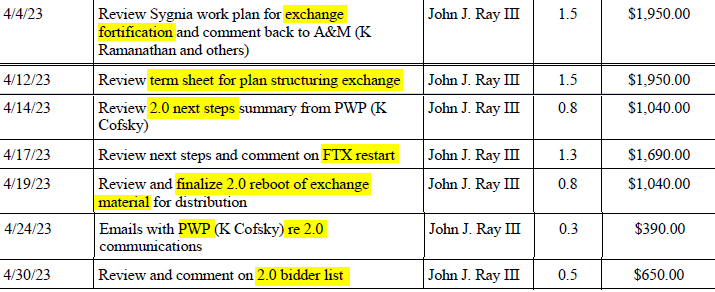

Meanwhile, FTX CEO John Ray III has been busy working to steer the ship. There are rumors that there could be a reboot of the exchange, in what the crypto community called an FTX 2.0 reboot.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link