[ad_1]

Within Germany’s finance sector, Bundestag member Joana Cotar has recently announced her support for recognizing Bitcoin as legal tender.

This marks a potential paradigm shift in the country’s approach to digital currencies and contrasts sharply with the European Central Bank’s (ECB) current efforts to develop a digital euro central bank digital currency (CBDC).

Could Germany Be Next to Adopt Bitcoin as Legal Tender?

Cotar’s advocacy for Bitcoin stems from a desire to bring the cryptocurrency into the mainstream of German finance. She is spearheading a “preliminary examination” to establish a legal framework that would formally recognize Bitcoin in this capacity.

Her approach is not just about embracing digital currency but also about crafting a balanced regulatory environment. Cotar stated,

“This includes ensuring the legal security for companies and citizens.”

She also addressed challenges such as money laundering and tax evasion, often associated with Bitcoin usage.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

To further her cause, Cotar has initiated the “Bitcoin in the Bundestag” program, aimed at educating her parliamentary colleagues about the myriad benefits of Bitcoin. This initiative underscores the importance of privacy protection, robust security standards, and a regulatory approach that avoids excessive restrictions.

Unlike her contemporaries, who often focus on the broader crypto spectrum, Cotar’s efforts are exclusively Bitcoin-centric. She believes in the unique technological attributes of Bitcoin and its significance to society, affirming,

“My initiative is Bitcoin only.”

Digital Euro Pushback

Cotar’s stance also includes a clear opposition to the digital euro CBDC. She argues that Bitcoin’s decentralized nature makes it a more fitting digital asset for Germany, enhancing financial freedom and privacy.

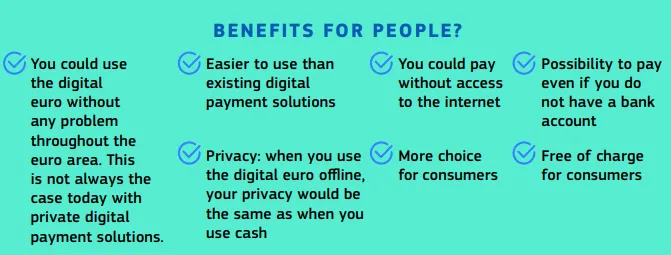

This viewpoint contrasts with the ECB’s ongoing project to create a digital euro. The ECB envisions the digital euro as a universally accessible digital currency offering high levels of privacy and instant payment settlements.

The ECB, led by President Christine Lagarde, is advancing to the preparation phase of the digital euro project, focusing on designing it as a digital form of cash for all types of digital transactions.

“We need to prepare our currency for the future,” Lagarde commented. She further emphasized the ECB’s vision of a digital euro that meets the highest privacy standards and is free for digital payments.

While Cotar advocates for the adoption of Bitcoin, the ECB continues to work closely with European institutions to determine the optimal design of the digital euro, ensuring it aligns with people’s needs and preferences. This development reflects the broader trend of CBDC adoption worldwide. Countries like Ireland, Spain, France, and Italy are actively exploring digital euro prototypes.

Cotar’s push for Bitcoin as legal tender in Germany could position it as a pioneer in adopting Bitcoin at a governmental level. This move also has the potential to influence other nations to reconsider their stance on Bitcoin. This is especially true considering Germany’s economic influence in Europe and globally.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

[ad_2]

Source link