[ad_1]

Grayscale Chief Legal Officer Craig Salm said the US Securities and Exchange Commission (SEC) could soon give approval to Bitcoin exchange-traded funds (ETFs) should it lose the Grayscale lawsuit.

He estimates that ETF approvals could occur in October if the judge issues a decision on Grayscale’s lawsuit within the next month.

Grayscale Could Lead to Major TradFi ETF Approvals

According to Salm, several companies await rulings on applications whose approval could be catalyzed by a Grayscale victory.

Last year, Grayscale sued the SEC for rejecting its application to convert the Grayscale Bitcoin Trust into a spot ETF. It hired former Obama lawyer Donald B. Verrilli Jr. to argue the SEC’s ruling was ‘arbitrary and capricious’ for rejecting an application citing the same Bitcoin price reference as several approved Bitcoin futures ETFs.

Want exposure to Bitcoin without the hassle of custody? Learn about Bitcoin futures here.

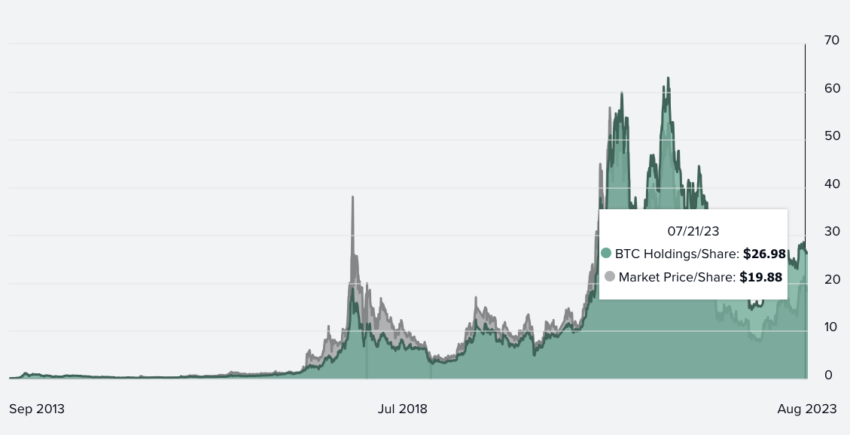

If Grayscale wins, GBTC shareholders can align the trust’s shares with Bitcoin’s net asset value.

Last month, BlackRock, Fidelity, and others also filed applications with the SEC to launch spot Bitcoin ETFs. Additionally, its CEO, Larry Fink, appeared on Fox News after the application to promote the product.

Notably, BlackRock’s filing lists the CME/CF rate used by other Bitcoin exchange-traded products in the US. The CME price is sourced from several reliable exchanges, reducing the chances of market manipulation.

ETF Rejections Could be Politically Damaging for Gensler

Salm’s sentiments echo those of Bloomberg ETF analysts Eric Bahunas and James Seyffert, who recently increased the odds of a spot Bitcoin ETF launching this year to 65%. The analysts suggest that BlackRock and Democrats could make ETF denials “politically untenable” for SEC chair Gary Gensler.

Additionally, Bahunas and Seyffert Gensler point out that the SEC’s tacit approval of Coinbase’s Bitcoin business signifies a softening stance. Gensler has also previously said that Bitcoin could be a commodity.

If codified, these views could defer Bitcoin’s regulation and enforcement away from the SEC.

In the meantime, Grayscale earned $40 million in revenues from its GBTC and Ethereum Trusts in July.

Got something to say about Grayscale’s opinion on ETF approvals or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link