[ad_1]

US labor market data for May is due on Friday the 2nd of June.

The data, which is closely scrutinized by policymakers at the US Federal Reserve, could trigger volatility in the Bitcoin market, depending on how and if it impacts expectations for further interest rate hikes from the US central bank.

According to the media of a series of polls of economists, the labor market is seen adding 193,000 jobs in May, slightly slower than the 253,000 pace at which jobs were added in April.

Meanwhile, the unemployment rate is seen ticking higher to 3.5% from historic lows of 3.4% and the MoM pace of earnings growth is seen moderating to 0.3% from 0.5%.

Should the data come out as expected, then that will indicate that the US labor market continues to hum along nicely, pushing back against the idea that the US is anywhere near entering into a recession.

That could weigh on cryptocurrencies like bitcoin if it triggers markets to start rebuilding expectations for more tightening from the Fed.

But recent communications suggest that, even if the Friday jobs report tops expectations, that may not be the case.

Fed Signals Pause Likely at This Month’s Meeting

Fed policymaker and nominee to pick up the spot as Vice Chairman Philip Jefferson on Wednesday stated his preference for the Fed to pause its interest rate hiking cycle at this month’s upcoming meeting.

“Skipping a rate hike at a coming meeting would allow the committee to see more data before making decisions about the extent of additional policy firming,” Jefferson said.

His remarks echoed that recently communicated by Fed Chair Jerome Powell in a speech last month.

Powell cited a desire to observe the lagged effect of the last 15 months of interest rate tightening, as well as concerns about tighter credit conditions in wake of March’s mini “bank crisis”, as reasons to be more cautious.

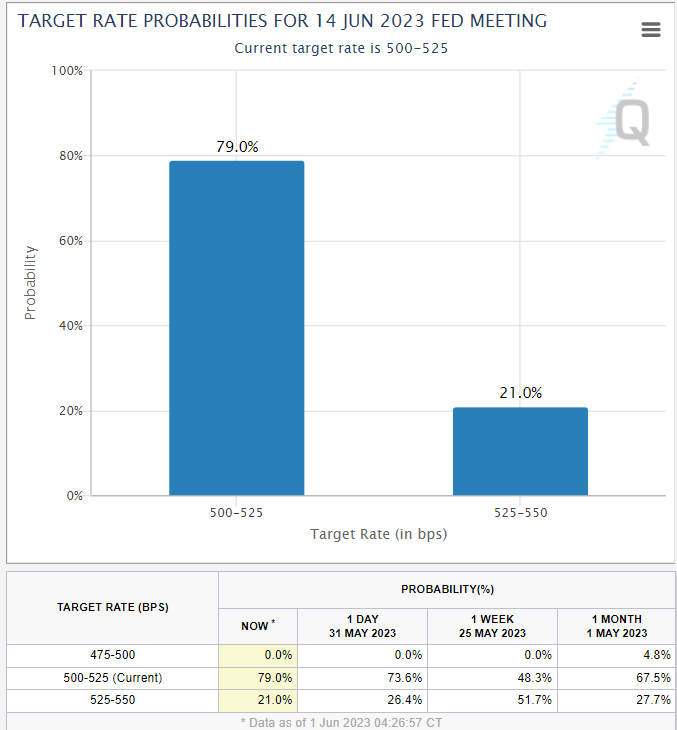

According to the CME’s Fed Watch Tool, US interest rate futures markets imply that there is an 80% probably that the Fed leaves interest rates unchanged at 5.0-5.25% this month, despite some Fed policymakers expressing their preference for continued tightening.

In wake of recent communications from core Fed policymakers like Jefferson and Powell, even a strong jobs report may not shift these expectations much.

But Downside Bitcoin Price Risks Remain

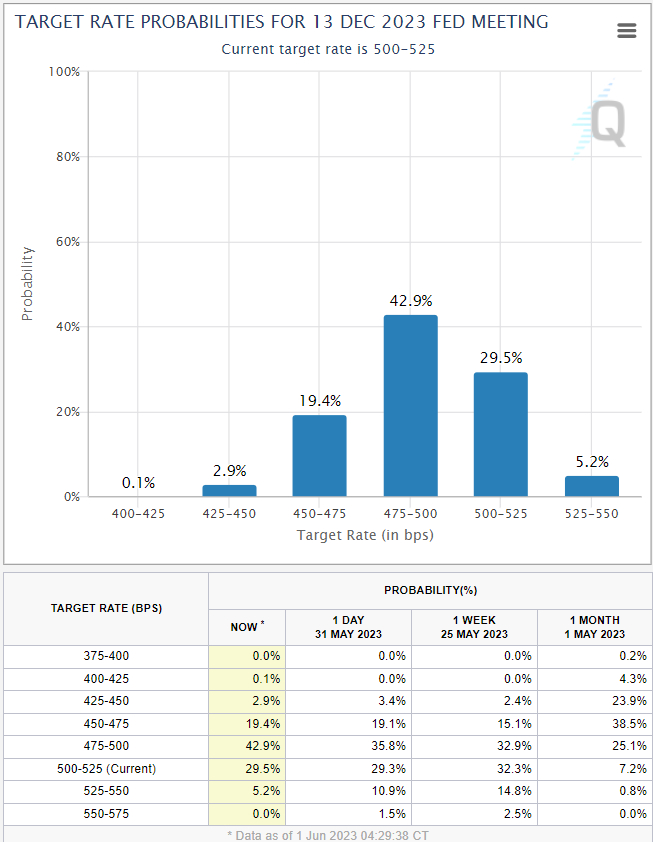

But a much stronger-than-expected jobs report may still undercut expectations for Fed interest rate cuts before the end of 2023, which could weigh on Bitcoin.

The CME’s Fed Watch Tool currently implied about a more than 65% chance that the Fed will have cut interest rates by at least 25 bps from current levels by the end of the year.

A strong jobs report could thus reinforce the recent bearish trading bias seen in the Bitcoin market.

Prices were last in the $26,800s, almost bang on the 100-day Moving Average and slightly below the 21DMA.

Technicians largely remain bearish in light of bitcoin’s recent rejection of its 50DMA and a downtrend from the yearly highs in the low-$28,000s.

Many think a retest of recent sub-$26,000 lows is likely, and that bitcoin may be in the process of forming a descending triangle structure, a break to the downside of which could trigger a test of, or even break below key long-term support in the low-$25,000s.

[ad_2]

Source link