[ad_1]

Banking and money transfers in the United States can often be a painstakingly slow process. Unlike in many countries where the transfer of funds can occur instantaneously, moving money between US accounts can take days. However, the US Federal Reserve appears to be aware of this and plans to compete with crypto.

The Fed has developed FedNow, a high-speed transportation lane that could potentially revolutionize the banking industry, allowing bank transfers to occur within seconds just like cryptocurrencies.

US Federal Reserve to Speed Up the Traditional Banking System

The Federal Reserve has recognized the need to evolve to stay relevant in a world where financial transactions can be executed instantly with cryptos. Launched in July, FedNow aims to revolutionize the American banking system. Until now, it has been notoriously slow, often taking days for funds to be transferred between accounts.

Although digital platforms like PayPal’s Venmo and Block Inc.’s Cash App offer quick workarounds, they merely mask the slow mechanics of the traditional banking system.

FedNow aims to cut through this red tape. It wants to facilitate instant bank transfers and finally bring the US banking system up to speed with countries that already offer near-instant bank payments.

The Automated Clearing House (ACH) has been the traditional method of transfer for decades. This system lumps transactions together, processing them at intervals that can take days to complete.

This slow pace has often resulted in consumers abandoning financial transactions due to their lengthy processing times. Additionally, it has been especially costly for those living paycheck to paycheck who face late fees or overdraft penalties.

FedNow: Is It a Game-Changer?

One question many might ask is why have not banks already solved this problem? The short answer is they have had little incentive to do so.

With income derived from overdraft fees and the ability to earn yields from short-term securities, speeding up the process was not a priority.

Some banks even offer their high-speed transfer platforms, such as Zelle or the real-time payments system (RTP). However, these are mainly marketed to business customers. While advertised as real-time services, these too often fall back on the legacy system and the bank extends short-term credit until the payments settle.

FedNow’s introduction signifies the Federal Reserve’s intention to compete with crypto, leveraging its instant payments feature.

However, with this feature comes a caveat. Once a payment is made, it cannot be canceled or put on hold. Furthermore, unlike credit cards, there are no rewards or fraud protection with FedNow.

A Step Toward the Digital Dollar or Not?

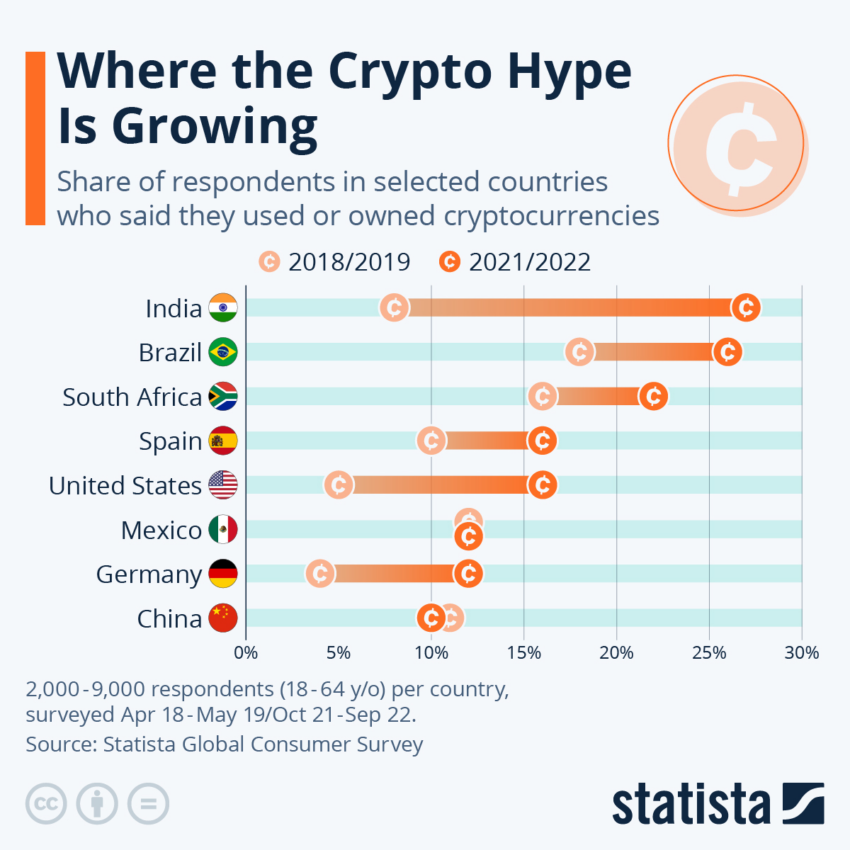

Despite the limitations, the introduction of FedNow has spurred rumors of a transition toward digital currency. This narrative has been fueled further by the rise in crypto’s popularity and the declining use of physical cash.

These rumors were further heightened by politicians speculating about a possible official government-backed digital currency to replace the dollar. However, the Federal Reserve has denied these claims, asserting that FedNow is merely a tool to expedite bank transfers.

On the other hand, the Commodity Futures Trading Commission (CFTC) has highlighted significant risks associated with digital assets. It raised questions about the financial sector’s ability to manage these new challenges.

The volatility and unpredictability associated with cryptos such as Bitcoin have reinforced the need for robust risk-management rules. Consequently, prompting a reassessment of the CFTC’s existing regulatory framework.

CBDCs: The New Frontiers in Money Competition

Central Bank Digital Currencies (CBDCs) are yet another development stirring the financial waters. Viewed as a response to the rise of cryptocurrencies, CBDCs aim to combine the stability of traditional currencies with the speed and accessibility of digital ones.

However, the promise of privacy protection, a fundamental feature of cryptocurrencies, remains unfulfilled in many proposed CBDCs.

Christine Lagarde, European Central Bank President, has stated that central banks have no interest in using consumer personal data in the provision of digital cash.

“Is it going to be as private as cash? No. So a digital currency will never be as anonymous and as protecting of privacy, in many respects, as cash. Cash will always be around [for privacy],” said Lagarde.

Still, it raises the question of whether a US CBDC could rival its international counterparts on the privacy front.

This competitive landscape, where the value proposition of privacy has become significant, could define the success of CBDCs and, more broadly, the future of money.

Money in the Digital Age

It is clear that the Federal Reserve is not sitting idle in the face of disruptive fintech innovations. With the introduction of FedNow, the Federal Reserve is making significant strides to remain competitive in digital finance.

However, how they continue to adapt and evolve, especially in privacy protection and the adoption of cryptocurrencies, remains to be seen.

Whether through fast payment systems like FedNow or potential developments toward a privacy-focused CBDC, the competition between CBDCs and cryptocurrencies will undoubtedly shape the future of money.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link