[ad_1]

On Monday, Bitcoin price experienced a minor decline of 0.50%, trading at $25,742. This shift in value comes amidst India’s contemplation of regulating the cryptocurrency sector in alignment with the IMF-FSB guidelines.

While the move towards introducing Central Bank Digital Currencies (CBDCs) seems inevitable on the global stage, it does not come without its set of challenges and concerns.

The potential risks associated with CBDCs, especially in a dynamic and evolving market like India’s, could have profound implications for the broader crypto ecosystem.

India Considers Adopting IMF-FSB Guidelines for Cryptocurrency Regulation

India is contemplating cryptocurrency regulation in line with recommendations from the International Monetary Fund (IMF) and Financial Stability Board (FSB). Initially leaning toward an outright ban, Indian authorities have shifted their stance, recognizing the need for global consensus on cryptocurrency regulations.

The recent G20 leaders’ summit endorsed the IMF-FSB recommendations, emphasizing the importance of unified regulations while allowing countries to adopt stricter rules based on perceived risks.

India’s Minister of Finance, Nirmala Sitharaman, emphasized the necessity of international cooperation in regulating crypto assets during the Global Fintech Fest 2023. She highlighted that cryptocurrencies transcend national borders, requiring a coordinated global response.

In India, challenges in shaping crypto regulations persist, with the local industry seeking tax relief due to an investor exodus caused by unfavorable tax policies.

A new 1% tax on crypto transactions and the removal of loss offsets have impacted market participants’ profitability.

The impact of this news on BTC prices today is negative, with BTC/USD falling as investors react to the uncertain regulatory landscape in India.

The Inevitable Rise of CBDCs: Potential Risks Ahead

The global trend toward central bank digital currencies (CBDCs) is accelerating, with nearly 100 nations actively exploring or launching their CBDC initiatives. CBDCs are gaining favor for their perceived security and stability compared to cryptocurrencies like Bitcoin, potentially enhancing payment systems and expanding financial access.

CBDCs offer notable advantages, such as bolstered payment efficiency, accessibility, and security for both online and offline transactions.

They also hold the promise of simplifying cross-border payments and providing real-time economic data for informed policy decisions. However, challenges include technological limitations, cybersecurity risks, and concerns regarding increased financial surveillance.

For the success of CBDCs, financial institutions need to invest in digital currency education, evaluate diverse use cases, and develop integration strategies.

Despite potential pitfalls, CBDCs are seen as a promising evolution in payments, casting a shadow over the crypto market sentiment. Currently, BTC/USD is on a downward trend, independent of this news.

Bitcoin Price Prediction

Bitcoin’s price hovers just above $25,500, with potential resistance at $26,200. Past attempts to breach the $26,200 mark have faltered, leading to pullbacks below $25,650. However, bullish support around $25,350 has kept it above $25,500.

Presently, BTC trades below the $26,000 mark and the 100-hourly Simple Moving Average, facing a bearish trend line resistance near $25,950. The key resistance is at $26,200, and surpassing this could signal a rally towards $26,750 or even $28,000.

On the downside, if $26,000 remains unconquered, support exists at $25,500 and $25,350, with a risk of slipping towards $24,500 or $24,000.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

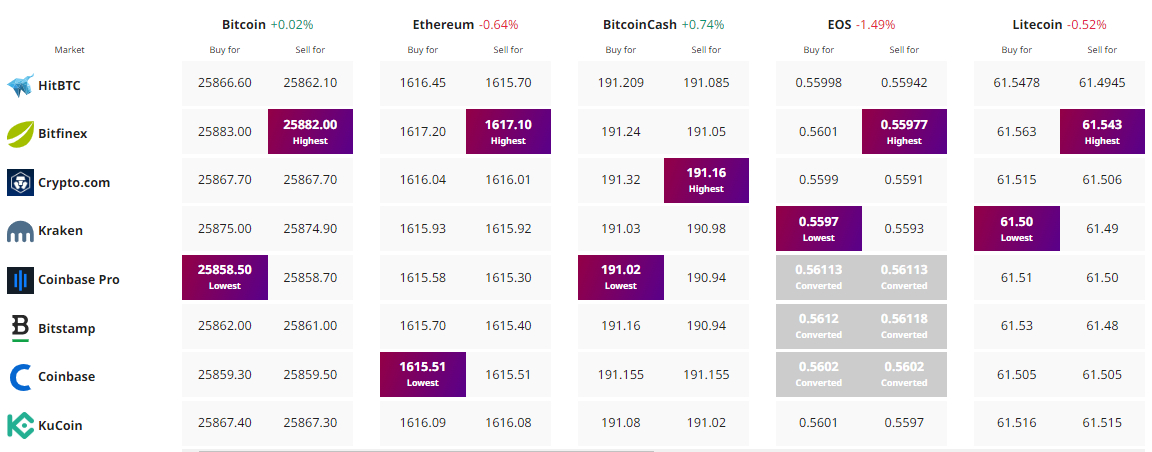

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

[ad_2]

Source link