[ad_1]

Central Bank Digital Currencies (CBDCs) continue to gain exposure as countries conduct trials. Japan’s government has alluded publicly to the formation of a panel to assess the launch of a digital yen.

Japan’s pending launch of a digital yen is essential in the global race toward adoption of CBDCs. The move could have several benefits for the country, including reduced cash usage, greater financial inclusion, and a boost to the economy. However, several challenges are associated with launching a digital yen, including the impact on the banking sector and privacy concerns. Other countries will closely watch the success of the pilot program.

Understanding the CBDC

Japan rolls out its pilot program with other countries already far ahead. China has already launched its digital currency, the digital yuan, and is piloting it in several cities nationwide.

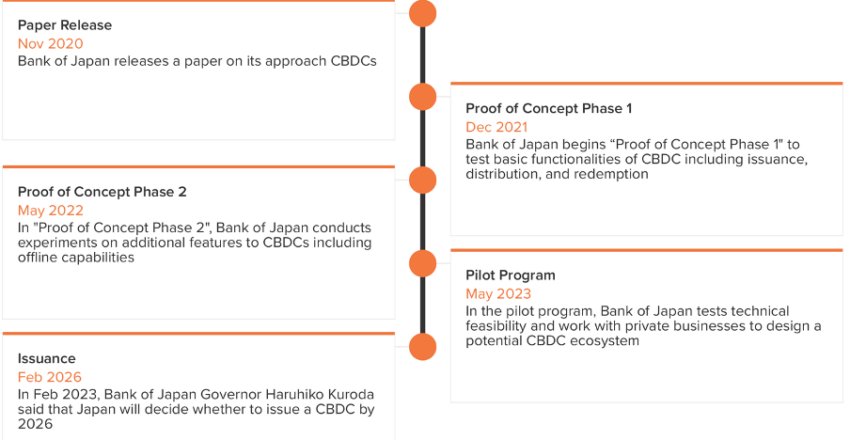

The Bank of Japan, the nation’s central bank, has done experiments on the key functions of CBDCs, such as issuance, distribution, and redemption, as well as the feasibility of their use in payments and settlements. The pilot program, initiated last month, will last a year, and will involve private companies.

Japan’s Finance Ministry has announced the formation of an expert panel to explore the feasibility of a digital yen. The board will include academics, economists, a lawyer, and a consumer group representative, who will meet regularly and compile a report by the end of this year.

Based on the results, the bank will decide whether to launch a digital currency by 2026. However, the leaders aren’t sure yet, per an April 14 Reuters report.

“We understand the BOJ’s study is making a steady headway,” a finance ministry official told Reuters. “However, we have not at all decided on whether Japan will issue a CBDC.”

CBDC Competition

The Bank of Japan has been exploring the possibility of a digital yen for some time now and has set up a research team to study the issue. Proof of concept tests have been underway since 2021, and the central bank published a CBDC paper in November 2020.

The bank believed the digital yen could enhance the convenience of payments, reduce costs, and increase financial inclusion. Even maintain the stability of the country’s financial system in the face of changes in the payment and settlement systems.

The move by Japan to launch a digital yen comes as many countries worldwide are exploring the possibility of CBDCs. The European Union, for example, is working on a digital euro, while the United States is studying the feasibility of a digital dollar. China, however, is the front-runner in the race, having already conducted pilot programs for its digital yuan.

The digital yuan is piloted in several Chinese cities, including Shenzhen, Suzhou, and Chengdu, and is being used for various purposes, including retail payments and government services. The pilot programs have been successful so far, and China plans to expand the use of the digital yuan to more cities.

What Are the Advantages?

Japan’s launch of a digital yen could benefit the country. One of the blessings could be the reduction of cash usage. Japan is known for its heavy use of cash. A digital yen could help reduce the amount of physical money in circulation, making it easier to combat money laundering and other illegal activities.

A digital yen could also help to increase financial inclusion in Japan. The country has a large elderly population, many of whom do not use digital payment methods. A digital yen could make it easier for these people to make payments and engage in other financial transactions.

Finally, a digital yen could boost Japan’s economy. The country has been struggling with low economic growth for many years. A digital yen could help stimulate the economy by increasing the efficiency of payments and easing transaction costs.

Challenges to Consider

However, serious challenges are also associated with launching a digital yen. One of the biggest is the potential impact on the banking sector. A digital yen could reduce the demand for bank deposits, which could, in turn, hurt banks’ profitability. This could lead to a contraction in the sector, negatively affecting the economy.

One of the main concerns about CBDCs is that they could lead to the erosion of privacy. CBDCs are digital currencies issued and backed by central banks, and as such, can be tracked and monitored more easily than cash transactions. This means that CBDCs could give governments and financial institutions unprecedented access to people’s financial data and activities.

Additionally, CBDCs might be used to implement negative interest rates or other forms of financial repression, further eroding privacy and individual autonomy. There is also the risk of cyberattacks and data breaches, which could expose sensitive financial data to bad actors.

To address these concerns, it will be necessary for central banks and governments to prioritize privacy and security in the design and rollout of CBDCs. This could involve strong encryption and security protocols and limiting the collection and use of personal data. It may also be necessary to establish legal frameworks that protect individuals’ privacy rights and prevent the misuse of CBDC data.

The Bank of Japan must address these concerns to gain public support for a digital yen.

A Tale of Two CBDCs

China is reportedly way ahead of the game on CBDCs. But China and Japan have profound political, social, economic, and cultural differences. Many have voiced concerns about the erosion of privacy that CBDCs may entail.

Japan has been exploring the possibility for several years, but has yet to announce concrete plans for its implementation. However, it is likely that Japan will not simply follow the lead of China, the United States, and the European Union but will instead pursue its path.

One factor influencing Japan’s approach to CBDCs is its unique economic and financial landscape. Japan’s rapidly aging population and shrinking workforce have put pressure on its financial system and raised concerns about its ability to maintain economic growth. In addition, Japan is a world leader in cash usage, with many individuals and businesses still preferring physical currency.

These factors suggest that Japan may take a cautious and deliberate approach to CBDCs, focusing on addressing its specific economic and financial challenges rather than simply following the lead of other countries. For example, Japan may explore using CBDCs to promote financial inclusion and support its aging population or address deflation and spur economic growth.

At the same time, Japan is an essential player in the global financial system and has close ties with other major economies, including China, the United States, and the European Union. Japan may therefore look to collaborate with these countries on developing and using CBDCs, while also pursuing its own approach.

Japan Promotes Innovation

Overall, while time will tell how Japan approaches CBDCs, the country will likely seek to balance its own specific needs and priorities with the broader trends and developments in the global financial system.

But Japan has promoted innovation. For instance, integrating non-fungible tokens (NFTs) to boost its economy. Even giving the green light to exchanges such as Binance to set up shop despite a troubled past in the region.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link