[ad_1]

Join Our Telegram channel to stay up to date on breaking news coverage

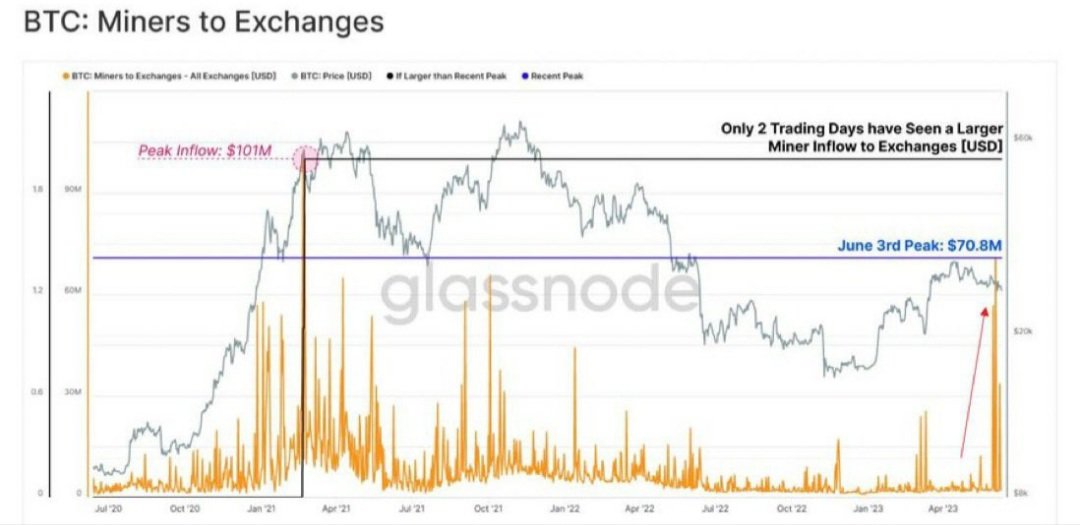

Over the past week, on-chain data suggests that Bitcoin miners are moving a considerable amount of coins to exchanges, reaching a notable inflow of $70.9 million. This is the third largest inflow on record, $30.2 million less than the peak inflow of $101 million recorded during the primary bull market in 2021.

#Bitcoin Miners are depositing #BTC on exchanges. In June, the third largest influx #BTC to exchanges from #miners in history was recordedThis usually indicates that there will be selling pressure pic.twitter.com/QcmkUMHThk

— Crypto Economy (@cryptooeconomy) June 12, 2023

On crypto exchanges like Binance and Coinbase, notable outflows have occurred in the past week. According to data recorded by Nansen, there has been a significant outflow of multi-chain assets in the past week, excluding Bitcoin from Binance, which amounts to $2.376 billion. At the same time, Binance.US recorded an outflow of $124 million, while Coinbase experienced $1.787 billion.

Whales Continue to Accumulate at Every Dip While Bitcoin Miners are Selling Coins

The price of Bitcoin has been on the rise since December 2022. However, the selling of coins by miners has been on the rise in recent months, with price declines and rising mining costs as apparent reasons. However, it’s worth noting that not all miners sell their coins immediately. Some choose to hold onto them (HODL), while others sell only a portion of their earnings

Bitcoin continues to trade below $26,000 as it nears a phase of strong consolidation. On-chain data, however, indicates some accumulation from whales at every dip.

Based on a report from Santiment, Bitcoin whales have accumulated close to 60,000 BTC amidst a recent price correction of 10% in the last few weeks.

🐳 As #altcoin madness has ensued, there quietly is a #bullish divergence between #Bitcoin‘s accumulating whales and falling price. With whale holdings moving up by ~1K $BTC per day while prices fall, there is reason to believe a strong rebound can occur. https://t.co/Ol0cK5VhPE pic.twitter.com/FeHPqqJx7o

— Santiment (@santimentfeed) June 11, 2023

Additionally, Bitcoin’s market dominance has also moved closer to 50%. This comes amid the recent market crash in altcoin prices due to high-handed SEC action. It is the first time since April 2021 that Bitcoin’s (BTC) dominance has reached 50%.

When Bitcoin’s dominance rises above 50%, it usually suggests a bear market situation. Such a situation may arise because investors move money into safer havens. This was seen in 2018, when BTC dominance reached above 50%.

There is the likelihood that Bitcoin could likely continue to trade with a support of $25,000 and an upside resistance of around 26,100. Amidst the recent SEC action, BTC long-term holders continue to hold their assets.

Miner Activity Ignites Curiosity

The surge of Bitcoin miners moving substantial amounts of Bitcoin from their wallets to exchanges has ignited curiosity and raised questions about the potential impact on Bitcoin’s price and overall market sentiment. Miners play a crucial role in the ecosystem, securing the network and maintaining its integrity. However, recent activities have suggested a shift in their behavior.

One possibility of such activities may be that miners are taking advantage of the recent price increase in Bitcoin. Miners may capitalize on the opportunity to cash in their holdings and secure profits. Others believe that miners may be positioning themselves for future market developments.

In the short term, there is a belief that miners’ trends could exert downward pressure on Bitcoin’s price. A move towards exchanges means there is a likelihood of sell pressure outweighing buy pressure, potentially resulting in a price correction.

There is also the belief that the long-term implications may not be as straightforward. Miners may use exchanges as intermediaries to carry out over-the-counter trades or even take part in other strategies.

The reasons for these activities remain speculative, with Bitcoin’s price uncertain. As such, it underscores the importance of monitoring miner activity and its potential implications for the overall market.

More News

Wall Street Memes – Next Big Crypto

Early Access Presale Live Now

Established Community of Stocks & Crypto Traders

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Best Crypto to Buy Now In Meme Coin Sector

Team Behind OpenSea NFT Collection – Wall St Bulls

Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

[ad_2]

Source link