[ad_1]

Ethereum (ETH) has become the primary hub for the booming decentralized finance (DeFi) sector, hosting thousands of blockchain projects and decentralized apps (dApps).

These applications leverage the Ethereum blockchain to provide a wide range of services, including but not limited to finance, trading, gaming, non-fungible tokens (NFTs), and numerous other offerings.

Among the prominent projects operating on Ethereum are UniSwap, AAVE, GMX, Chainlink, OpenSea, StrongBlock, Tether, 1Inch V4, Ethichub, Zeroex, and Otherdeed.

However, the continued growth and success of these DeFi platforms have put a strain on the Ethereum network’s ability to process transactions, leading to longer confirmation times and higher transaction fees.

To help with scalability and speed, Ethereum has turned to secondary blockchains built on top of it, which are called layer 2 scaling solutions.

These layer 2 scaling solutions take stress off the Ethereum mainnet and therefore help speed up transaction times and lower transaction fees while still maintaining the same security guarantees (in the case of L2 solutions).

“Layer 2s are a hotbed of innovation enabled by lower gas fees, scalability, modularity, and choice of different security tradeoffs,” Bruno Faviero, CEO of token management platform Magna.so, told Cryptonews.

“The BD and marketing efforts by these Layer 2 foundations have also helped keep developer momentum going even during the bear market, contributing to the 1100% growth in EVM contracts deployed since Q2 2022.”

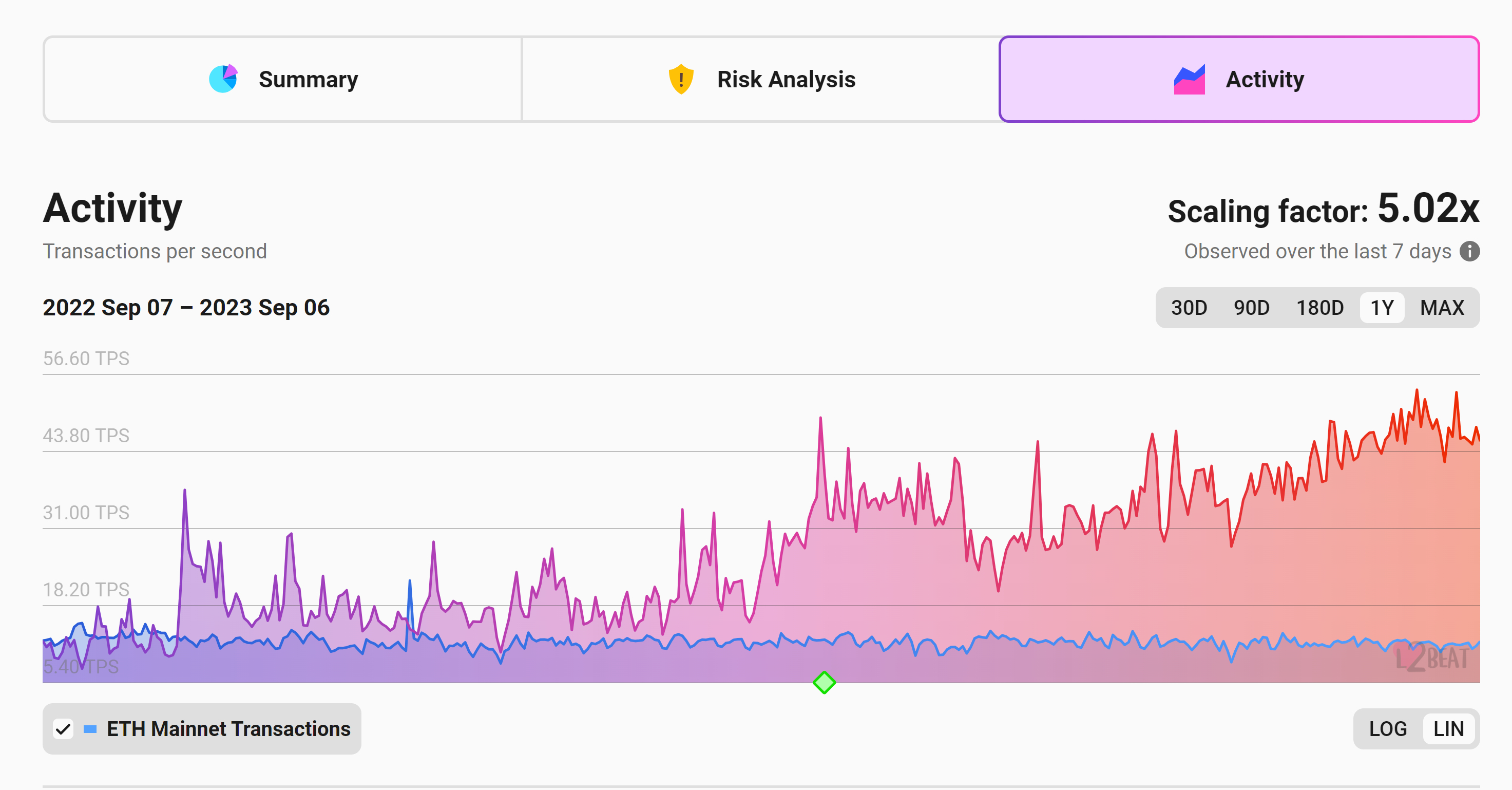

Due to their ability to offer better throughput and transaction speeds, Ethereum layer 2 solutions have gained significant traction, with activity hovering around all-time highs since late March.

Layer 2 Activity Overreach Ethereum by a Factor of 5x

Activity across Layer 2 networks is booming, with combined L2 throughput outpacing the Ethereum mainnet by a factor of 5x.

The weekly average scaling throughput of Ethereum’s Layer 2 ecosystem has been around 50 transactions per second (TPS) since early August, according to data from L2beat.

During this period, the Ethereum throughput has been around 11 TPS, leading to a 5x scaling factor for the leading blockchain.

“There has been a surge in Ethereum L2 in recent times, notable successes being Polygon, Arbitrum, Optimism and Base,” Fakhul Miah, Elastos’ global head of growth, said in a comment.

“They have attracted a significant number of users and TVL, with developers enjoying the speed and cost improvements over Ethereum whilst maintaining the security from the layer above.”

Miah added that newer chains are gathering more eyes as retail users look to explore DeFi to find earning potential while developers experiment with new protocols in search of new opportunities at lower transactional costs.

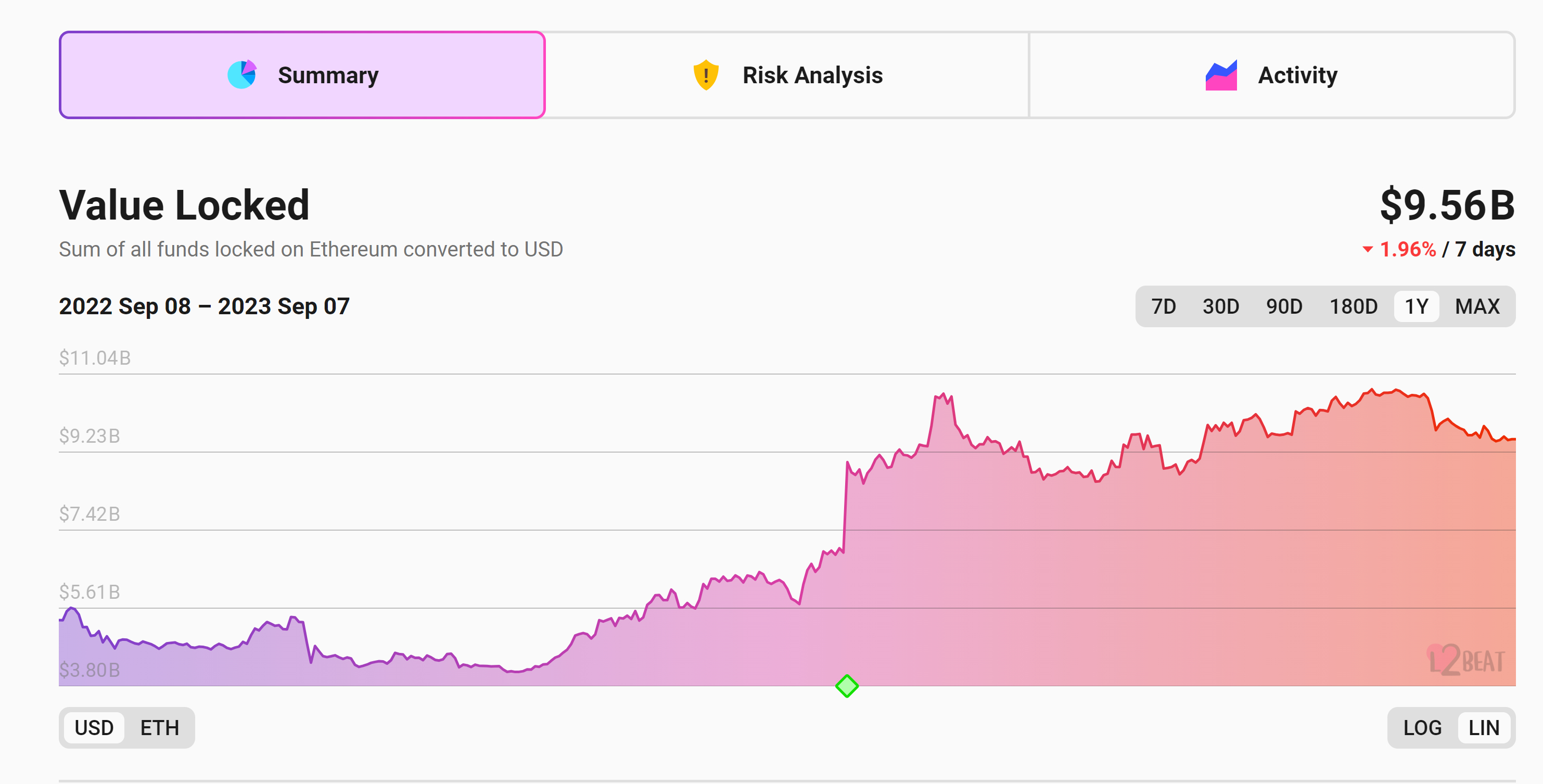

Data by L2beat also shows that the total value locked (TVL) on Ethereum scaling solutions has more than doubled since the start of the year, settling at $9.47 billion at the time of writing.

Arbitrum leads the pack with $5.6 billion in total value locked, closely followed by Optimism with $2.6 billion.

zkSync secures the third position with $408 million, trailed by dYdX with $339 million, and Base with $237 million.

However, Elena Sinelnikova, a co-founder of the MetisDAO Foundation, which introduced the Metis Layer 2 Ethereum scalability solution, believes the main narrative that drives the lion’s share of volume in the L2 space is airdrops.

“We have seen the airdrop farmers “rotate” through the various new chains as they come out, hoping to hit the critical threshold that would have them qualify for the new chain’s upcoming native token,” she said in a comment.

Sinelnikova added that as there are a whole bunch of new chains, there is a huge amount of airdrop farming going on, which has “contributed to the idea that playing around a lot on L2s as a crypto user is likely the most profitable thing you can do with minimal risk.”

Emerging Layer 2 Blockchains Take The Spotlight

It is worth noting that new contenders in the L2 space have found notable traction as of late, even challenging the established dominance of incumbents Arbitrum and Optimism.

If measured by the speed at which new highly funded L2s have hit 1 million users, the number of days required to hit this milestone is consistently decreasing in chronological order of launch dates, Sinelnikova said, adding:

“Arbitrum, Optimism, ZkSync, and Base have all launched within the past few years and have taken less and less time, culminating with Base only taking 11 days to hit this critical threshold.”

Base, the recently launched L2 solution backed by the prominent US exchange Coinbase, has emerged as the second most active L2 network, boasting a transaction throughput of 9.93 transactions per second (TPS) following a remarkable 50% growth rate over the past week.

“BASE’s on-chain summer is quite remarkable,” Leonard Tan, chief technology officer (CTO) and co-founder at Web3Auth, a non-custodial authentication infrastructure for Web3 wallets.

“The velocity at which BASE is gaining momentum and recording daily transactions is astounding, especially considering the prevailing market conditions.”

The popularity of friend.tech, an application enabling users to trade tokens associated with public Twitter profiles, has significantly contributed to the rising activity on Base.

Arbitrum secures the third position with a transaction throughput of 6.2 TPS, followed by Starknet at 4.8 TPS and Optimism at 4.2 TPS.

Nonetheless, despite the emergence of these new players, Arbitrum and Optimism continue to dominate the Layer 2 landscape, collectively accounting for over 80% of the nearly $10 billion in total value locked within Layer 2 networks.

According to Miah, Arbitrum leads in terms of developer experience. One of the key advantages of the L2 is that it enables developers to run unmodified Ethereum Virtual Machine (EVM) contracts and transactions on a second layer.

“Polygon tends to provide flexibility and enterprise adoption,” he said, adding that the OP stack has also gained significant traction in the ecosystem.

In terms of technology, Sinelnikova said that Optimistic and Zk rollup are leading the pack.

The zk proofs are newer to the table, she said, claiming that their advantage is that they remove the need for “game theory” and incentives to try and catch malicious actors, instead using complex math to create proofs that the information is true and correct.

“What is sacrificed is the instant confirmations and lightning fast speed from the UX perspective, but the finality is exponentially faster. The cost is also increased with zk, due to the increased complexity of the network security developing these proofs.”

Have L2s Become the New Norm?

The massive popularity of layer 2 solutions suggests that these blockchains have become the new norm on Ethereum.

According to an April report by Alchemy, users bridged over $635,000 worth of crypto assets to L2 networks in the first quarter, an increase of 44% over Q4 2022 and 518% over Q1 2022.

The report showed that only 103,000 users made bridging transactions to layer 2s in the first quarter of 2022, whereas the same three months saw over 635,000 users perform these transactions.

The deployment of smart contracts related to layer 2s also increased by 160% when compared to Q1 2022, despite a 30% decrease relative to Q4 2022.

“With regards to scaling approaches, L2s do currently hold the status as “norm” within Ethereum,” Sinelnikova said.

“Unless there is new innovation within the space that abstracts the need for L2s altogether, I do not foresee any new norm within the industry in this domain.”

She noted that even as Ethereum itself scales through dank sharding and other mechanisms, it will still be far more expensive compared to L2s.

“As such, layer 2s have the potential to be the layer upon which most value transfers occur, where most DeFi (and even TradFi on-chain) takes place, where most on/off-ramps plug into, and ultimately, where the Web3 economy hub lies,” she added.

[ad_2]

Source link