[ad_1]

The Grayscale DeFi Fund has added Lido DAO (LDO) token to its portfolio.

In an update to investors announcing the rebalancing of its various funds, the asset management firm revealed that it had purchased a large quantity of the Lido liquid staking protocol’s governance token.

Liquid Staking Surges Post-Shappella

Liquid staking is a form of crypto staking. It allows owners of Proof of Stake (PoS) tokens to receive a substitute token in exchange for any crypto they choose to lock up in a staking pool.

You can read What is Liquid Staking? to learn more.

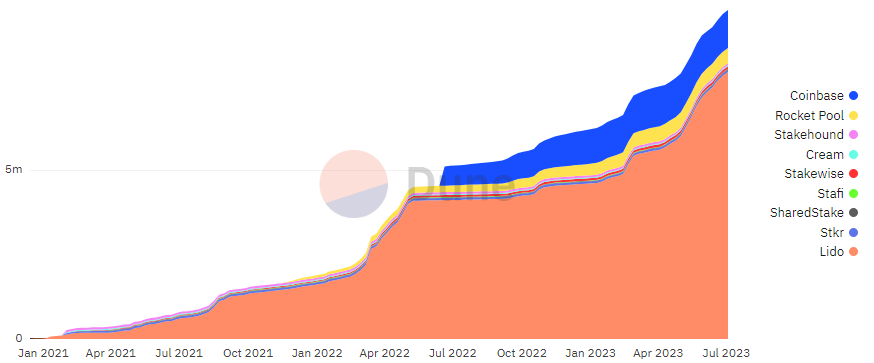

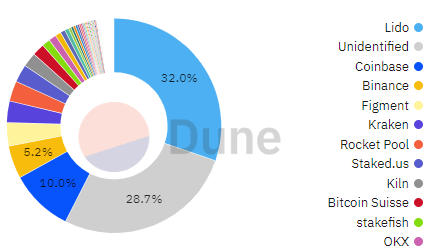

In the post-Shappella Ethereum landscape, liquid staking is one of the preferred means of staking ETH. And Lido has triumphed as the protocol of choice as staking has surged since the major Ethereum upgrade.

As of Saturday morning, over 10 million ETH was staked via a liquid staking pool. Of this, Lido accounts for nearly 80%.

Staking with Lido is now so popular that Lido staked Ether (stETH) is now the seventh largest cryptocurrency by market capitalization. The market cap of stETH now trumps those of Cardano (ADA), Litecoin (LTC), and Solana (Sol).

It is also the most successful coin to have emerged from the contemporary DeFi ecosystem. There is more value locked in Lido than DeFi tokens like UNI and CAKE, as well as the DeFi stablecoin Dai.

Grayscale Becomes Major Lido DAO Stakeholder

Grayscale’s DeFi fund currently manages around $3.1 million USD in assets. After the latest reallocation, LDO tokens account for over 19% of assets in its basket. Grayscale sold off some of its existing DeFi investments to raise funds for the purchase. However, no asset was removed from its portfolio.

Considering that the fund held zero LDO previously, the decision to invest in cryptocurrency marks significant confidence in the DeFi protocol.

The only asset the fund holds more of is Uniswap’s UNI token, which makes up over 45% of its total portfolio.

What Next for Grayscale’s DeFi Strategy?

With a sizable cache of LDO tokens, Grayscale will now be eligible to vote on Lido’s governance proposals. Grayscale could increase its authority within the DeFi ecosystem by participating in Lido DAO votes.

Having gained a say in Lido’s future direction, the investor could shape policy in its favor. With this in mind, a new question arises. Will Grayscale embrace liquid staking derivatives like stETH now that it is a Lido stakeholder?

In a blog post last year, Grayscale stated that:

“While we do not currently stake assets in any of our investment vehicles, our team has been working diligently to identify solutions that could allow our investors to get exposure to staking-related rewards while mitigating risks.”

And although there have been no further announcements on the topic, Grayscale’s new exposure to LDO could pave the way for its funds to begin staking their existing assets.

Certainly, staking ETH with Lido presents an enticing investment opportunity compared to just letting it sit in a wallet.

Last month, the Lido DAO voted to increase staking rewards for the largest participants in its pool.

In a bid to attract more wallets, institutions, crypto services, neobanks, and custody services, participants that can drive 2,500 ETH to Lido over 12-24 months will now receive a greater share of the ETH received from staking.

With a larger share of rewards now up for grabs, Lido presents a more enticing opportunity to investors like Grayscale than ever before.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link