[ad_1]

South Korea’s Parliament has passed a new Virtual Asset User Protection bill to codify rules that could have prevented the Terra Luna collapse.

The new legislation is geared towards protecting investors and addresses market manipulation and unfair trading practices.

South Korea’ New Bill Regulates Exchanges to Protect Investors

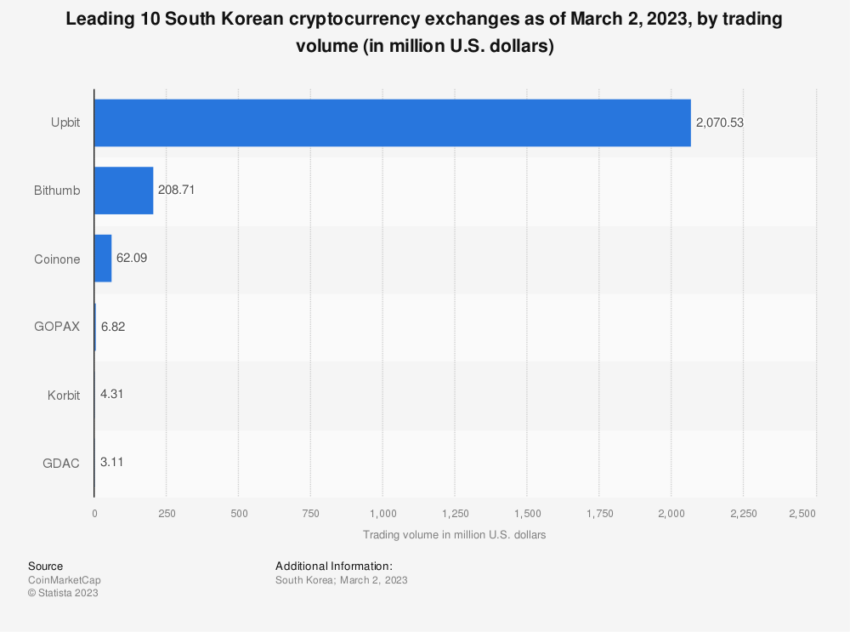

The much-needed legislation brings crypto under the jurisdiction of the Financial Services Commission, which will supervise crypto service providers. These include exchanges and custodians.

Under the new law, digital asset companies must insure customer funds, hold a certain percentage of reserve capital, and keep necessary records.

South Korean platforms Haru and client Delio paused withdrawals in June after one of Haru’s service providers violated their agreement. Later, Haru fired 100 employees to reduce risk as clients unable to withdraw funds instituted legal action.

The country’s National Policy Committee Chair, Back Hye-ryun, said South Korea’s new crypto bill would first focus on investor protection. Existing capital markets laws will still govern securities, while the new bill will cover Bitcoin and other assets.

Critically, the new bill means South Korea is firmly positioned to compete with its Asian rival Hong Kong in attracting crypto investors. While strict, Hong Kong’s new digital asset laws provide companies with a solid base for operating in the region.

Earlier this year, Gemini co-founder Cameron Winklevoss predicted that Asia would spur the next bull market.

South Korean prosecutors believe Terra’s co-founder Do Kwon defrauded investors and want him extradited from Montenegro. Kwon created and touted the TerraUSD stablecoin and its sister token LUNA as the holy grail of financial independence.

TerraUSD stayed at $1 through an algorithm that Kwon developed to mint and burn LUNA depending on whether Terra was above or below $1.

Get the lowdown here on what a stablecoin is.

Meanwhile, Kwon is currently serving a four-month sentence in the Balkan nation for passport fraud.

South Korea’s bid for Kwon’s extradition competes with the US, where the Securities and Exchange Commission (SEC) has leveled eight fraud charges. Montenegrin authorities said it is not a foregone conclusion which country’s extradition request the nation will honor.

The decision will be based on the seriousness of each country’s charges against Kwon, among other things. Kwon’s lawyers previously said the SEC has no authority to bring charges against the Terra founder.

Got something to say about South Korea’s new crypto bill or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link