[ad_1]

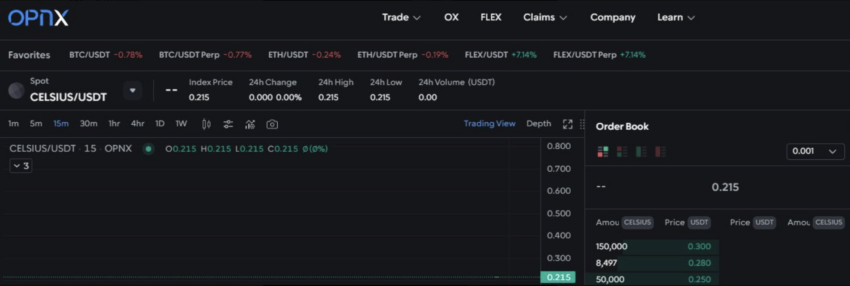

Bankruptcy claims exchange OPNX has launched a new OX governance token to incentivize trading of Celsius claims and other crypto assets.

The new ERC-20 token offers trading fee discounts as the firm looks to boost trading volumes.

New Token Launch Boosts OPNX Trading Volumes

At press time, 133 people had either minted or bought the asset, while the amount staked is currently 136 million OX.

Customers whose share of all staked tokens matches their share of OPNX’s weekly volume will receive a 100% fee rebate. Stakers can also vote on decisions to change fees or listings on the exchange.

Holders of the exchange’s previously launched FLEX token can receive OX in a 1:100 ratio.

OPNX is a bankruptcy claims marketplace co-founded by former 3AC execs Kyle Davies and Su Zhu to trade claims of bankrupt crypto firms. It offers creditors instant liquidity by buying claims at a discount.

The platform then assumes the risk of recovering the original claim once courts finalize a debtor’s bankruptcy distributions.

Despite paltry numbers early on, OPNX trading volumes spiked to $17 million after the launch of OX. Zhu initially blamed poor OPNX volumes on a lack of liquidity caused by the absence of an internal market maker.

Zhu and Davies founded 3AC to apply Zhu’s super-cycle thesis that crypto prices will rise with growing adoption despite short-term bearish deviations. The firm filed for bankruptcy last year after the Terra LUNA debacle tanked crypto prices.

A US court rebuked Davies for failing to respond to a subpoena requesting 3AC company information. The pair have also only minimally cooperated with liquidators appointed to wind down 3AC’s bankruptcy estate.

Why Only Celsius Claims?

At press time, OPNX only listed tokenized bankruptcy claims for Celsius creditors. Celsius collapsed last year after leveraged investments were hurt by the crypto market downturn in July last year.

Vischal Shah, CEO of Heimdall, the firm responsible for tokenizing OPNX’s claims, said that Celsius had a comprehensive creditor list that simplified the creation of the new technology layer.

“Celsius has a completely unredacted database, so it’s very easy to kind of mine that information, and parse it in the way that you need and kind of work toward a seamless validation [of claims].”

The firm has not started work on FTX’s bankruptcy claim since bankruptcy proceedings have yet to release account information, except for the top 50 creditors.

Click here for the full background of the collapse of FTX.

Shah said Heimdall had taken a conservative approach to avoid bankruptcy claim fraud.

“As a lot of this information begins to drip feed, over time we’ll be able to take on FTX claims.”

FTX filed for bankruptcy on Nov. 11, 2022, and is believed to be the largest crypto failure. It owes its top 50 creditors $3 billion.

Shah said Heimdall would soon open an intake portal for FTX claims.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link