[ad_1]

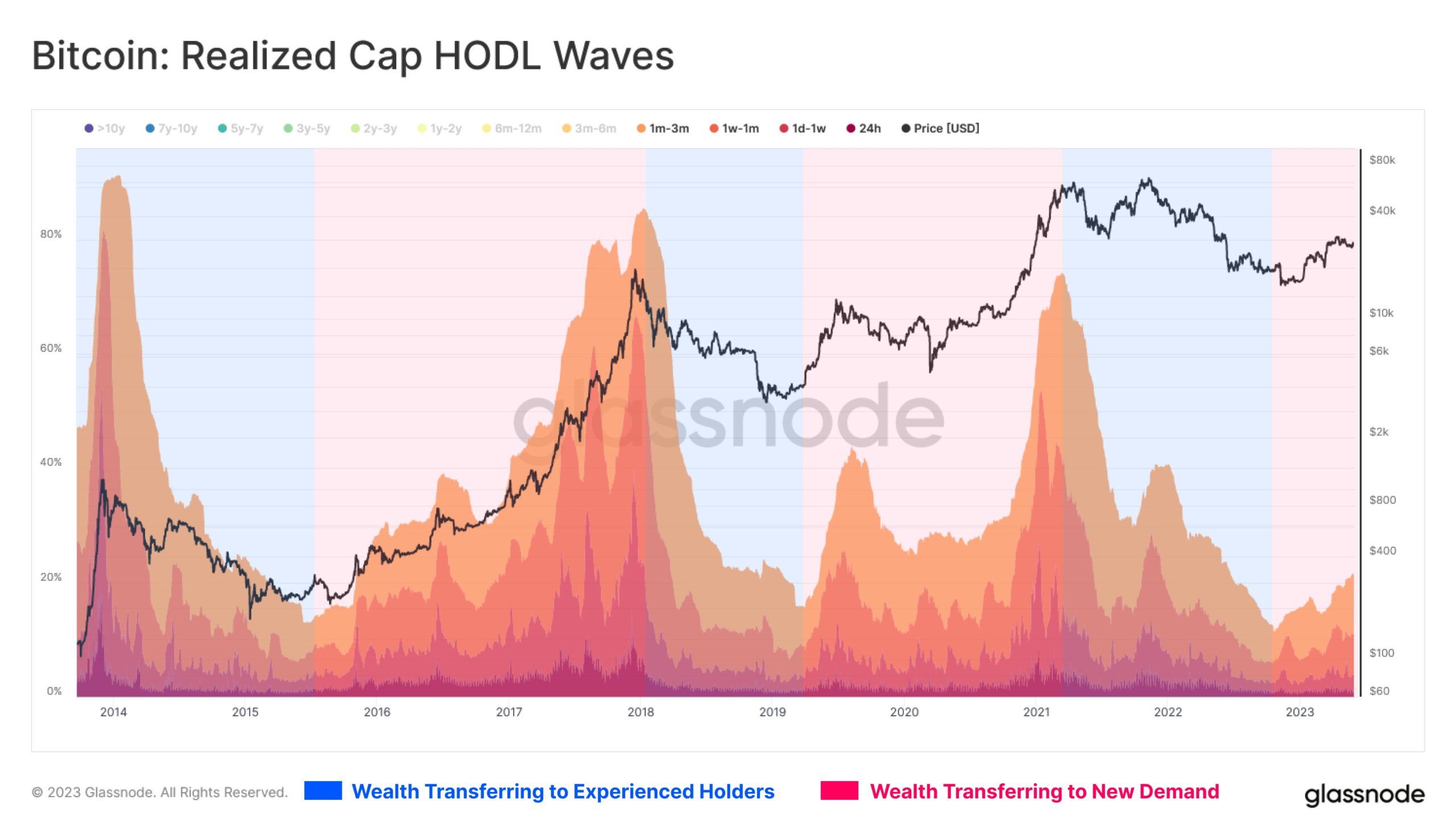

Bitcoin is gradually being transferred from experienced long-term holders to new investors. This suggests that the market cycle is at a transition point, according to on-chain analysis.

On-chain analytics provider Glassnode delved into HODL waves to reveal that a wealth transfer has been occurring.

“This suggests that the transfer of wealth from experienced holders to newer demand is occurring,” it noted. The firm also stated that it was a phenomenon common across cycle inflection points.

Transition to a Bitcoin Bull Market?

HODL Waves use on-chain data to display the amount of BTC in circulation grouped into different age bands depicted by different colors. They are used to measure what different groups are doing with their coins.

The expansion on the chart shows that the 1-day to 3-month band has increased from the cycle low. Furthermore, Glassnode reported an 86% increase from 11.5% to a current value of 21.4%.

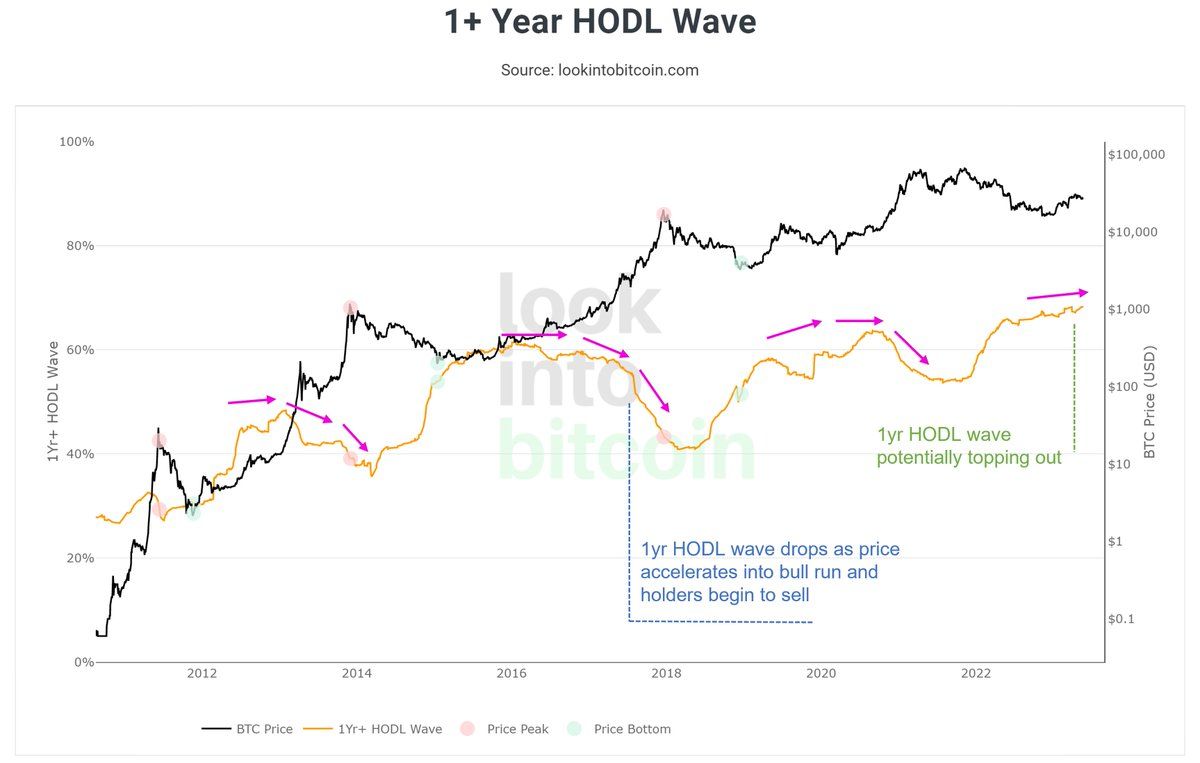

Bitcoin analyst Philip Swift predicted that the 1-year HODL wave would start to trend down, and BTC prices would start to move up.

“Because when new participants (new demand) enter, HODL’ers who accumulated at the lows will begin to sell to them at higher prices.”

Additionally, Bitcoin prices have now moved above several key long-term indicators. BTC is currently just above the 200-week moving average, which is at $25,818, according to Woo Charts. This has been a historical level of support that was broken during the cycle low in December.

It is also above the Realized Price of $19,914. This metric is the value of all coins in circulation at the price they last moved. It can also be considered an approximation of what the entire market paid for their coins.

Last week, BeInCrypto reported that more volatility was expected following a long period of low volumes. However, it has yet to materialize as the consolidation continues.

If you want to read about the incredible first notable real-world Bitcoin transaction, check out BeInCrypto’s article on ‘Bitcoin Pizza Day!’

Bitcoin Price Outlook

BTC prices have ticked up marginally, but crypto markets are still sideways. The asset was trading at $26,952 at the time of writing, climbing from an intraday low of $26,715.

Support currently lies at $26,200, with lower levels at $25,000, a price not visited since mid-March. On the upside, Bitcoin would need to break resistance at $28,000 to see any meaningful gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link