[ad_1]

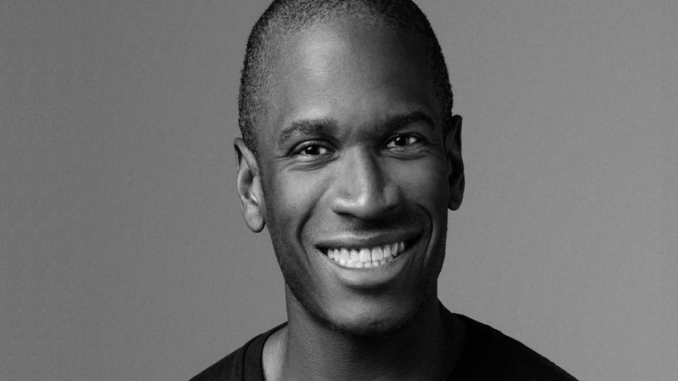

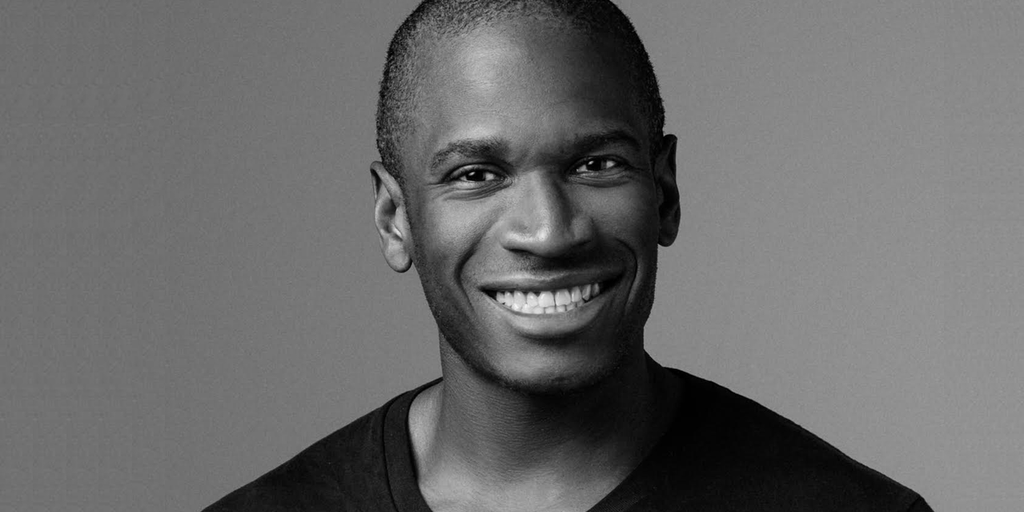

Bucking the conventional wisdom about Bitcoin’s relationship with interest rates, popular macro-analyst Arthur Hayes published a blog post arguing that such traditional economic logic will crumble under the U.S. government’s exorbitant amount of debt.

“Central banks and governments are flailing about trying to use the economic theories of yesteryear to combat the novel situations of the present,” Hayes wrote on Monday.

Since last year, the Federal Reserve has raised its benchmark rate from 0.25% to 5.25% in an attempt to bring inflation back down to 2%. Though its efforts have proven successful so far, Hayes thinks inflation may prove “sticky” going forward, as nominal GDP growth exceeds government bond yields.

According to Hayes’ estimates—based on data from the Atlanta Fed’s GDPNow forecast—nominal Q3 GDP growth remains at a “mind-bogglingly massive” 9.4%, whereas the 2-year US Treasury yield is only 5%.

“Conventional economics says, as the Fed raised rates, growth in a very credit-sensitive economy would falter,” Hayes wrote. This proved true for financial asset markets like stocks and Bitcoin, which cratered in 2022 and washed away capital gains tax receipts for the government, he said.

Yet lower tax revenue also meant higher government deficits, which must be funded by selling more bonds to repay old debt. For the U.S. government, that means more interest payments to the nation’s wealthy bondholders—which are exacerbated by the higher yield on such bonds in a high-rate environment.

“To sum up: when rates rise, the government increases interest payments to the rich, the rich spend more on services, and GDP pumps even more,” Hayes explained.

So long as the economy continues to expand at a faster rate than the government will pay out through its debt, Hayes believes bondholders may seek yield in more rewarding “risk assets” like Bitcoin.

In a similar essay last month, Hayes argued that Bitcoin would win in the face of a tightening Fed, whose methods may inadvertently increase the money supply.

“If the Fed believes that to kill inflation it must both raise interest rates and reduce the size of its balance sheet, then it is cutting its nose to spite its face,” he wrote at the time.

Analysts generally view lower rates as good for Bitcoin and other risk assets, as cheap money leaves room for investors to speculate for potentially higher returns. In June, Coinbase analysts published a report arguing that Bitcoin’s 4-year cycles may be attributable to low-rate central bank policy.

Hayes still doesn’t discount the positive impact of low rates on Bitcoin’s price, describing the asset’s connection to central bank policy as a “positive convex relationship.”

“Things become non-linear—and sometimes binary—at the extremes,” Hayes concluded. “The U.S. and the global economy is at such an extreme.”

Stay on top of crypto news, get daily updates in your inbox.

[ad_2]

Source link