[ad_1]

Popular trading platform Robinhood has released its quarterly revenue report with better-than-estimated figures. However, there has been a decline in crypto trading-related revenue.

On May 10, millennial-favored trading firm Robinhood released its earnings report for the first quarter of 2023.

The firm managed to beat analysts’ estimates, reporting a 47.5% increase in revenue of $441 million for Q1. Comparatively, the firm made $299 million in net revenue for the same period in 2022. However, Robinhood reported a first-quarter net loss of $511 million, or $0.57 a share.

Analysts polled had expected the trading firm to lose $0.62 per share on revenue of $425 million.

Moreover, the online stock and crypto brokerage reported a 30% decline in digital asset trading revenue. Robinhood made $38 million in crypto trading revenue in Q1, down 29.6% from $54 million in Q1 2022.

The fall in crypto trading revenue comes despite a 50% gain in crypto markets for the three-month period.

Robinhood AUM Increases

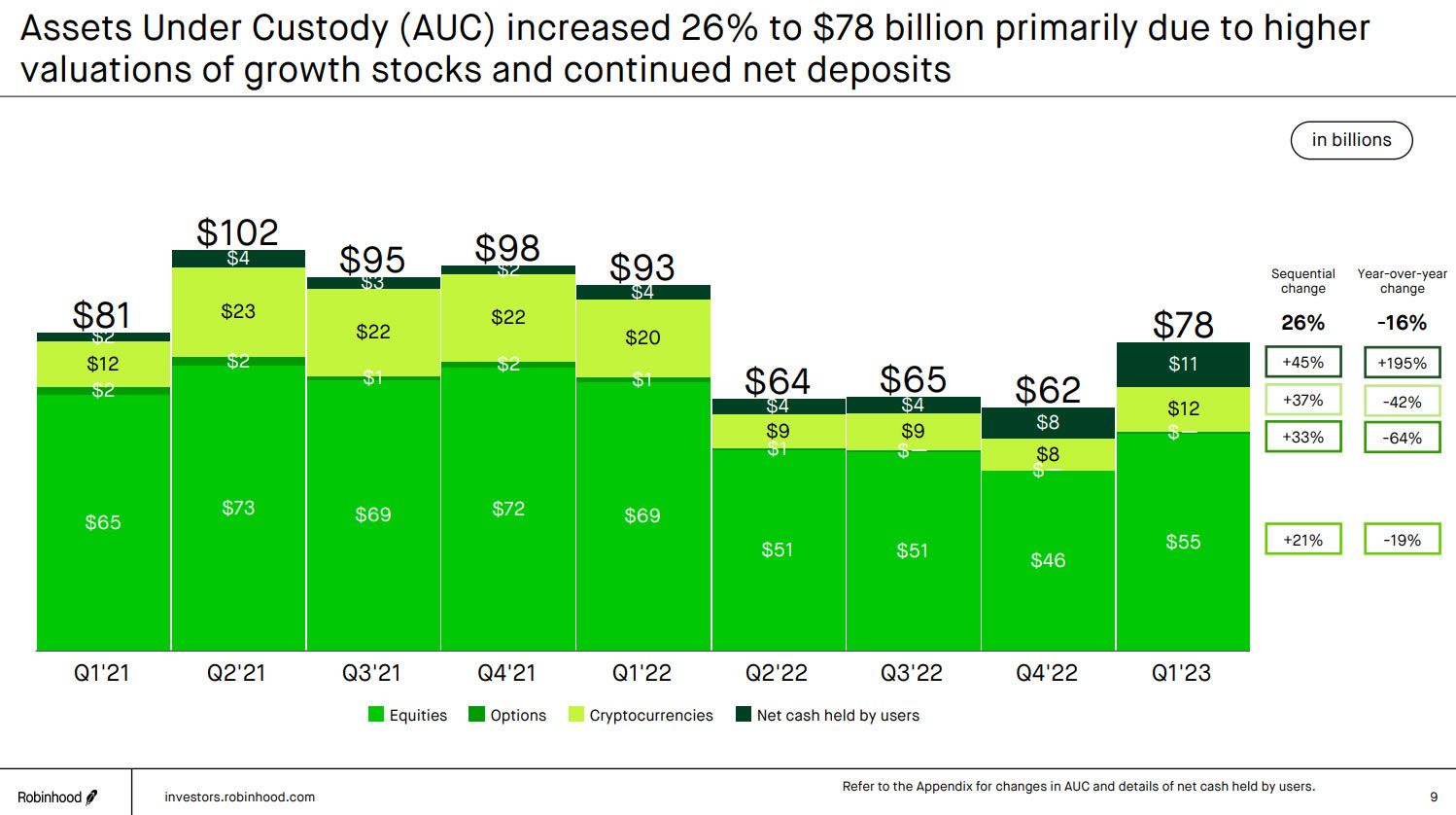

According to its SEC filing, the firm reported a 26% increase in assets under custody which rose to $78 billion. This was helped by “higher market valuations for growth stocks and crypto assets and continued net deposits,” it stated.

Around 15% or $12 billion of those assets are in crypto under custody on the trading platform. This figure is down 40% compared to the same period last year.

Furthermore, monthly active users decreased to 11.8 million, compared with 15.9 million a year earlier. Chief Financial Officer Jason Warnick said, “The broader macro backdrop has been tougher on trading volumes and engagement with brokerages.”

Chief Executive Vlad Tenev remained upbeat, stating,

“In the face of uncertainty in the banking sector, we’re continuing to see strong net deposits and improving customer satisfaction.”

The firm launched a new fiat-to-crypto on-ramp in late April and remains committed to digital assets.

Robinhood stock (HOOD) dropped to $8.21 on May 4 but is currently trading at $9.49 in pre-market hours. Shares prices have gained 15.7% since the beginning of the year.

Marathon Digital Reports Net Loss

Bitcoin mining giant Marathon Digital also released a revenue report this week. The firm reported a net loss of $7.2 million, or $0.05 per share, for Q1 2023.

Its revenue was $51.1 million for the quarter, slightly lower than the previous year’s Q1 revenue of $51.7 million.

Marathon chairman and CEO, Fred Thiel, commented:

“After weathering a tumultuous 2022 that tested the resilience of our entire industry, this year is off to a strong start as we grew our hash rate, reduced our cost to mine, and improved our balance sheet during the first quarter,”

Marathon stock (MARA) rose 9% on the day to reach $10.15 in after-hours trading.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link