Singapore warns money laundering risk for virtual payment token services

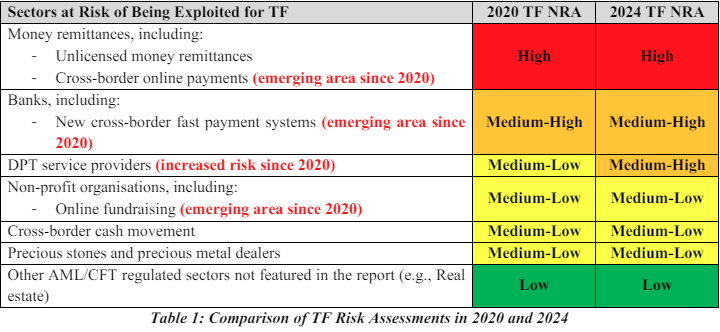

Singapore has upgraded its advisory rating for digital payment token (DPT) providers that could be used for terrorism financing from “medium-low” to “medium-high” in its latest update of the terrorism financing national risk assessment.

The authorities made known the rise of the risk level.

On Monday, the Ministry of Home Affairs, the Ministry of Finance, and the Monetary Authority of Singapore held a joint announcement to say that the newest risk assessment was similar to the one in 2020 but it highlighted the terrorism financing risk in the same areas. However, the report also recognized the ambiguity of data supporting the assertion of digital records in Southeast Asia. This is said to happen because those areas have unstable technology which is the result of terrorism as well as the lack of both the financial infrastructure and a proper internet connection.

Such entities are the ones involved in cryptocurrencies which run on blockchain technology.

Crypto Tokens: One of the Factors That Make Terrorism Finances Stopped Really Hard

Despite the fact that regular money is still the most common way of terrorists funding their activities, the professionals from all over the world are more and more anxious about digital currencies like Bitcoin being pro-transgressors. The main reason for this is that the COVID-19 pandemic has made the concern more widespread. The Singapore authorities are actively monitoring the situation as upsurge in popularity of virtual currencies is observed.

“There are no TF cases involving DPTs in Singapore, but the increase in DPT service providers results in the possibility of higher TF risks”, the report was quoted.

There are several reasons why terrorism financing poses a threat to DPTs. First, these transactions are mostly done without providing any identification, being fast, and not to mention that they can occur across borders. Second the (sic) companies in Singapore can still do business with the unlicensed ones overseas to the extent that the former ones could also be misused.

Thirdly some (sic) countries do not have the same laws and regulations about these transactions making it easier for terrorists to take advantage of the situation.

Besides, facilities like anonymity tools and privacy coins bring about the inability to track who or where to being the sending and receiving persons. Furthermore, these cryptocurrencies also boost the swift and efficient transfer of money across the borders making them a better option than the traditional route of moving large sums of money.

Though there’s this anonymity and simplicity used yet for the enforcement agencies however the monitoring of money in the hands of terrorists using digital currency will be a hurdle so tough

Singapore Puts Preventing Money Laundering in Banks and Digital Token Services on a Priority.

An analysis of Singapore presented that banks, particularly wealth management services, are the most exposed entities to money laundering. This takes place because banks deal with large amounts of money and so have quite a few clients who may more often than not be found out to be involved in illegal activities.

According to Singapore’s assessment, the payment companies that make international money transfers and the investment firms that are in charge of external assets of customers are also part of the problem with money laundering, apart from banks.

Singapore’s financial regulator initiated measures to address money laundering risks in April. It introduced amendments to the Payment Services Act, which will permit the authority to take over those companies that operate in digital currencies.