[ad_1]

Singapore crypto exchanges must keep customer assets in a Statutory Trust to prevent their loss if the company goes bankrupt, the Monetary Authority said Monday, as competition for Asian volumes intensifies.

The new rules follow regulations the agency tabled in October to separate investor and company funds and compel daily asset reconciliations.

Singapore MAS Takes Cautious Approach To Exchanges

In addition to asset separation, companies must ensure that custodial functions are distinct from other business units. They must also inform customers of the risks of keeping assets on the platform.

The Monetary Authority is asking for feedback before implementing these regulations. Meanwhile, it will proceed with an earlier proposal prohibiting non-institutional staking and lending on digital asset platforms.

The central bank will also propose new requirements for Singapore crypto exchanges to address unfair trading practices.

Read here about the best crypto staking platforms.

Cameron Winklevoss argued recently that crypto’s next bull market would start in Asia as US companies’ standoffs with regulators reach boiling point.

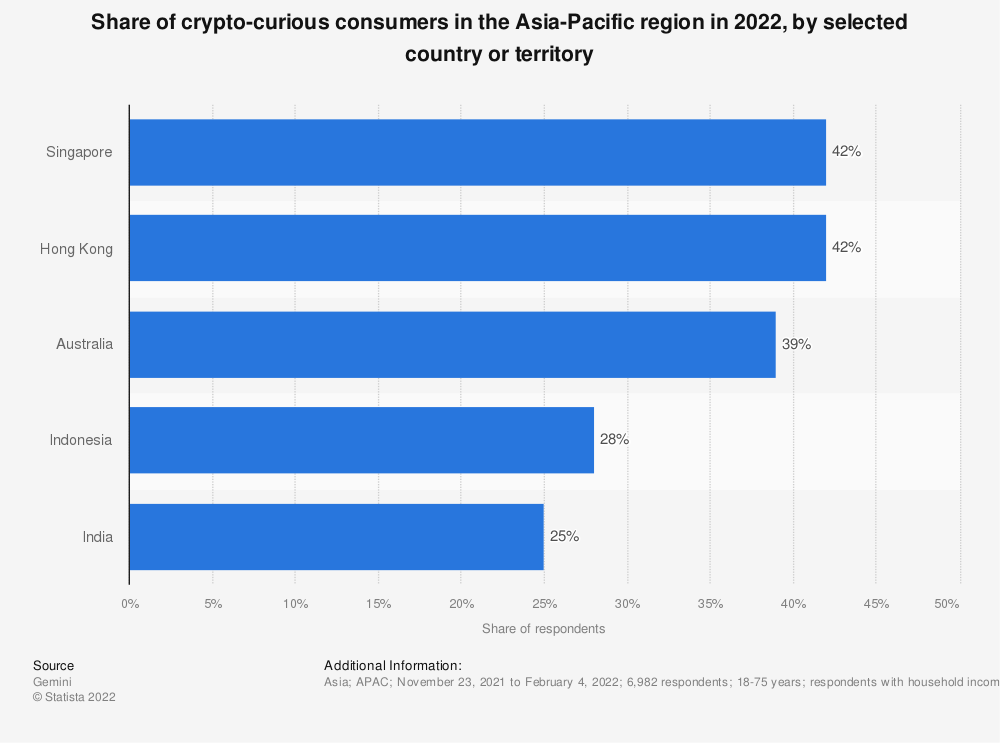

Cameron and his identical twin Tyler, who started Gemini in 2012, recently announced the expansion of their Singapore branch with 100 staff.

Hong Kong and Korea Compete With Singapore for Asian Volumes

Competition for Asian volumes is rising, with three major financial hubs staking claims through regulations prioritizing user protection.

South Korea’s government recently passed a bill that gives the Financial Services Commission authority to oversee digital asset firms.

The new Virtual Asset User Protection laws, like MAS’ proposal, also include rules for keeping customer assets separate from business funds.

In addition, it protects users from exchanges using nonpublic information, unfair market practices, and manipulation. Like the proposed MAS rules, Korean exchanges must maintain sufficient records of customer transactions.

The world’s largest exchange Binance ceded trading volume in April to Korean venues amid investigations in multiple regions.

Moving southwest, Hong Kong’s latest play is a new Web 3 task force to complement new crypto exchange laws.

On Friday, finance secretary Paul Chan said that Web 3’s promise of “disintermediation, security, transparency, and low cost” solves many difficulties in traditional commerce and life.

The state’s crypto asset regulations finalized earlier this year set out digital asset platform requirements. The rules govern custody, capital other investor protection requirements exchanges must adopt to earn a license.

Got something to say about Singapore crypto exchanges or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link