[ad_1]

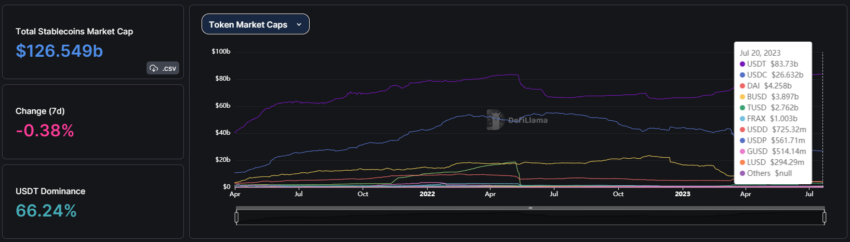

July marked the 16th consecutive month of declining market capitalization for stablecoins, according to the latest report by CCData. The total market cap of stablecoins fell by 0.82% to reach $127 billion.

This is the lowest level seen since August 2021. At press time, the cumulative market cap of the sector is close to $126.3 billion, with a trading volume of $33.2 billion on CoinMarketCap.

Challenges Faced by the Stablecoin Market

The dominance of stablecoins against the overall market also experienced a decline, according to the report. July marked a drop from 10.5% to 10.3%. Many industry analysts also believe that the broader trend of regulatory challenges and evolving market dynamics have played a role.

BeInCrypto recently reported that the decision by the House Financial Services Committee to postpone the vote on stablecoin and crypto trading legislation has generated debate. The bill that aims to regulate stablecoins is a focal point in the ongoing regulatory complexities in the United States.

During the month, there was a drastic drop in the prices of top stablecoins players. CCData notes that USDT was trading at a discounted $0.73 and USDC (USD Coin) at $0.82 on Binance.US. However, this is a bit misleading because all fiat on and off ramps have been closed on the US arm of the exchange. This has caused major discrepancies in the actual prices of the assets listed.

The report attributes the price decrease to the suspension of fiat operations on the exchange following a legal battle with the Securities and Exchange Commission (SEC). Which, in turn, negatively impacted the liquidity of stablecoins on the back of decreased demand.

Despite the challenges in the sector, stablecoin trading volumes witnessed a notable rebound after March. In June, the volumes spiraled by 16.6% to reach $483 billion, per the report.

It notes that the surge in trading activity was partly driven by the market’s reaction to the SEC’s lawsuits against Coinbase and Binance. Additionally, the filing of spot Bitcoin ETF applications by traditional financial companies helped to boost positive sentiment.

The SEC initially claimed that the proposals for Bitcoin ETFs did not meet its regulatory standards. However, this past week the agency finally acknowledged that it had formally started the review process after applications were resubmitted with additional information on surveillance-sharing.

USDT Dominates as Sector Spirals Weakness

Pax Dollar (USDP) experienced a significant drop in market capitalization. Its market cap fell by a staggering 43.1% to $563 million, hitting its lowest level since December 2020, CCData noted. It marks that MakerDAO’s decision to remove $500 million of USDP from its reserves due to insufficient revenue generation played a crucial role in the decline.

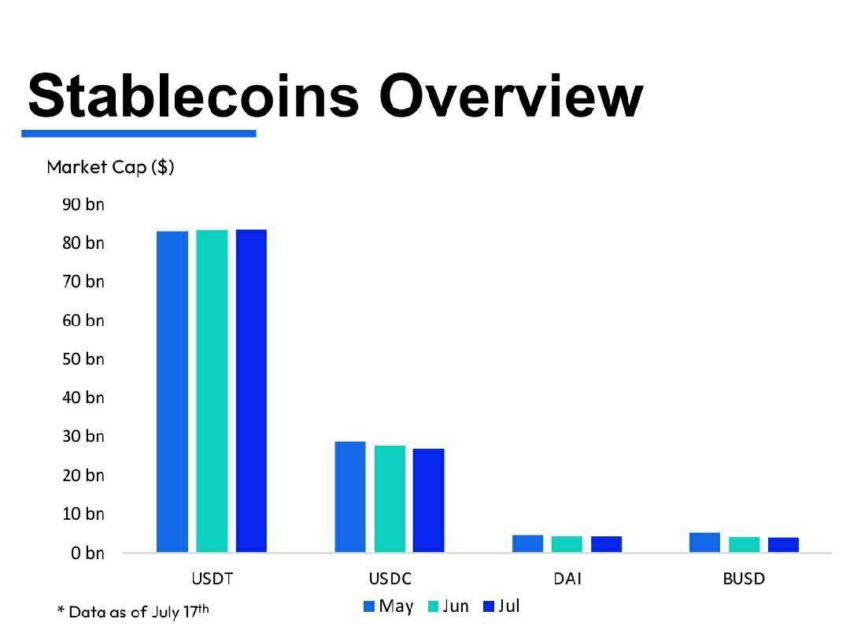

USDC and BUSD market caps declined by 3.01% and 4.57%, bringing their market caps to $26.9 billion and $3.96 billion, respectively. This marked the seventh consecutive month of decline for USDC, reaching its lowest market cap since June 2021. BeInCrypto reported that

Circle’s USDC stablecoin experienced a notable decrease in its circulating supply over the past week, amounting to approximately $100 million.

Meanwhile, USDT continued to assert its dominance with a new all-time high market cap of $83.8 billion. TetherUSD now represents 65.9% of the stablecoins sector by market cap.

In July, stablecoin trading volume on centralized exchanges hit $219 billion. The report stated that optimistic trade activity in the wake of an XRP court decision boosted this metric. In the lawsuit, the judge declared that Ripple’s Programmatic Sales and other distributions of XRP on public exchanges do not fall under the category of investment contracts.

Nevertheless, despite this rise, volumes are still on course to post historically low monthly figures, with big assets finding it difficult to overcome significant resistance.

Regulatory pressures continue to pressure market liquidity and prices. At press time, Bitcoin is trading just under the crucial level of $30,000. The cumulative market cap of private cryptos has also seen a marginal decline on the daily charts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link