[ad_1]

Bitcoin options expiration day has come around again, where we will see a sizeable tranche of contracts expiring. BTC and crypto markets have been cooling off following a new 2023 high this week, where will they go next?

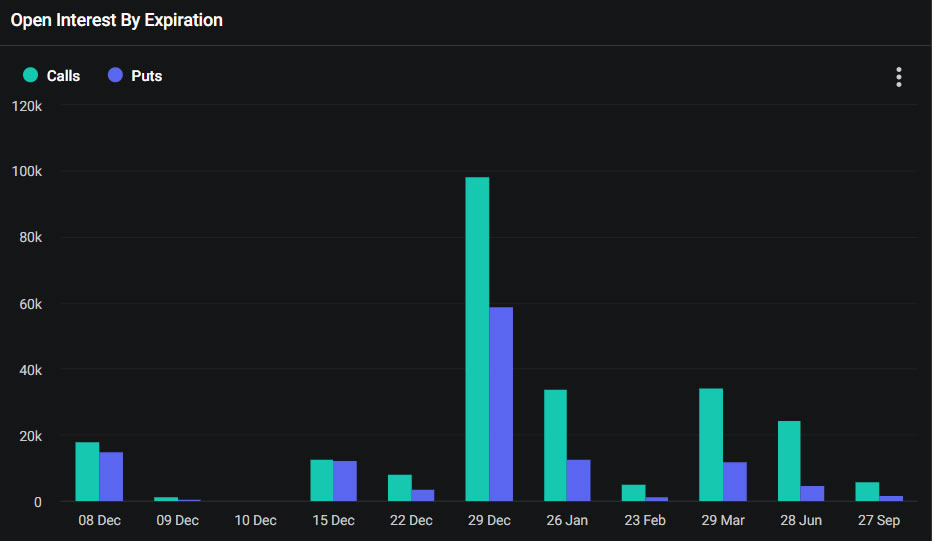

Around 33,000 Bitcoin options contracts are set to expire on Friday, December 8. It is slightly more than last week’s expiry event but small in comparison to the big one looming at the end of the month and year.

Bitcoin Option Expiry

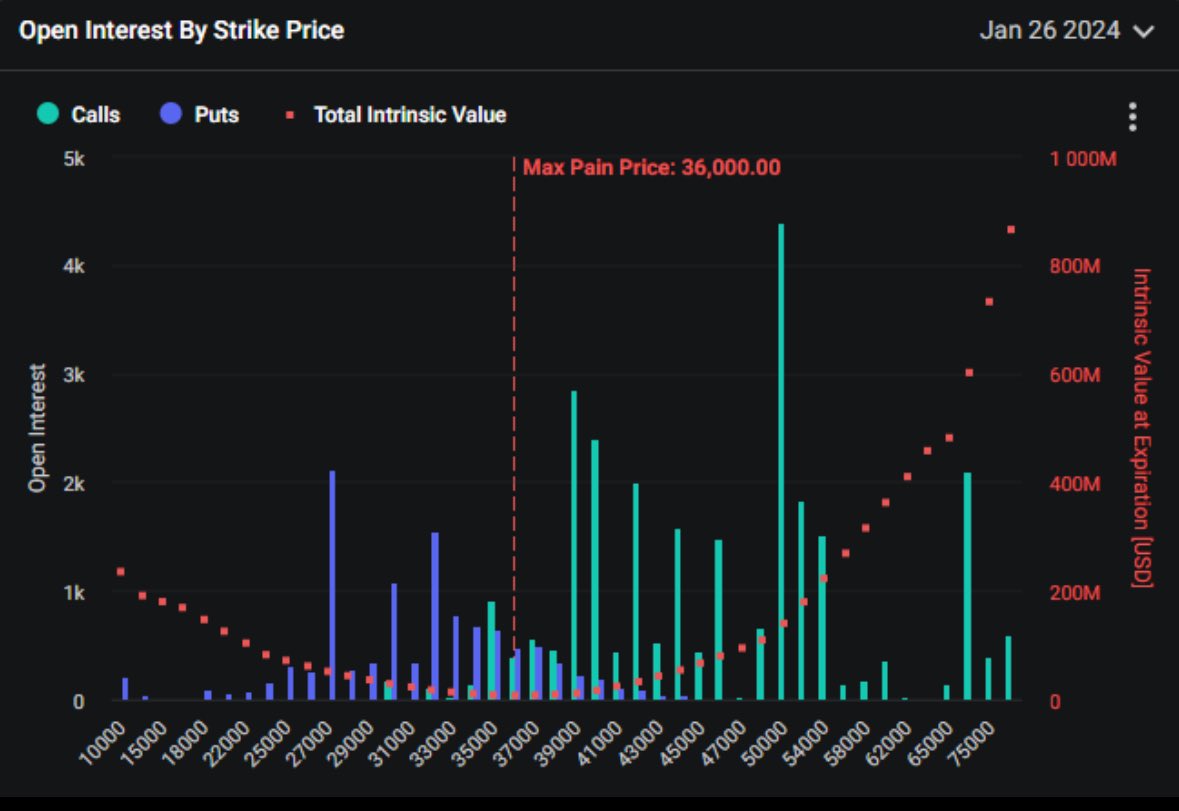

The notional value of today’s batch of BTC contracts is $1.4 billion. The put/call ratio is 0.84, meaning slightly more call sellers than puts. Max pain price is currently around $36,000.

Total open interest, or the value of all contracts yet to be closed or expire, is close to record levels at $16 billion, according to Deribit.

On December 7, Greeks Live noted that after last week’s delivery, December’s Bitcoin options share was over 50%. But as the market advanced this week, the monthly options share fell back below 50% again.

It added that the market is very hot right now, “as if it is back to the atmosphere of the end of 2020.”

“On the one hand, the short-term market is driving a significant increase in short-term options positions, and on the other hand, traders who are bullish on the ETF will simply choose to trade January options.”

There are currently two hot strike prices with more than 20,000 calls for both $40,000 and $50,000.

“Options markets are suggesting that Bitcoin will hit $50,000 by January,” commented the Kobeissi Letter on December 7.

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

This also happens to be the same month that Bitcoin ETF approvals are expected, it noted.

“Options are suggesting the run is only just beginning. Could this become a massive sell-the-news event? Possibly. However, history has proven that when Bitcoin runs, it runs. The approval of Bitcoin ETFs may already be priced into crypto markets.”

Ethereum Expiries

In addition to the expiring Bitcoin options, around 207,000 Ethereum contracts will expire today. These have a notional value of $491 million and a put/call ratio of 0.58.

Ethereum derivatives have been lackluster lately, with all eyes on Bitcoin. However, this may be starting to change as speculators eye the second-largest crypto asset.

For the first time in a while, ETH has outperformed BTC today with a 5% gain to reach $2,375 at the time of writing. It is the highest price ETH has reached since early May 2022.

BTC, by comparison, has started to correct, slipping 1.2% on the day in a fall to $43,430. Moreover, most altcoins are in the green this Friday, with Solana gaining double digits.

Best crypto platforms in Europe | December 2023

![]()

KuCoin

Explore →

![]()

Ducascopy

Explore →

![]()

Wirex App

Explore →

![]()

Paybis

Explore →

![]()

YouHodler

Explore →

Explore more

The post The $1.4B Question: How Bitcoin’s Massive Option Expiry Could Affect Your Portfolio appeared first on BeInCrypto.

[ad_2]

Source link