[ad_1]

UK citizens fear surveillance and financial stability risk associated with a government-issued digital currency.

A recent survey by the Bank of England and the His Majesty’s Treasury dented ambitions to introduce a central bank digital currency.

CBDC Surveillance Question Still Up For Grabs: UK Survey

A survey of 50,000 UK citizens revealed concerns about surveillance and that its digital nature would allow customers to move funds and cause financial instability rapidly. Others expressed concerns over the future of cash.

Despite the central bank’s attempts to calm privacy concerns, a CBDC system tracking user balances offers unparalleled insight into spending habits that third parties could exploit, says Susannah Copson at Big Brother Watch.

A case in point is China’s e-CNY system which must comply with socialist ideals that include information censorship.

It is not inconceivable that governments could limit spending at politically-polarizing merchants. The UK government has repeatedly denied allegations it will program central bank money in such a way.

Moreover, while large transaction limits could cause lower financial stability, smaller limits may reduce the attractiveness of a CBDC.

New UK Crypto Bill Could Reduce Attractiveness of CBDC

The UK has been mulling a central bank digital currency through several projects testing settlement technologies and their associated asset transfers.

The BoE concluded its real-time gross settlement trial in April to synchronize tokenized asset movements between ledgers. The test predates a wholesale settlement service the bank will launch in the spring of 2024 to lower counterparty risk.

Additionally, the recently-completed Project Rosalind tested retail transfers between peers, while a new sandbox allows the exchange of digital securities over blockchain technology.

But all the tests could be a moot point after the government passed a new bill legalizing crypto trading. Cryptocurrencies, while not completely anonymous, offer some protection against surveillance.

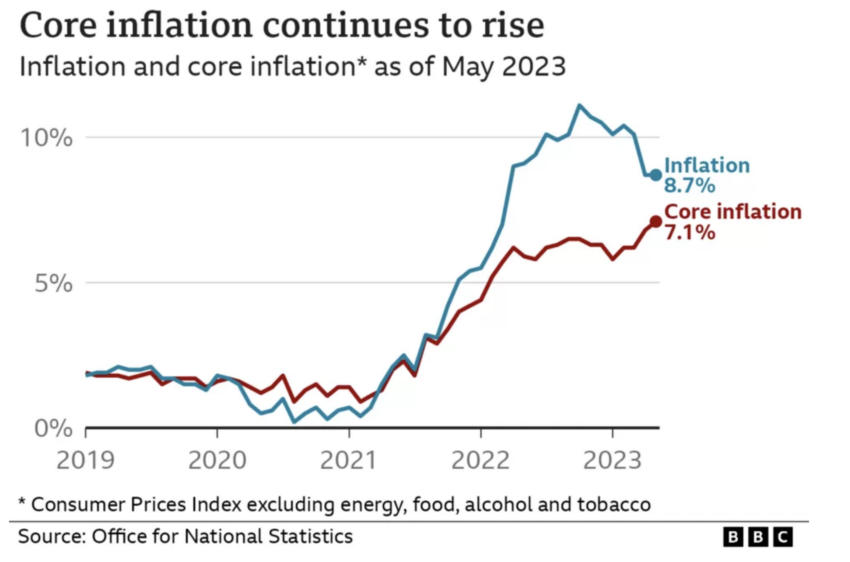

Additionally, the UK central bank’s inflation fight still seems a long way from victory, with core inflation at 7.1% in May.

Tired of central banks lowering the value of your nest egg? Find out here how crypto can help.

The cost-of-living crisis has seen many citizens unable to pay bills or buy enough food. As a result, cryptocurrencies could provide an alternative monetary system to help the worst hit.

Got something to say about concerns UK citizens have about CBDC surveillance or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link