[ad_1]

The US Court of Appeals for the Third Circuit has compelled the US Securities and Exchange Commission (SEC) to respond to Coinbase’s 2022 petition on clarity regarding which assets should be regarded as securities.

Judge Cheryl Ann Krause gave the securities watchdog seven days to answer Coinbase whether it would grant or deny the request.

SEC Dismisses Coinbase Request for Relief

Krause also ruled the SEC can also communicate how much time it needs to decide whether to agree or disagree with the petition.

In July 2022, Coinbase filed a petition asking the agency to regulate digitally-native securities and table potential rules for determining an asset’s security status.

It said current schemes to register assets as securities were impossible or infeasible. It also left vulnerable investors in projects unable or unwilling to comply, the exchange argued.

The agency’s initial response was a brief arguing that Coinbase could not demonstrate an indisputable right to relief. It argued that it is not obligated to respond or regulate crypto and that Coinbase’s proposals were “complicated.”

As a result, the petition should be denied, the agency concluded. SEC Chair Gary Gensler has said that the rules Coinbase requested already exist.

The agency recently sued Coinbase for not registering as a broker-dealer and denying investors protection by offering them unregistered securities.

Did Coinbase Vetting Hold Legal Weight?

While the securities debate continues to rage and will likely end up in a long legal battle, a closer look at Coinbase’s modus operandi under current securities law could spark discussions of whether the exchange would have been better off in jurisdictions other than the US.

According to the SEC lawsuit, Coinbase released the Coinbase Crypto Asset Framework asking crypto projects targeting a listing to complete a form.

The form required projects to disclose details of tests used to determine whether the coin satisfies the Howey Test.

Read here about the Howey Test’s impact on crypto.

Later, the exchange co-founded the Crypto Rating Council. The CRC distilled Howey Test analysis to a set of binary yes or no questions.

It asked applicants to rate the asset’s resemblance to a security on a scale of one to five. One describing an asset that only marginally represents a security.

However, the SEC alleges that Coinbase used assets likely to be securities to double the number of tokens it listed on its platform between the end of 2019 and 2020.

In other words, it listed tokens that regulators would deem securities and should have offered investor protection.

Middle-of-the-Road Approach May Hurt Domestic Business

Coinbase’s approach contrasts with that of Binance, whose US arm handled minimal business compared with its global operation. By recognizing that certain products were illegal in the US, the exchange minimized exposure to the US market.

Coinbase, on the other hand, created its own process that it seems carried little legal weight. The CRC process gave it the discretion to list tokens above a certain risk threshold without immediate consequences.

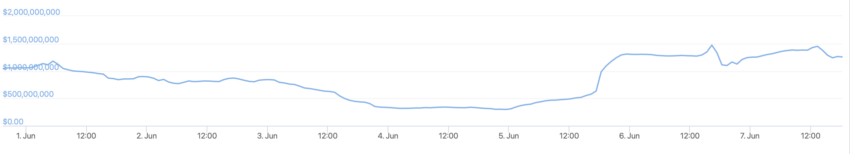

As a result, it appears to have ended up in the uncomfortable position of being an “almost-compliant” business that now faces a possible existential threat. Its trading volumes have fallen over $200 million since the SEC suit.

The company is listed on the Nasdaq and is audited by Deloitte and Touche.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link