[ad_1]

US deficits keep rising despite the economy growing

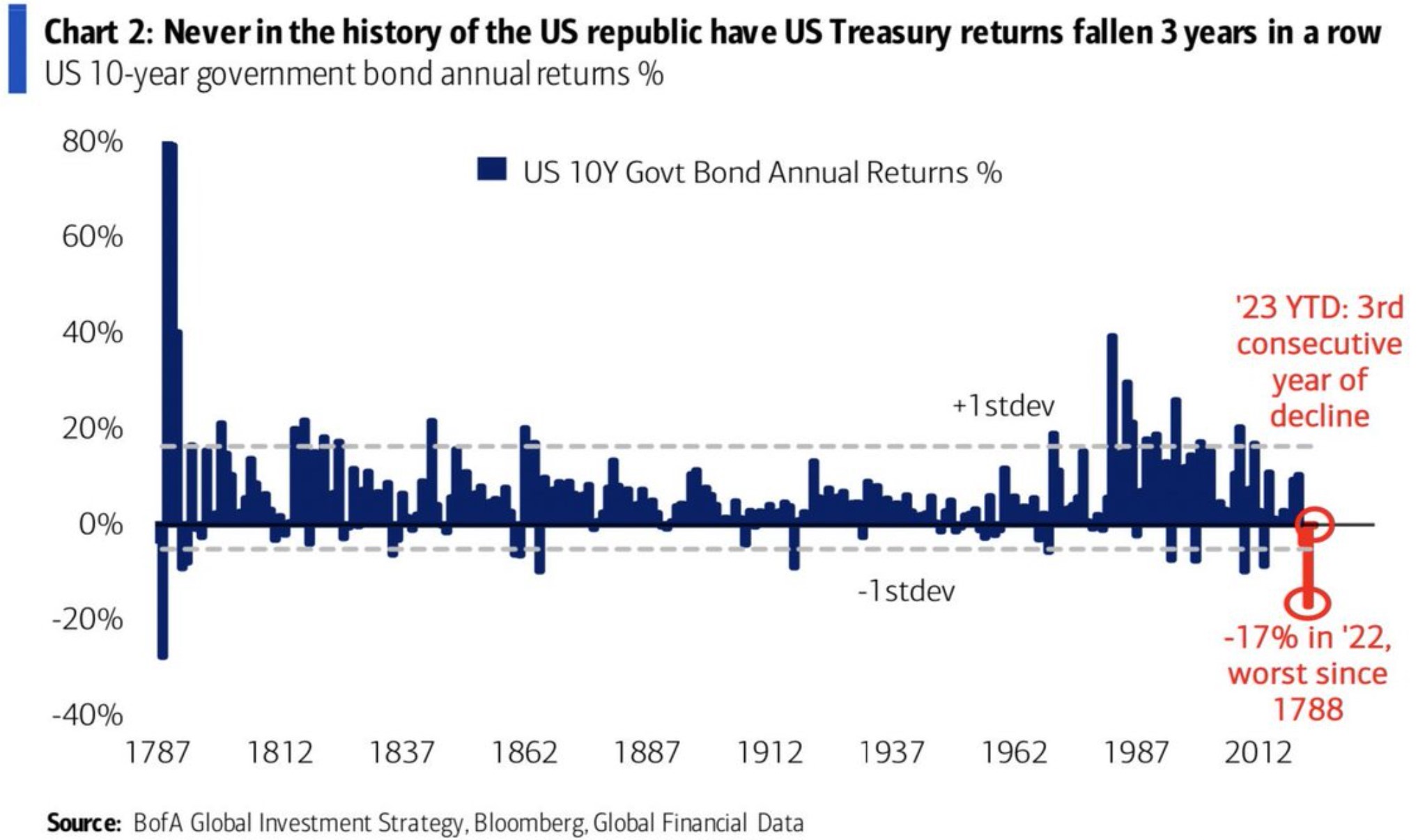

US Treasury returns dropped for the past three years in a row

A weakening dollar might cause cryptocurrencies’ next step higher

In previous articles published here, I’ve argued that the next move in the cryptocurrency market will likely be driven by the US dollar rather than crypto-related news. Given the current interest rate levels, the surging deficit makes raising money difficult for the US government.

Hence, one way to make it easier is to lower the rates.

The Federal Reserve will never tell market participants that rates cannot move much higher. The moment it does that, inflation expectations are not anchored anymore.

However, one might take time to understand what the bond market tells. For the first time in the history of the United States, US Treasury returns dropped three years in a row.

A vicious circle could spark the US dollar’s weakness

The price of a bond is inversely related to its yield. Lower bond prices mean higher yields and one way for bond prices to bounce back is for yields (i.e., interest rates) to decline.

But the deficit poses a huge problem. Deficit spending is one of the reasons why bonds underperform.

Because deficits surged even as the economy grew, more bonds are issued to pay for it. However, issuing more bonds means issuing more debt, but interest rates are not low anymore as they were in the past years.

Therefore, interest rate expenses would increase, offsetting the revenue collected from selling the bonds.

One way to solve this problem is to let the dollar slip. The starting point might be a signal that the Fed has already reached the terminal rate.

If the dollar starts weakening, its decline should be generalized and also have ramifications for the cryptocurrency market. Therefore, if Bitcoin is about to make a move higher, one should keep an eye on the US deficit and the dollar.

[ad_2]

Source link