[ad_1]

The enduring ambiguity of crypto regulation in the United States is poised to witness a defining moment. Senators Cynthia Lummis (R-WY) and Kirsten Gillibrand (D-NY) prepare to unveil their revamped crypto regulation proposal.

The controversial bipartisan bill, known as the Lummis-Gillibrand Responsible Financial Innovation Act, seeks to bridge the regulatory divide that underscores the crypto industry in America.

The Lummis-Gillibrand Act: Regulatory Clarity

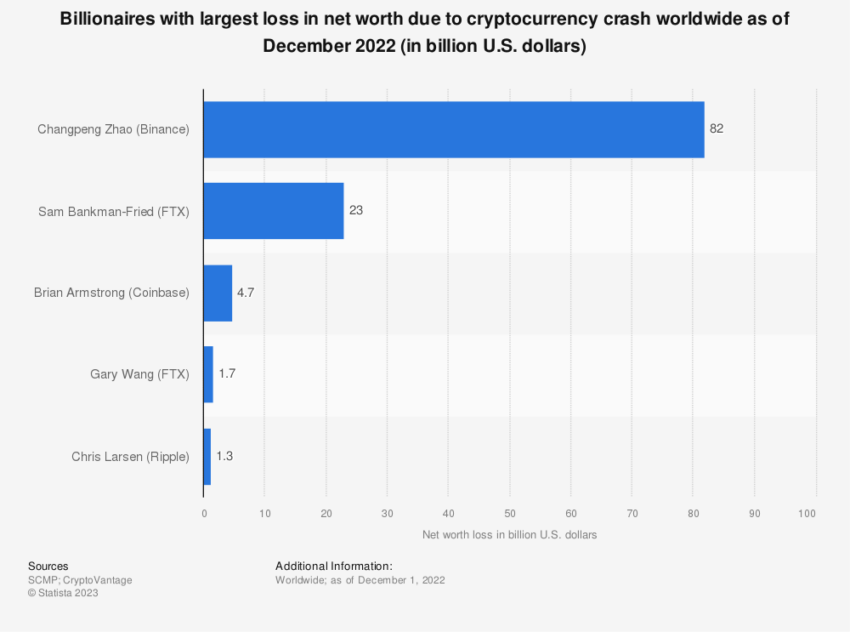

An escalating dispute between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) over the precise nature of cryptocurrencies has left businesses in limbo. Both regulators are wielding their respective enforcement powers against crypto exchanges, Coinbase and Binance.

The Lummis-Gillibrand Act aims to “provide for responsible financial innovation and to digital assets within the regulatory perimeter.” It designates most cryptos as commodities under the CFTC’s purview, in stark contrast to the SEC’s ongoing enforcement actions.

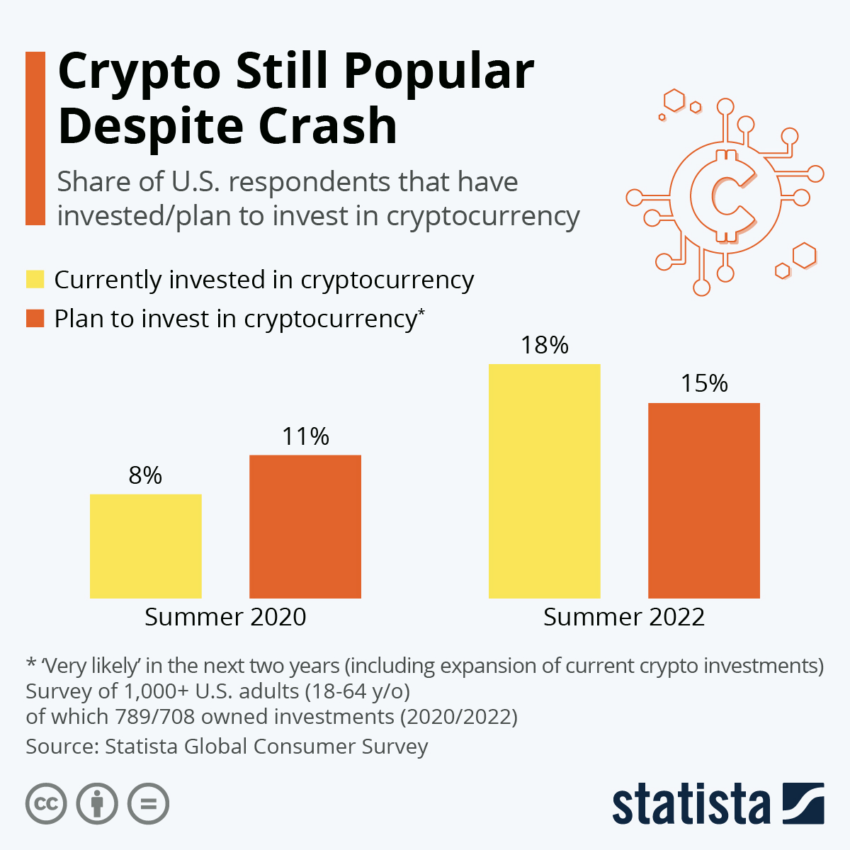

The legislation asserts a bid to prevent further turmoil in the crypto sector, which has seen a string of high-profile collapses leading to substantial investor losses in the past two years.

“This legislation is the most comprehensive proposal to date that provides robust consumer protections and appropriately addresses the current landscape surrounding crypto assets,” said Senator Lummis.

The proposed act would mandate crypto exchanges to store customer assets securely in third-party trusts. Subsequently, prohibiting “proprietary trading” or trading with their own funds on their own platform.

Crypto Exchanges Must Be Held Accountable

The US crypto regulation bill could also mark a regulatory tightening on “material affiliates” of crypto exchanges. This follows allegations that FTX reportedly lent vast sums of customer funds to its sister company, Alameda Research, prior to a liquidity crisis that triggered its downfall.

“It is critical to integrate digital assets into existing law and to harness the efficiency and transparency of this asset class while addressing risk… As this industry continues to grow, it is critical that Congress carefully crafts legislation that promotes innovation while protecting the consumer against bad actors,” said Senator Lummis

Furthermore, the proposal aims to clamp down on “rehypothecation” of crypto assets. It effectively proscribes high-risk, yet profitable crypto services such as staking. It also imposes stricter standards on new tokens before they are listed on crypto exchanges.

The proposal, set to unveil on Wednesday, July 12, emerges against a backdrop of significant opposition to SEC Chair Gary Gensler. Particularly in the Republican-dominated House which has already taken steps to reduce Gensler’s sway.

While the US crypto regulation bill’s passage in its existing state or within the current Congress appears doubtful, it nonetheless marks a significant initial stride towards cultivating bipartisan legislation on this crucial subject.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link