[ad_1]

Prices for virtual land inside leading Metaverse ecosystems have plunged this year. This has resulted in major losses for speculators that have sold recently.

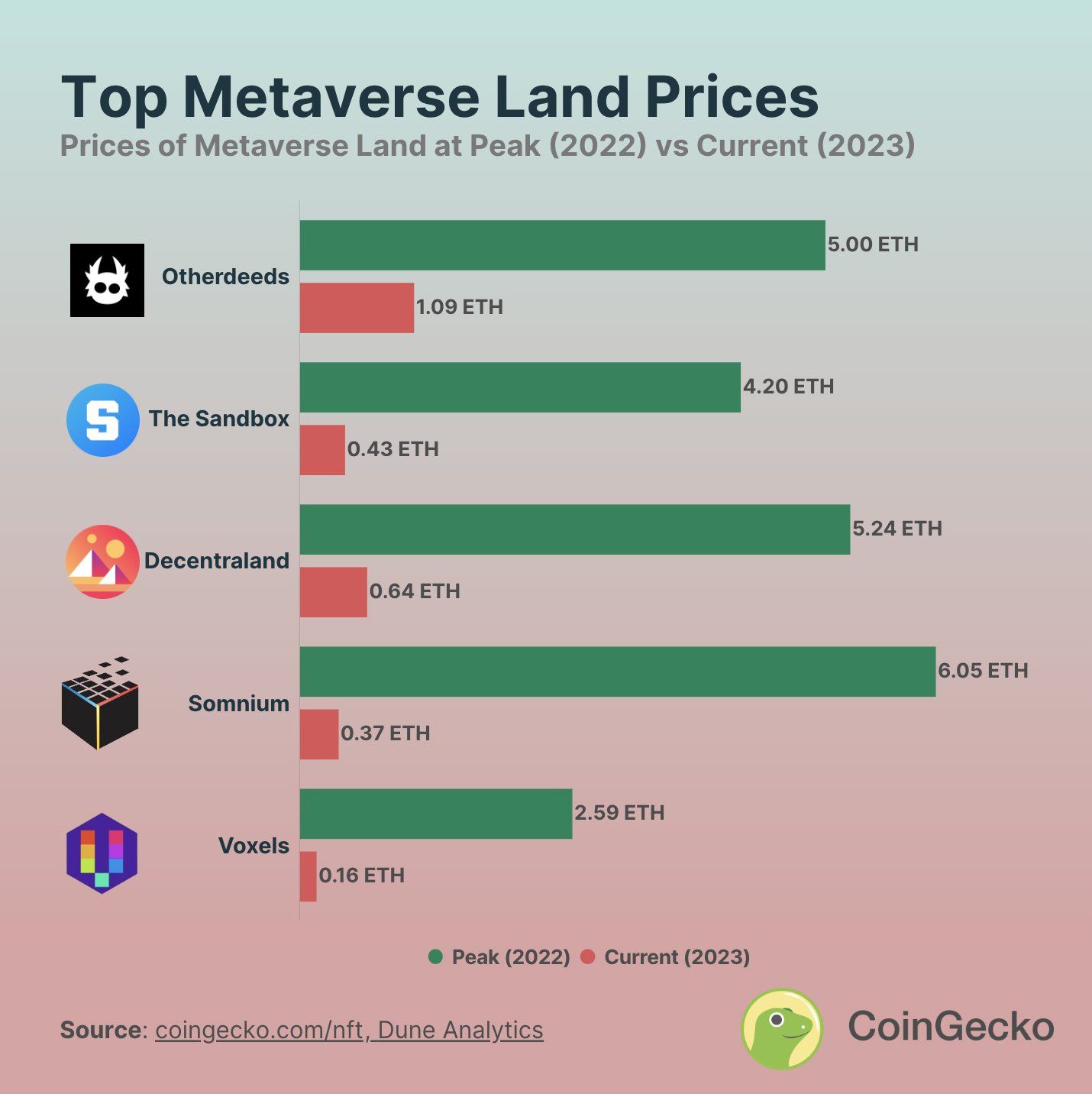

On May 26, CoinGecko co-founder Bobby Ong posted an update on Metaverse land prices. He compared those at their peaks with what they currently fetch—and the picture isn’t pretty for landholders.

Metaverse land was all the rage during the 2021 bull market and into the first half of 2022. Virtual parcels were getting snapped up at big prices. Additionally, huge global brand names even bought up large swathes of Metaverse land.

Virtual Land Languishing

Fast forward to mid-2023, and the virtual landscape looks rather desolate for those needing to liquidate.

The most expensive Metaverse land at the moment is Otherdeeds by Otherside, at 1.09 ETH (around $1,970). The project was launched by Bored Ape Yacht Club (BAYC) studio Yuga Labs. However, prices have slumped 78% since their peak when a plot of land cost 5 ETH.

In May 2022, the floor price of Otherdeeds land spiked to 7.5 ETH, according to the research.

Decentraland virtual land currently sells for 0.64 ETH or around $1,156 at current prices. This has declined by 88% since its peak when parcels went for 5.24 ETH.

Land in The Sandbox has declined 90% in price since its peak of 4.2 ETH. Today, a plot will set you back around 0.43 ETH or $777.

Furthermore, smaller Metaverse projects such as Somnium and Voxels have seen virtual land prices slump by 94%.

It is a similar story for NFTs, where popular projects have plunged in price terms this year. Collections such as Doodles, Moonbirds, and Goblintown have seen NFT floor prices plummet.

Overall, NFT sales volume has declined by 84% from April 2022 to April 2023, according to CryptoSlam.

Metaverse Tokens Mauled

Metaverse land is not the only thing to fall since tokens related to virtual ecosystem projects are also in the doldrums.

The Sandbox (SAND) has been battered and remains down 94% from its all-time high of $8.40 in November 2021. The Metaverse token was trading at just $0.50 at the time of writing.

Decentraland (MANA) has faced a similar fate, having fallen 92% from its $5.85 peak. Today, MANA is changing hands for $0.46.

The once-hyped Axie Infinity AXS token is in even more pain. This Metaverse asset has lost a whopping 96% from its all-time high of $165. Traders can scoop up AXS tokens for just $6.82 at the moment.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link