[ad_1]

With its inherent volatility, the cryptocurrency market is girding itself for a new challenge: the potential impact of an economic recession.

The complex interaction between global economic trends, monetary policy, and the digital asset market is set to be a pivotal force in the crypto ecosystem.

The Role of the Federal Reserve

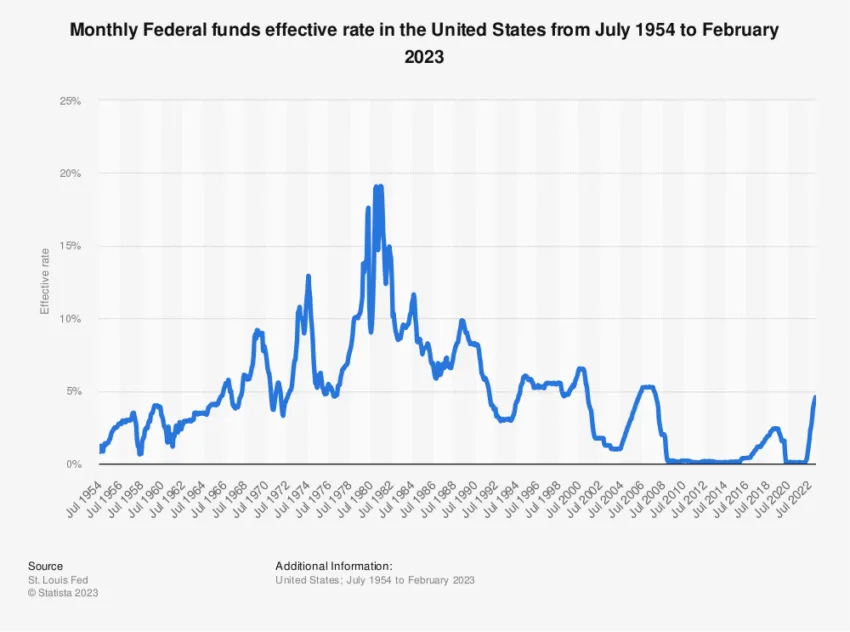

The Federal Reserve, the central banking system of the United States, plays a crucial role in the economic landscape. Its monetary policies, specifically those pertaining to interest rates, greatly impact the economy and, by extension, the crypto market.

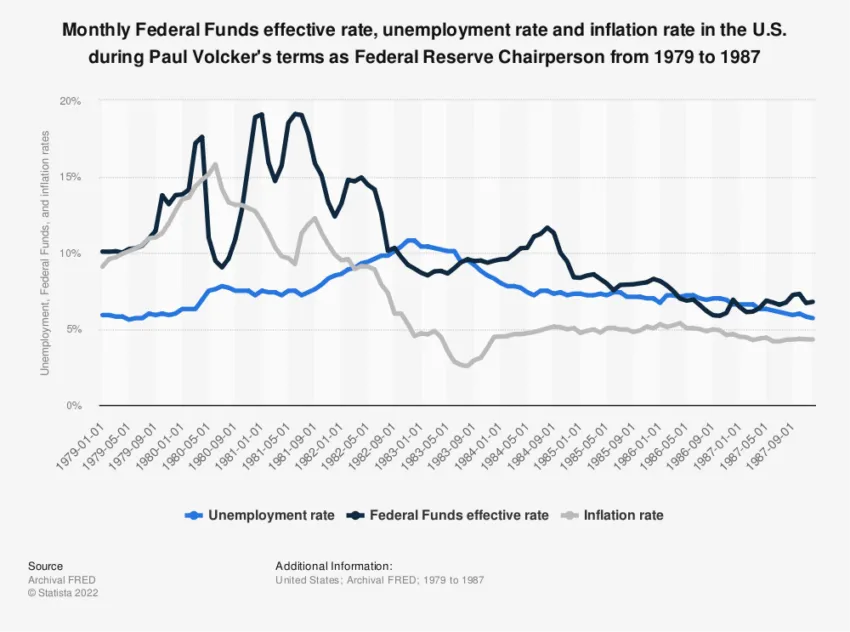

In the face of a recession, the Federal Reserve has traditionally opted to lower interest rates to stimulate economic activity by encouraging borrowing and investing. However, the unpredictability of a recession’s onset and duration often poses challenges for such policies.

During the Great Recession, the mortgage crisis severely impacted the US economy. The Federal Reserve responded to lower interest rates, easing mortgage distress and stimulating the economy. The question now arises: how might such strategies impact the crypto market?

The Impact of a Recession on Crypto

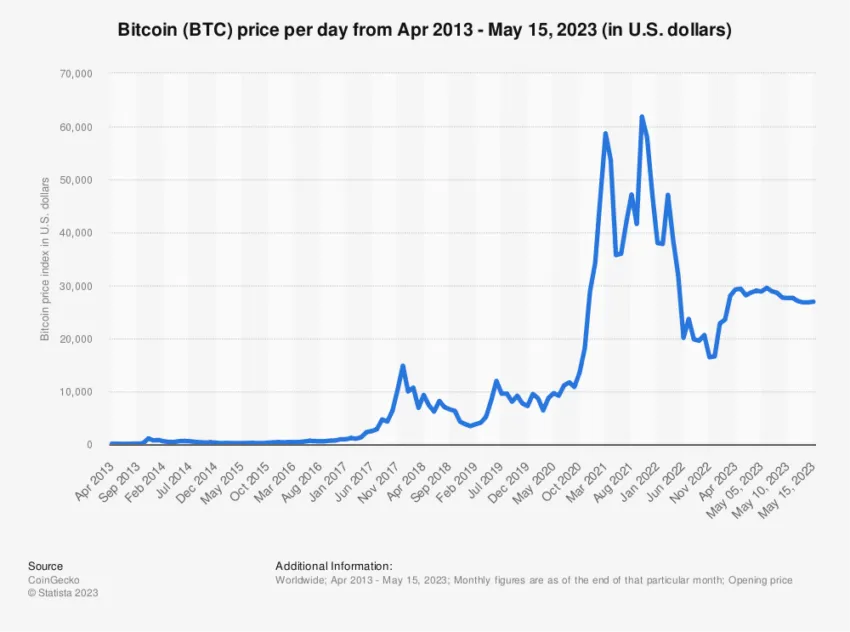

Often touted as “digital gold,” Bitcoin has presented itself as a potential hedge against traditional financial market instability. As such, the impact of a recession on the crypto market is a topic of intense interest and speculation.

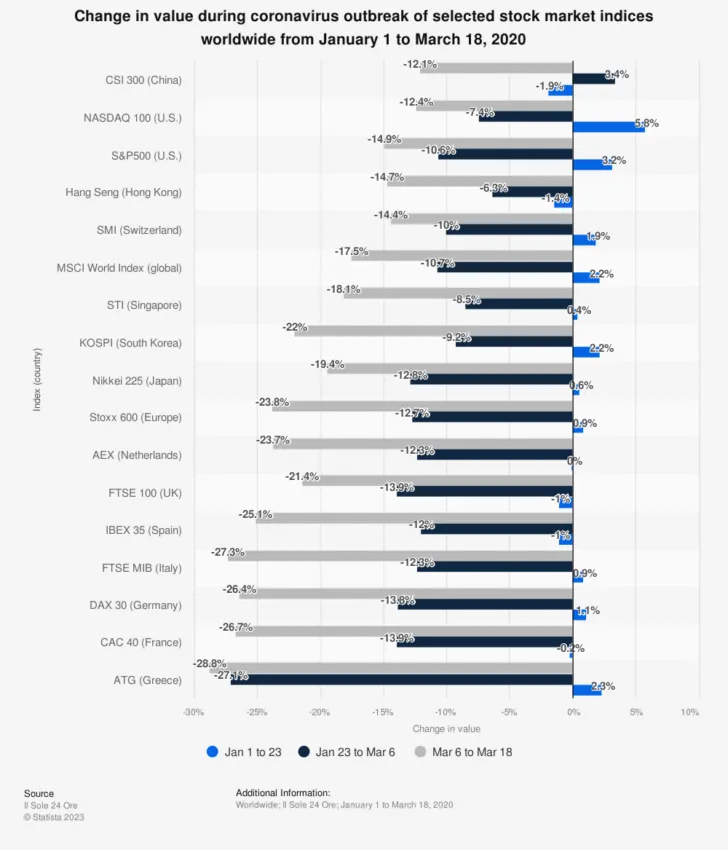

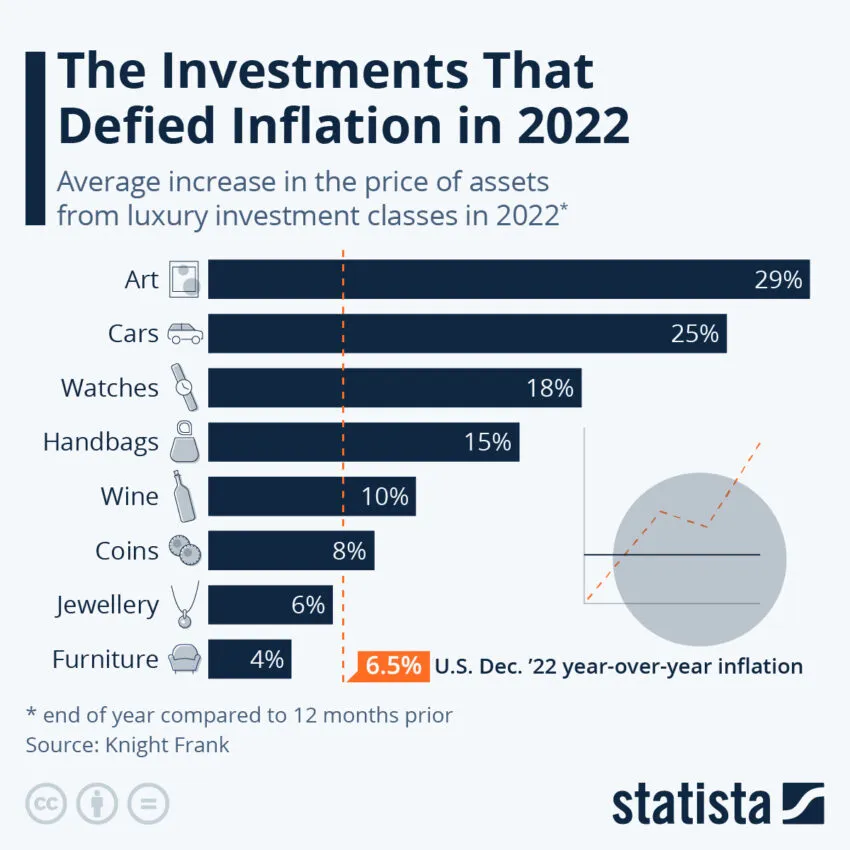

An economic downturn typically leads to a fall in asset prices, as was evident during the Great Recession. However, the crypto market’s response to such a downturn may differ due to its decentralized nature and independence from traditional financial systems.

Contrary to traditional assets, cryptocurrencies like Bitcoin could offer an alternative investment during a recession. Bitcoin’s decentralized, borderless, and non-governmental nature might make it attractive as a store of value when traditional markets are in distress.

For instance, Bitcoin has occasionally displayed a negative correlation with traditional markets, suggesting that it could provide some level of diversification during market downturns. However, it is important to note that cryptocurrencies’ safe haven status is still a subject of debate among experts.

During the early stages of the COVID-19 pandemic, Bitcoin and other cryptocurrencies experienced significant price declines alongside traditional markets. This event raised questions about the reliability of cryptocurrencies as a safe haven asset in times of crisis.

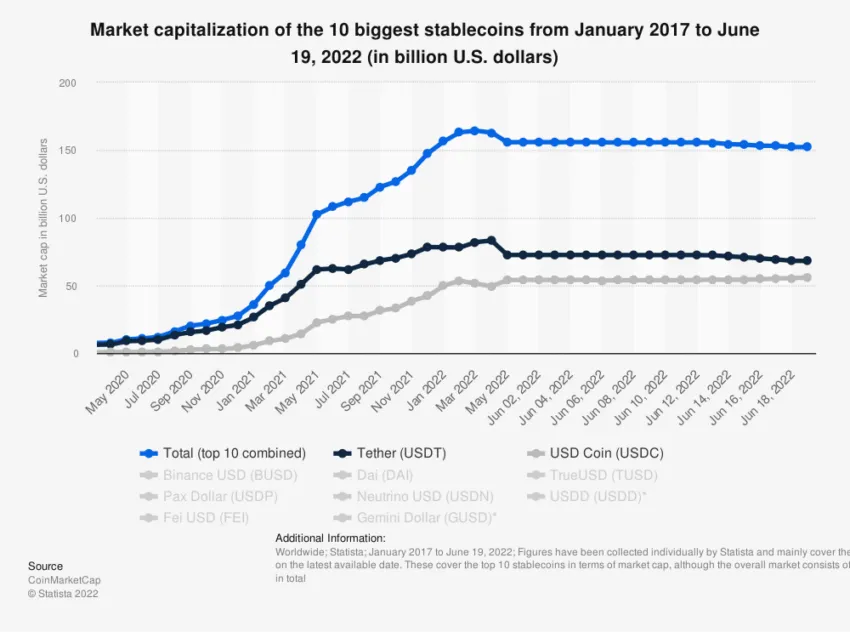

Stablecoins, cryptocurrencies pegged to traditional assets like the US dollar, could also play a significant role during a recession. These digital assets are designed to maintain a stable value, which might make them an attractive option for investors seeking to preserve their capital during periods of economic turbulence.

For instance, Tether (USDT) and USD Coin (USDC) are two popular stablecoins backed by the US dollar. These stablecoins provide a means for investors to escape the volatility of traditional cryptos while maintaining exposure to the digital asset market.

In a recession, the demand for stablecoins may increase as investors seek to mitigate risk while still participating in the digital economy.

The Intersection of Interest Rates

Interest rates can influence the crypto market in several ways. Traditional investments like bonds may offer lower yields in a low-interest-rate environment, such as during a recession, making riskier assets like cryptos more attractive.

On the other hand, higher interest rates can increase the cost of borrowing, potentially leading to reduced liquidity in the crypto market. Investors may be less likely to take on the risk of investing in cryptos when safer, higher-yielding investments are available.

The crypto market closely watches the Federal Reserve’s decisions on interest rates. In conjunction with other factors, these decisions shape the market’s direction.

The inverse relationship between interest rates and investment in risky assets can be seen in traditional markets and extend to the crypto market. In a low-interest-rate environment, borrowing costs decrease, making it less expensive for investors to fund purchases of riskier assets such as cryptocurrencies.

Conversely, safer assets like bonds become more attractive when interest rates are high. This is mainly due to their guaranteed returns, potentially decreasing investment in riskier assets like cryptos.

In the crypto market, borrowing and lending platforms may also be impacted by changes in interest rates. These platforms allow users to earn interest on their crypto holdings or borrow against them.

The interest rates offered on these platforms could become more attractive than traditional investments in low-interest-rate environments.

Current Economic Indicators

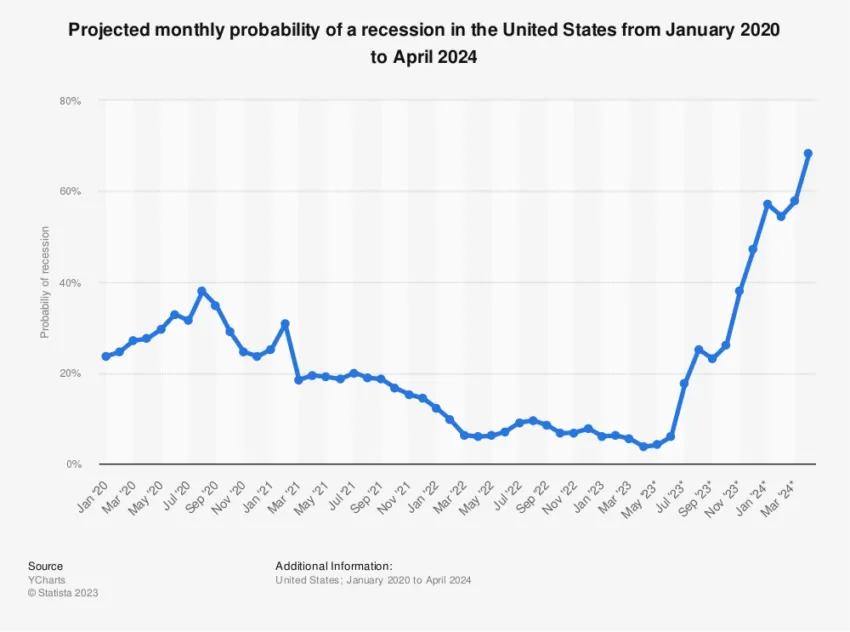

Current economic indicators indicate potential changes in the Federal Reserve’s monetary policy. US Treasury Secretary Janet Yellen has warned that time is running out for corrective fiscal measures ahead of crucial meetings.

These changes could potentially signal the onset of a recession, which would have implications for the crypto market.

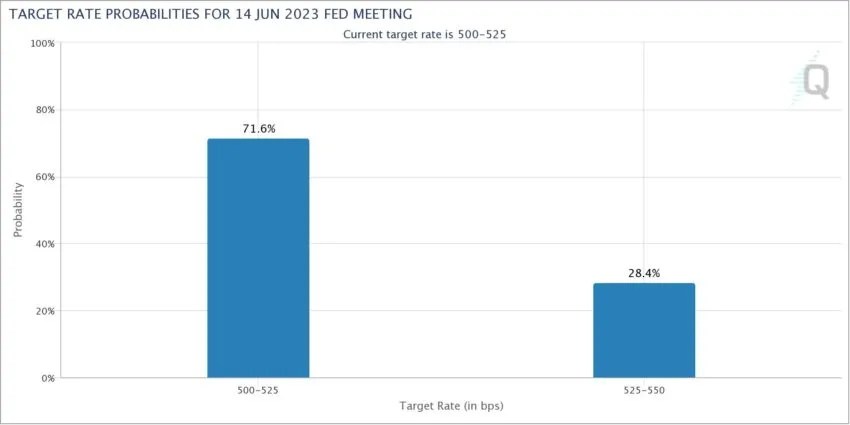

The CME Group’s FedWatch Tool analyzes the Federal Reserve rate moves’ probability, providing valuable insights for crypto investors.

It helps market participants gauge the likelihood of interest rate changes, which can impact the relative attractiveness of crypto investments.

Institutional investors could be crucial in how the crypto market responds to a recession. These investors, which include hedge funds, pension funds, and endowments, have shown increasing interest in the crypto market.

Their participation could stabilize a downturn, as these investors often have a longer-term investment perspective than retail investors. However, the risk-averse nature of institutional investors could also lead them to pull back from the crypto market in a downturn, potentially exacerbating market volatility.

Crypto Navigates Uncertain Waters

The potential impact of a recession on crypto presents a new frontier for investors. While uncertainty surrounds how exactly a recession might impact cryptocurrencies, it is clear that such a period could present both challenges and opportunities.

The crypto market’s resilience will be tested in the face of a recession, as will the theories that propose cryptocurrencies as a hedge against traditional market instability.

Investors, regulators, and market participants must closely monitor economic indicators and policy decisions to navigate this uncertain landscape. The intricate interplay between the Federal Reserve’s policies, the broader economic environment, and the crypto market is set to shape the future of digital assets in the face of economic turbulence.

Understanding the dynamics and potential strategies to mitigate risk and seize opportunities is essential. This understanding will be key to navigating the impact of a recession on crypto and beyond.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link