[ad_1]

Join Our Telegram channel to stay up to date on breaking news coverage

Investors are trying to catch their breath following a gruesome sell-off on Wednesday. In a surprise move, Bitcoin led the entire market on a downward spiral, losing at least 4.2% of the total market capitalization to $1.05 trillion.

Crypto Market In Turmoil

While there might be many reasons backing this rout that saw BTC dump 4.2% in 24 hours to trade slightly above $25,000 on Thursday, the United States Federal Reserve decision to temporarily halt interest rate hikes is the biggest culprit.

The pause on interest rate hikes was a positive gesture, yet the remarks made by the regulator’s Chair, Jerome Powell, following this announcement seemed to unsettle the markets.

Powell reaffirmed the Fed’s dedication to reducing yearly inflation to a set goal of 2.5%, a figure that presently stands at 4%. However, opponents of the bank’s strategy argue that an excessive emphasis on price stability could inadvertently plunge the economy into a recession.

Other than that, the crypto market has been in a dilapidated condition since last week after the U.S. Securities and Exchange Commission (SEC) launched more attacks on crypto entities, including Binance and Coinbase.

In the process, the SEC implicated 64 cryptocurrencies, listing them as security offerings including Cardano (ADA), Polygon (MATIC), and Solana (SOL).

The lawsuits against Coinbase and Binance come hot on the heels of another case the regulator has been battling with Ripple Labs, the company that issues XRP.

According to a related report by CoinDesk, which quoted Ruslan Lienkha, the chief of markets at YouHodler, a Web3 and fiat service company, investors need to give the market time to reveal the ultimate direction. This could be a bear trap, occasioned by one big whale’s decision to sell BTC at this time.

“We have to remember that the crypto market is a relatively small market, and a few hundred million dollars can move the market for a few percent,” Lienkha said in an emailed statement. “So, let’s see the following days if it is really a downward trend or just a single whale sell-off.”

Bitcoin Whales Stay Put – Eyes on The Prize

Bitcoin price tends to move in cycles of four years each. Large volume holders and institutions have carefully mastered these cycles which they capitalize on to make the most out of their crypto investments.

The cycles are often marked by the Bitcoin halving event, which takes place after every four years. Halving keeps inflation on the Bitcoin network at a bare minimum by reducing the supply of the largest crypto.

So, every four years, miner rewards are slashed by half. This significantly reduces supply and with demand increasing or even staying the same, Bitcoin price eventually ignites a bull market to fresh all-time highs.

For further information on HODLer cycles, please visit our curated Dashboard below👇🏼https://t.co/6KJHVYjlg6 pic.twitter.com/Sw3TYYS4Up

— glassnode (@glassnode) June 15, 2023

According to Markus Levin, who cofounded XYO Network, a blockchain geospatial protocol, Bitcoin has “bottomed already” in regard to its prevailing “four-year circle.”

“But nothing is certain in this market, especially when it comes to crypto,” Markus explained. “For example, if we do enter recession territory, then we should be prepared for even more unpredictable movements with Bitcoin and other assets that are further along the risk curve.”

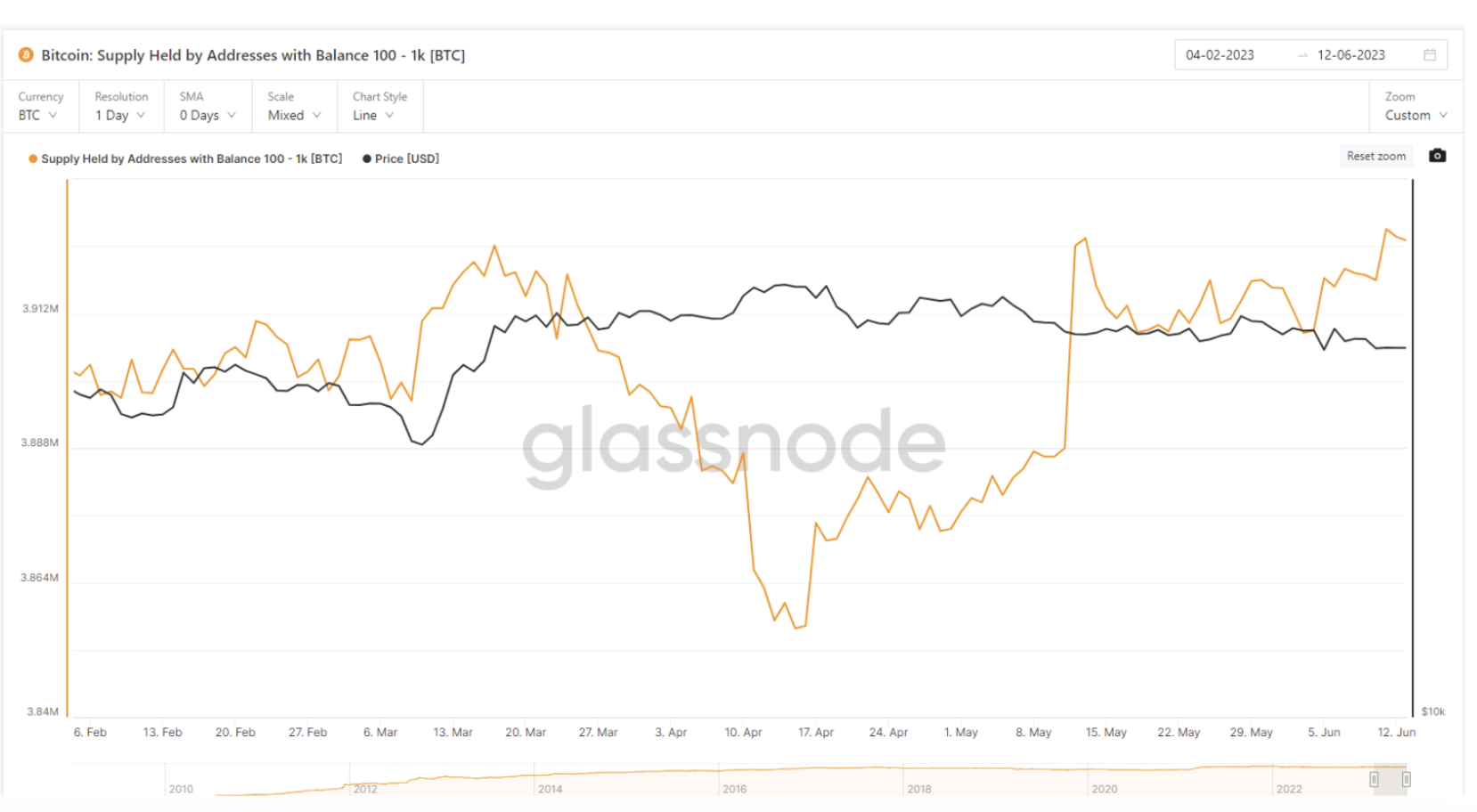

Glassnode, an on-chain analytics company, reveals that unique wallets containing between 100-1,000 BTC have grown their BTC holdings following the U.S. SEC’s lawsuits against Binance and Coinbase.

Wallets holding between 10 and 100 BTC exhibited a similar trend. However, the risk appetite was not as prominent for wallets maintaining more than 1,000 BTC.

Wallets containing between 1,000 and 100,000 BTC remained relatively unchanged, albeit a minor drop was observed within the bracket of wallets holding between 1,000 and 10,000 BTC.

Bitcoin Price Technical Outlook

If whales hold firmly and fight the urge to sell, these dips would only be temporary. Investors would also be encouraged to buy the dip, allowing Bitcoin price to tap the fresh liquidity for a bigger rebound, aiming for $30,000.

The four-hour timeframe chart already shows BTC starting to nurture a rebound above $25,000. Based on the On-Balance-Volume (OBV) indicator, investors have started pumping more funds into BTC markets.

In other words, there is more positive liquidity to reinforce the bullish grip on BTC. However, support at $25,000 must be defended to avoid the possibility of declines extending to reach $24,000.

Related Articles:

Wall Street Memes – Next Big Crypto

Early Access Presale Live Now

Established Community of Stocks & Crypto Traders

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Best Crypto to Buy Now In Meme Coin Sector

Team Behind OpenSea NFT Collection – Wall St Bulls

Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

[ad_2]

Source link