[ad_1]

Bitcoin has broken out, reaching a yearly high of about $39,900. This surge has prompted market observers to suggest it might surpass the $40,000 mark very soon.

The recent price increase follows a speech by Jerome Powell, Chair of the United States Federal Reserve, hinting at continued restrictive rates until inflation aligns with their 2% target.

Is $40,000 Next for Bitcoin Price?

Post-Powell’s speech, Bitcoin touched a 19-month high, buoyed by market optimism and speculation regarding the Fed’s future direction. Some analysts, noting this uptrend, believe Bitcoin could breach the $40,000 mark and march toward $50,000.

Markus Thielen of Matrixport, in a note to investors, posited a 90% chance of Bitcoin reaching $45,000. He attributes this to market positivity and the potential approval of a spot exchange-traded fund (ETF).

“As we enter the last month of the year, we remain bullish. Historically, Bitcoin tends to rally by +12% in December, aligning with our early 2023 year-end target of $45,000 for Bitcoin, which now appears probable,” Thielen wrote.

In recent months, traditional financial institutions, like BlackRock, have sought a spot Bitcoin ETF from the US Securities and Exchange Commission (SEC). This development, coupled with active engagement from the SEC, fuels expectations of an imminent Bitcoin ETF approval.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Notably, Grayscale is preparing for such approval by appointing John Hoffman, formerly of Invesco, to lead its Bitcoin ETF efforts. Concurrently, the discount on Grayscale’s Bitcoin Trust to its net asset value has narrowed significantly, as per Coinglass data.

BTC On-Chain Indicators Turn Bullish

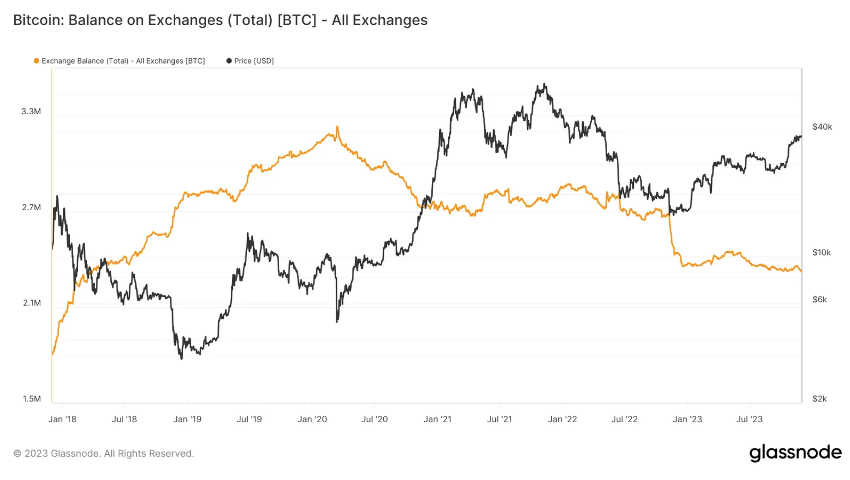

Further bolstering the bullish sentiment is on-chain data indicating a significant withdrawal of Bitcoin from exchanges. According to Glassnode, more than 37,000 BTC have been moved off exchanges since November 17.

This trend is generally seen as a bullish signal, suggesting a shift towards long-term holding and less selling pressure.

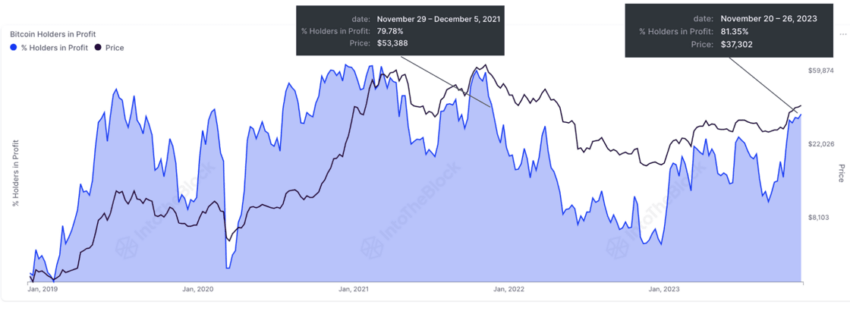

Moreover, the recent price surge has brought Bitcoin holders to their most profitable levels since December 2021. Data provider IntoTheBlock notes that over 80% of Bitcoin addresses are now holding at a profit.

“Over 80% of Bitcoin addresses are currently holding at a profit. This is the highest value since December 2021, when prices were above $50,000 per Bitcoin,” IntoTheBlock said.

Since this data was collected, Bitcoin has seen further gains, suggesting an even higher percentage of profitable addresses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link