[ad_1]

The Dogecoin (DOGE) price is trading between crucial resistance and support levels, the reaction to which can determine the future trend’s direction.

The readings in multiple time frames are inconclusive. Thus, the price movement in the next few days will be important in predicting whether the trend is bullish or bearish.

Dogecoin Price Approaches Convergence Between Resistance and Support

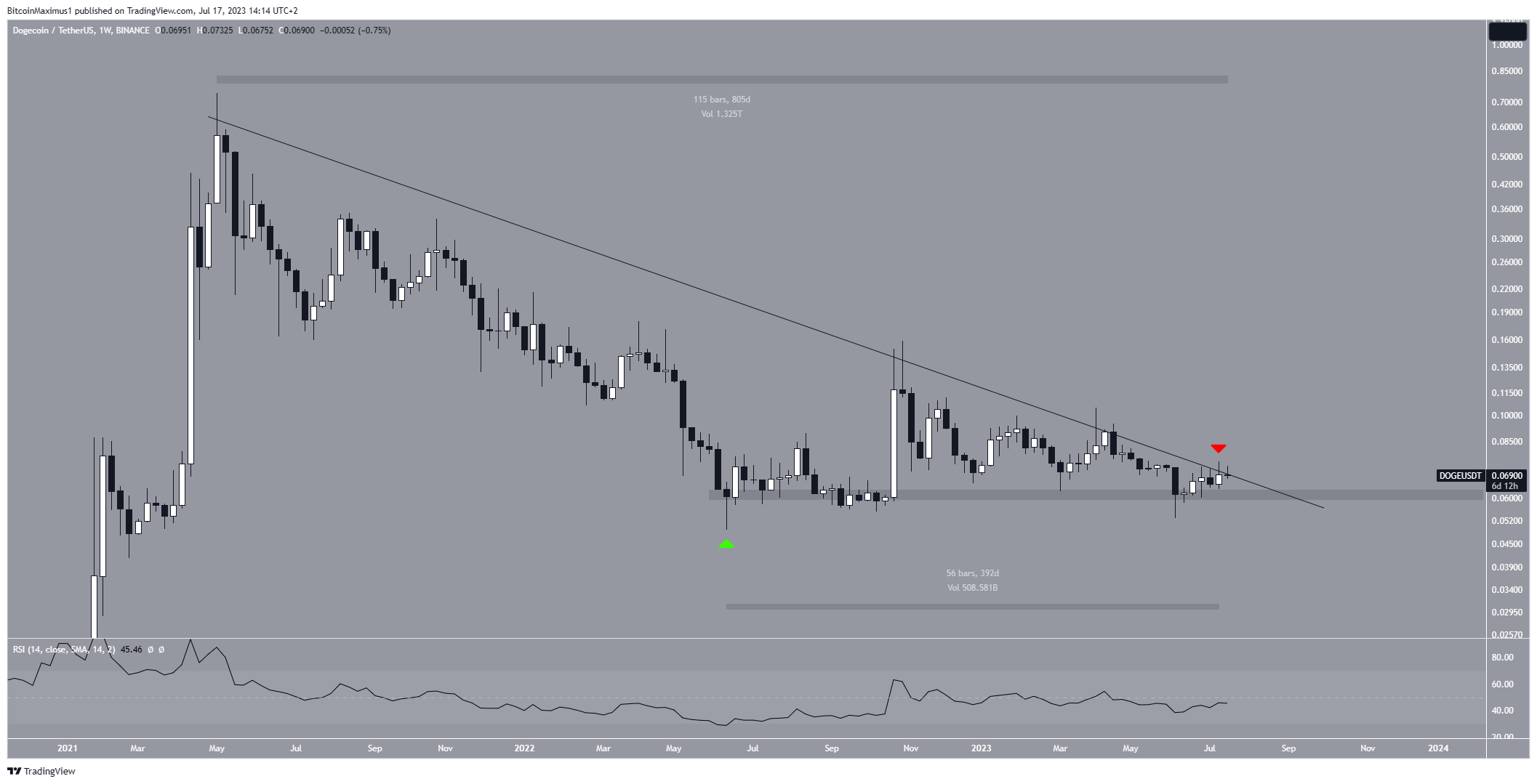

The weekly time frame technical analysis shows that the DOGE price has fallen under a descending resistance line since reaching its highest value of $0.739 in May 2021. This decline resulted in a low point of $0.049 in June 2022.

Following that, the price of DOGE experienced a recovery (green icon) and started trading above the $0.060 horizontal support level. However, it has not yet surpassed the long-term descending resistance line, which has been in effect for 805 days.

More recently, the resistance line rejected the DOGE price last week (red icon), but currently, there is another attempt to break through it.

Additionally, the price is very close to the convergence of the horizontal support level and the descending resistance line, indicating an imminent significant movement.

The weekly Relative Strength Index (RSI) reading does not provide a definite conclusion. RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to make decisions regarding buying or selling an asset.

Readings above 50 and an upward trend suggest that the bulls still have an advantage. Conversely, readings below 50 indicate the opposite.

Although the RSI is increasing, it remains below 50, indicating an uncertain trend. In order to confirm a bullish trend, the RSI needs to rise above 50, and DOGE needs to break out from the descending resistance line.

DOGE Price Prediction: Price Does Not Confirm Reversal Despite Breakout

Similarly to the weekly time frame, the daily one also provides conflicting readings, mostly relating to the price action.

On the bullish side, the DOGE price broke out from a descending resistance line on June 22. After validating it as support (green icon), the price resumed its upward movement. Moreover, DOGE reclaimed the $0.065 horizontal support area.

Additionally, the RSI broke its bearish trendline (green) and is now above 50.

However, DOGE has not moved above the 0.382 Fib retracement resistance level at $0.073. On the contrary, it was rejected by the resistance and is now trading below it.

So, the daily time frame also shows that the DOGE price trades below a crucial resistance level but above a crucial support level. As a result, the direction of the short-term breakout can also determine the long-term trend.

To conclude, the long-term DOGE price prediction will determine whether the meme coin breaks out from the long-term resistance line or down from the long-term horizontal support area. In the case of the latter, the price can increase to the next resistance at $0.15.

However, a sharp drop to $0.030 could follow if a breakdown occurs.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link

Be the first to comment