[ad_1]

Ripple (XRP) price made a 4% recovery on May 11 after a 12% decline in the previous seven days. On-chain data shows that intense trading activity by XRP whale investors could be behind the recent upswing. Is it indicative of a more bullish XRP price prediction?

Along with other mega-cap Layer-1 coins, XRP price took a significant hit in the past week. But the intense whale activity and the undersold status of the Ripple-backed XRP ledger native coin presents ample opportunity for strategic investors.

Here is why it could be indicative of a bullish XRP price prediction.

Whales Are Making Big Bets

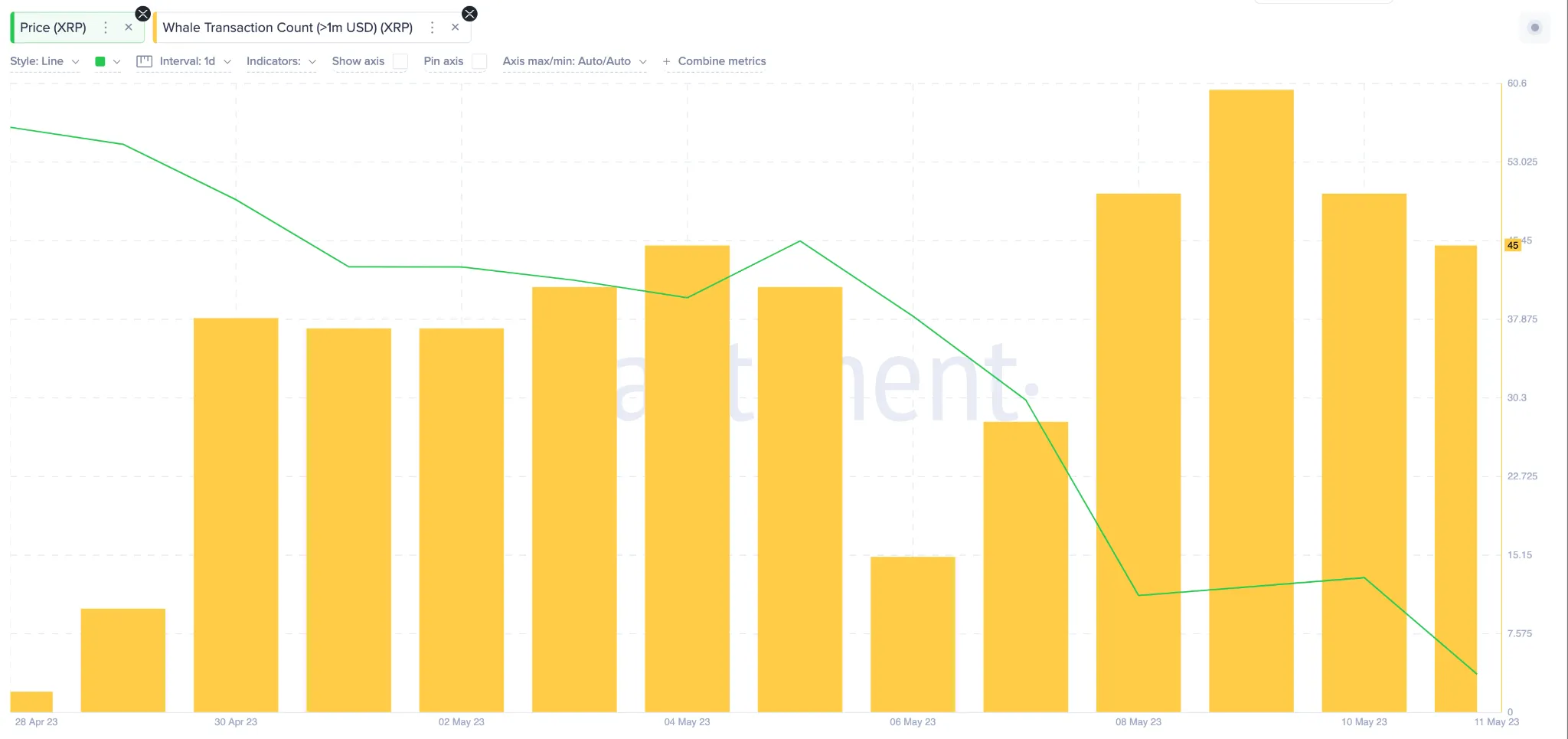

XRP whales have intensified their trading activity over the previous seven trading days. The chart below shows how the daily transactions exceeding $1 million increased from 15 to 45 between May 6 and May 12.

Whale Transaction Count is a financial metric that tracks the number of large transactions carried out daily. When it increases, it signals that whale investors are increasing their bets on the underlying asset.

XRP is Currently Undervalued

In further confirmation of the bullish XRP price prediction, on-chain data suggest that the recent price downtrend was largely due to macro factors and speculations.

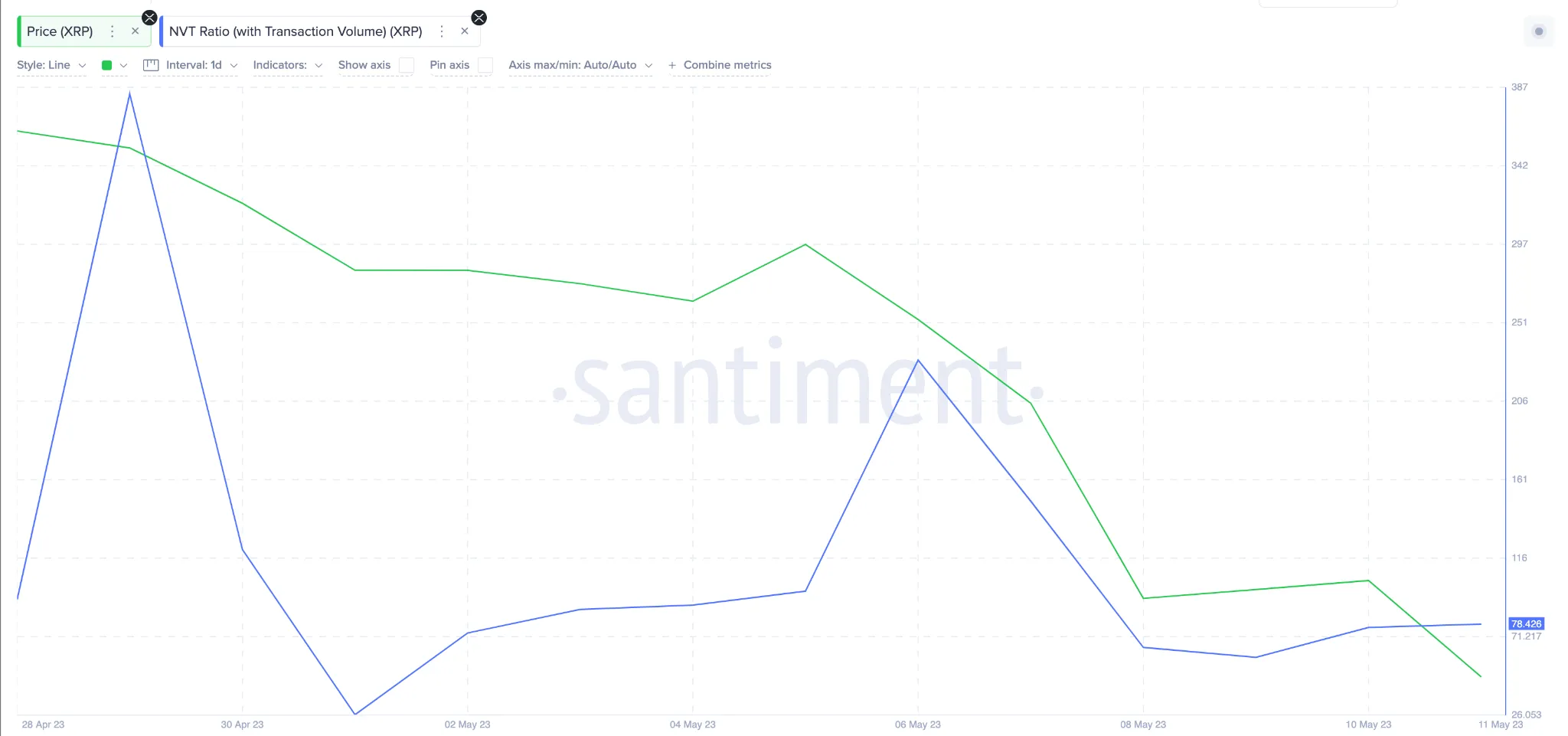

Network Value to Transaction Volume (NVT) depicts that there has not been a deterioration in the fundamental metrics of the XRP ledger network.

As seen below, the XRP NVT Ratio has dropped by 79% from 383.53 to 78.43 between April 29 and May 12.

Typically, strategic investors use the NVT ratio to assess the relationship between a cryptocurrency network’s market capitalization and the level of underlying transactional activity.

When the NVT ratio drops considerably, as observed above, the asset is undervalued and could be due for a bullish price reversal.

In summary, the increased whale activity and low NVT ratio could attract investors looking to enter the market at a critical positive turning point.

XRP Price Prediction: Bulls are Looking to Reclaim $0.50

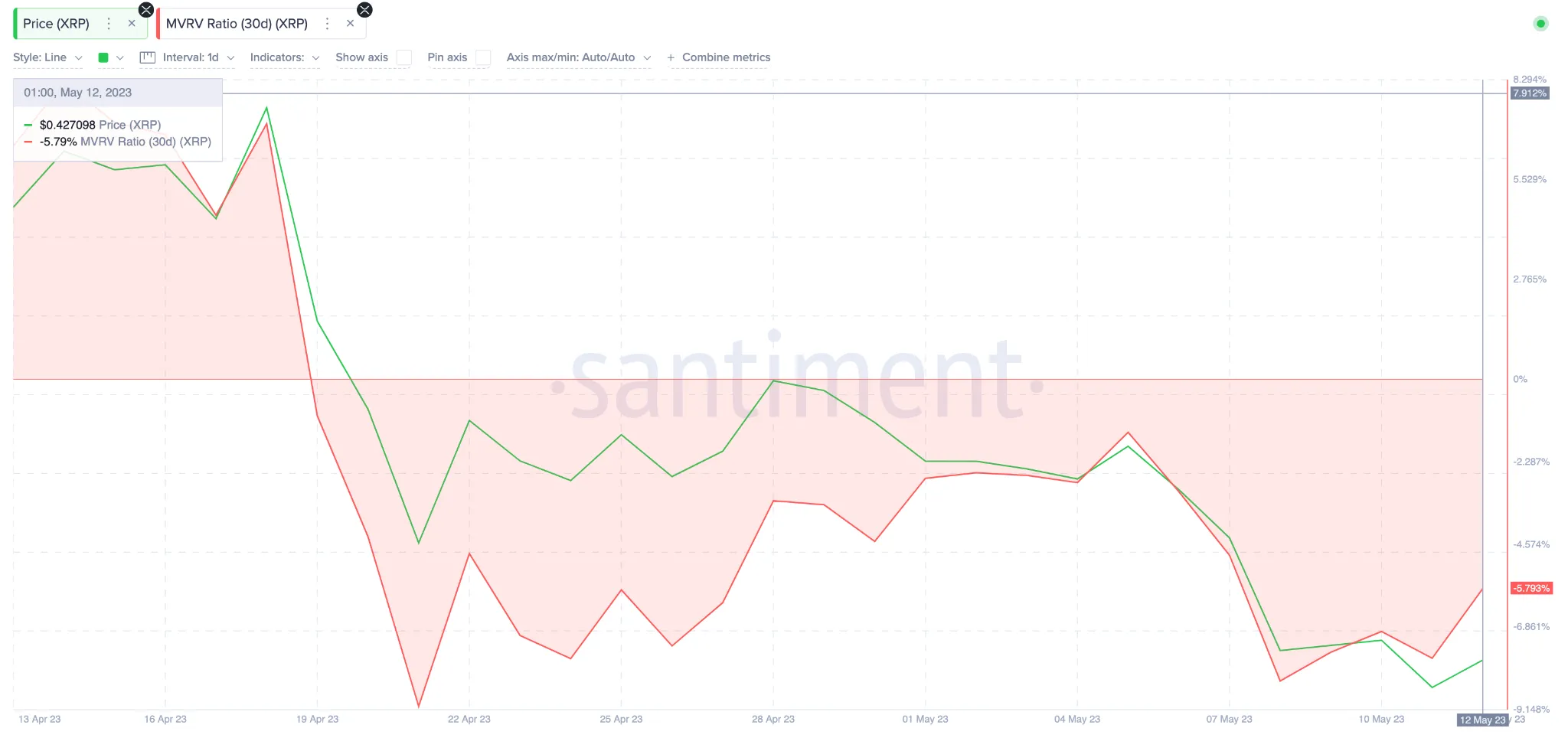

Over the past week, bullish XRP holders have defended the $0.40 support level. And according to Santiment’s Market-Value to Realized-Value (MVRV) data, a recovery may now be imminent.

Notably, most crypto investors that bought XRP within the past month are sitting on unrealized losses of about 6%. Historical data suggests they are unlikely to sell until the price surges by until they break even around $0.45.

And If XRP can break beyond that $0.45 resistance level, it could rise by another 7% toward the $0.50 zone before the bears begin to regroup.

Conversely, the bears could still flip the narrative if XRP price drops below $0.40. Nevertheless, investors will likely offer bullish support at this level as they look to keep their losses below 10%.

Otherwise, XRP could drop much further toward $0.35, which is the next significant support level.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link