[ad_1]

Michael Burry, the famous short seller, saw his firm Scion Asset Management take a hit in Q1 after it invested in several regional banks that have suffered steep drops in share prices.

Well-known short-seller Michael Burry, made famous by the book and film The Big Short, and his firm Scion have suffered a hefty loss this quarter. Scion Asset Management had purchased stocks in several regional banks, such as First Republic Bank, PacWest, and Western Alliance.

Banking Crisis Hits Financial World Hard

The firm had put about $2 million in First Republic Bank at the end of Q1, but the bank’s shares had fallen by a whopping 97% since then as it collapsed.

The other banks’ shares have fallen significantly as well. PacWest is down by 79% year-to-date, and Wester Alliance is down by 48% over the same period.

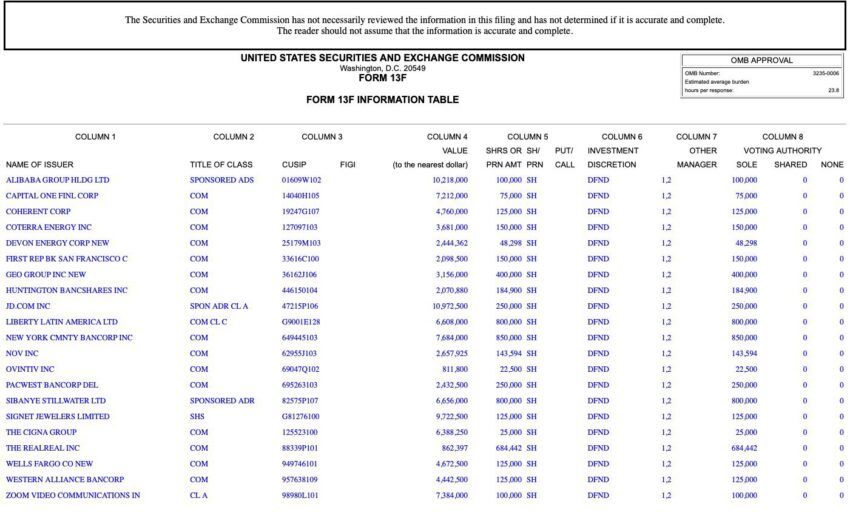

Currently, the U.S. equities portfolio of Scion is about $107 million. Companies in this portfolio include Alibaba, Capital One, Wells Fargo, Zoom, and Signet Jewelers.

The Chinese stocks of Jd.com and Alibaba Group form the two largest holdings of Scion. The firm is certainly under pressure from the banking situation, which still has global markets reeling.

The situation of banks in the United States has brought renewed attention to the health of the financial industry in the country and, by extension, globally. Victims of the banking crisis include Silicon Valley Bank, Signature Bank, Silvergate, and Credit Suisse.

The bailout costs are extensive, to the tune of $400 billion. Rescuing Silicon Valley Bank and Signature Bank comes to the tune of about $140 billion. Banks have also chipped in to help those that have fallen, with JPMorgan, Bank of America, and Citigroup providing $30 billion for First Republic Bank.

Michael Burry Skeptical of Crypto

Michael Burry’s position on crypto hasn’t been a favorable one. On one occasion in the past, Burry said that crypto shouldn’t be touched because “there is too much leverage.”

He said in a tweet on Nov. 9, 2022, that

“If you don’t know how much leverage is in crypto, you don’t know anything about crypto, no matter how much else you think you know.”

In December 2022, he further clarified his skepticism regarding crypto by saying that proof of reserve reviews like that offered by Binance were “essentially meaningless.” He was effectively saying this since crypto auditors were learning on the job.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment