Table of Contents

HBAR Price Prediction starts with one question

HBAR Price Prediction is not about guessing a number. It’s about answering one question: what has to be true for HBAR to be worth more tomorrow than it is today? If the answer is only “a bull market,” that’s not a thesis. That’s a bet on mood.

In this HBAR Price Prediction, we’ll build a clean framework: what Hedera is, why HBAR exists, what actually drives network value, how the price behaved across cycles, and what realistic scenarios look like for 2024, 2025, and 2030.

HBAR Price Prediction also needs a second rule: no forced narratives. Hedera is neither a guaranteed “Visa killer” nor a dead chain. It’s a high-performance network with a very specific design philosophy: speed, finality, predictable fees, and governance that enterprises can take seriously.

What Hedera is and why HBAR Price Prediction is different

HBAR Price Prediction is unusual compared with most L1 forecasts because Hedera does not present itself as “just another blockchain.” Hedera is often discussed as a blockchain platform, but the underlying structure is a Directed Acyclic Graph (DAG) style approach, where consensus can be reached without energy-intensive mining.

In classic Proof-of-Work systems, security comes from burning energy. In many Proof-of-Stake systems, security comes from capital and validator coordination. Hedera’s angle is different: it relies on hashgraph-style consensus and network messaging to reach agreement about transaction ordering.

That difference matters for HBAR Price Prediction because it influences throughput, cost, latency, finality, and the type of applications that can realistically run at scale without fee spikes.

The core mechanics behind Hedera and what they imply for HBAR Price Prediction

HBAR Price Prediction becomes more grounded when you understand how Hedera reaches consensus. Instead of miners competing, nodes communicate. They “compare notes” about transaction history and reach agreement on ordering and timing.

A commonly described concept in this model is the selection of “witnesses” and the network reaching a state of strong agreement about what other nodes will decide. The practical takeaway for HBAR Price Prediction is not the vocabulary. The takeaway is the output: fast consensus, low latency, and a design that targets very high transactions per second.

Hedera is positioned to process transactions in parallel rather than serially. If that holds in real-world usage, it supports an HBAR Price Prediction thesis where fees stay low even when activity rises.

The four Hedera services that directly impact HBAR Price Prediction

HBAR Price Prediction depends on what the network can do, and Hedera is typically explained through four main services.

HBAR token utility

HBAR is used for transaction fees and network operations. This is the first layer of HBAR Price Prediction logic: more real usage can translate into more fee demand and more economic activity denominated in HBAR.

Smart contracts

Hedera supports Solidity-based smart contracts. For HBAR Price Prediction, this means developers can build dApps with familiar tooling, which reduces friction. The important nuance is whether developers actually choose Hedera over alternatives, not whether Hedera can theoretically support them.

File service

Hedera’s file service is designed for distributed file storage with controls like append and deletion. HBAR Price Prediction can benefit from this because enterprise applications often need auditable storage primitives, not just token swaps.

Consensus service

The consensus service is built for fair, secure ordering of events for applications that need trust. HBAR Price Prediction gets stronger if this becomes a widely used “timestamping and ordering layer” for business workflows, supply chains, identity, and compliance-heavy systems.

Governance: the part that people love or hate, and why it matters for HBAR Price Prediction

HBAR Price Prediction gets polarized because Hedera’s governance is council-driven. The network is governed by a council of multinational corporations, and the council also oversees node operations and software administration.

This model has two big consequences for HBAR Price Prediction.

The bullish consequence: governance by known entities can reduce perceived institutional risk. Enterprises often prefer predictable governance, roadmaps, and accountability. If Hedera becomes a preferred network for real-world integrations, HBAR Price Prediction benefits from credibility.

The bearish consequence: crypto-native investors may discount the valuation due to perceived centralization or slower grassroots adoption. If “community energy” is what drives the next wave, HBAR Price Prediction could lag more narrative-heavy chains.

Both can be true depending on the cycle. That’s why this HBAR Price Prediction is scenario-based, not single-number-based.

Hedera adoption and partnerships in the HBAR Price Prediction story

HBAR Price Prediction improves when you map adoption to actual use cases rather than headlines.

Hedera raised significant funding via a token sale and launched mainnet in 2019. After that, it pursued collaborations across academia and industry, including large organizations such as Google joining the governing council and operating a node, and partnerships mentioned with IBM, LG, and Boeing.

HBAR Price Prediction also references ecosystem expansion such as token tooling, wallets like HashPack, and initiatives touching metaverse and NFT applications, where users pay fees in HBAR.

The BTCUSA lens here is simple: partnerships are potential energy. Only usage converts potential into value.

HBAR price history: what it teaches any HBAR Price Prediction model

HBAR Price Prediction should always include a price history sanity check.

HBAR traded in early ranges roughly around $0.01–$0.12 after launch. During the 2021 cycle, HBAR spiked hard, reaching an all-time high near $0.57. That move aligned with the broader market boom and liquidity expansion.

Then came the downside. HBAR followed the same pattern as most alts: sharp retracement, failed recoveries, and deep drawdowns through major market stress periods.

For HBAR Price Prediction, the critical lesson is that HBAR is an altcoin asset that has historically been dominated by macro liquidity and market regime. Even strong fundamentals do not automatically produce price appreciation on a straight line.

What market data means for HBAR Price Prediction right now

HBAR Price Prediction is often misread when people focus only on “how far we are from ATH.” Distance from ATH is not a catalyst. It’s just math.

Key observations from the provided stats:

HBAR has been far below its all-time high, implying a large recovery runway if the next cycle returns. HBAR remains meaningfully above its all-time low, implying that the market is still pricing a non-zero future.

Technical signals described include a bearish-to-neutral sentiment zone, a mid-range fear/greed reading, and moving averages that can act as resistance. RSI in the high-30s area typically aligns with weak momentum, not confirmed reversal.

For HBAR Price Prediction, that combination usually means one thing: the asset needs a catalyst, either macro liquidity or a clear adoption narrative that translates into visible usage.

The BTCUSA framework for HBAR Price Prediction

HBAR Price Prediction is most useful when it’s built on a repeatable framework. Here is the one we’ll use.

Network value drivers

HBAR Price Prediction rises in quality when it answers which drivers matter most. For Hedera, the top drivers are likely: real transaction volume, fee demand, enterprise integrations, and developer adoption.

Cycle sensitivity

HBAR Price Prediction must accept that HBAR is historically cycle-sensitive. In risk-off regimes, valuation compresses. In risk-on regimes, narratives and liquidity matter more than fundamentals.

Catalyst hierarchy

HBAR Price Prediction should rank catalysts by strength. A broad market risk-on shift is typically the strongest. Large-scale usage growth is second. New listings or short-term hype is weaker unless it produces sustained attention.

Scenario modeling

HBAR Price Prediction should not pretend the world has one future. We will model bearish, base, and bullish scenarios.

HBAR Price Prediction for 2026: post-cycle reality check

HBAR Price Prediction for 2026 shifts from anticipation to verification. By this point, the market will already have experienced at least one full expansion phase, and the key question will no longer be “what could happen,” but “what actually worked.”

In 2026, HBAR Price Prediction becomes less about speculative upside and more about sustainability. If Hedera managed to convert enterprise partnerships into measurable, ongoing network usage during the previous cycle, the market may start treating HBAR less like a pure altcoin and more like infrastructure exposure.

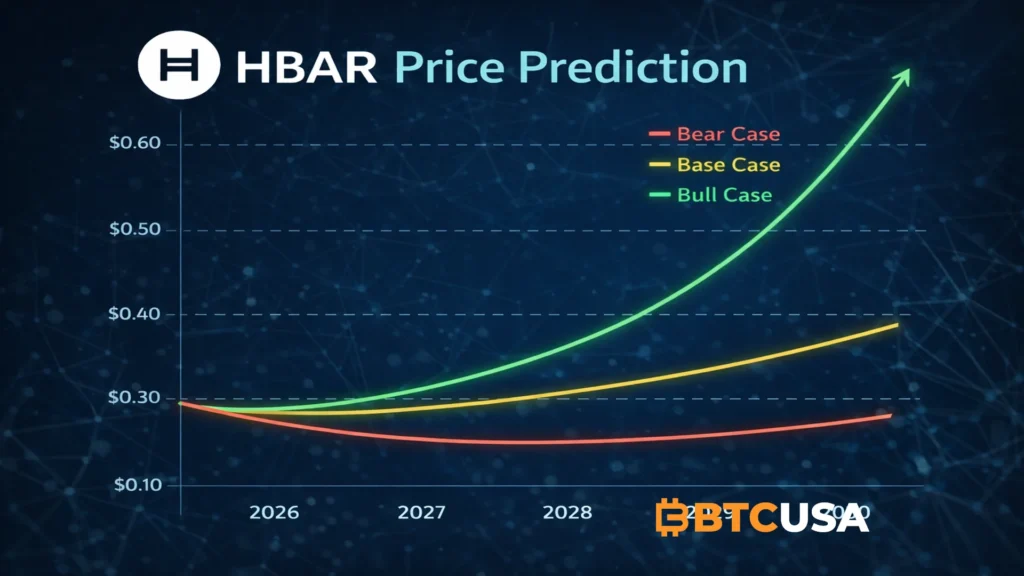

Bear case 2026

In a weaker scenario, HBAR Price Prediction reflects post-cycle fatigue. Liquidity tightens, speculative capital rotates elsewhere, and assets without strong narrative momentum often retrace significantly. In this environment, HBAR could spend extended time consolidating below prior cycle highs, with price action dominated by long-term holders rather than new inflows. Stability matters more than growth here.

Base case 2026

In the base scenario, HBAR Price Prediction assumes Hedera maintains relevance after the cycle peak. If real usage persists and the network avoids sharp declines in activity, HBAR can defend higher structural levels compared to previous bear phases. Price may oscillate within a broad range rather than collapse, reflecting a gradual transition toward a more mature valuation profile.

Bull case 2026

In a stronger outcome, HBAR Price Prediction benefits from the market beginning to price durability rather than hype. If Hedera is perceived as one of the networks that survived and delivered through volatility, HBAR could establish a higher long-term floor. Upside in this case is driven less by speculation and more by confidence in continued network relevance.

HBAR Price Prediction for 2027: maturity versus momentum

HBAR Price Prediction for 2027 sits at an interesting crossroads. Historically, this phase tends to separate assets that fade after a cycle from those that mature into long-term infrastructure plays.

By 2027, HBAR Price Prediction will largely depend on whether Hedera has proven it can operate as a dependable settlement and consensus layer beyond bullish market conditions. The narrative shifts from growth-at-all-costs to resilience and integration.

Bear case 2027

In a pessimistic scenario, HBAR Price Prediction reflects market disinterest. If newer architectures or ecosystems capture developer and user attention, HBAR may struggle to regain momentum. Price action in this case becomes increasingly range-bound, with valuation anchored more to survival than expansion.

Base case 2027

In a realistic base case, HBAR Price Prediction assumes steady but unspectacular progress. Hedera continues operating, serving specific enterprise and institutional niches, while HBAR trades as a mid-cap asset with periodic volatility. Price appreciation is slower and more selective, tied to real adoption milestones rather than broad market euphoria.

Bull case 2027

In a strong scenario, HBAR Price Prediction benefits from a re-rating as infrastructure. If Hedera becomes deeply embedded in payments, identity, compliance, or event-ordering use cases, the market may begin valuing HBAR as a long-duration asset rather than a cycle-dependent trade. In this case, upside comes from credibility and persistence, not hype.

HBAR Price Prediction for 2028: consolidation or quiet expansion

HBAR Price Prediction for 2028 sits in a phase that often gets overlooked: the period after excitement fades but before the next narrative fully forms.

By 2028, the market is usually less emotional. Capital becomes more selective, and assets that survived earlier volatility are judged by consistency rather than momentum. In this environment, HBAR Price Prediction is shaped less by headlines and more by whether Hedera continues to deliver stable, measurable utility.

In a weaker scenario, HBAR Price Prediction for 2028 reflects consolidation. Price action may compress into narrower ranges as speculative interest declines. This is not necessarily bearish, but it does mean limited upside without a fresh catalyst. HBAR in this case behaves more like a utility asset than a growth play.

In a base scenario, HBAR Price Prediction assumes gradual expansion without hype. If Hedera maintains steady transaction growth and avoids ecosystem stagnation, HBAR can slowly appreciate alongside broader infrastructure adoption. The key feature of this year is not acceleration, but durability.

In a stronger scenario, HBAR Price Prediction benefits from the market beginning to differentiate between “survivors” and “leaders.” If Hedera is perceived as reliable infrastructure during a quieter market phase, it can quietly build valuation without speculative excess.

HBAR Price Prediction for 2029: positioning ahead of the next regime shift

HBAR Price Prediction for 2029 often becomes forward-looking rather than reactive. Historically, markets begin positioning for the next regime change before it becomes obvious.

In this context, HBAR Price Prediction for 2029 depends heavily on expectations rather than current conditions. If Hedera has demonstrated consistent relevance through 2026–2028, the market may start repricing HBAR in anticipation of renewed liquidity and broader risk-on behavior.

In a conservative scenario, HBAR Price Prediction remains cautious. The market acknowledges Hedera’s survival but hesitates to price in aggressive growth. Valuation remains anchored to utility, with limited speculative premium.

In a base scenario, HBAR Price Prediction improves as anticipation builds. HBAR may begin outperforming purely stagnant assets, not because of hype, but because it offers exposure to infrastructure that already exists rather than promises that may never materialize.

In a bullish positioning scenario, HBAR Price Prediction reflects early accumulation. Capital rotates into assets perceived as “ready” for the next expansion phase. In this case, price action may strengthen before any obvious catalyst appears, driven by forward-looking allocation rather than reactionary trading.

HBAR Price Prediction for 2030: long-term outcome, not a sudden breakthrough

HBAR Price Prediction for 2030 should be understood as the outcome of decisions and performance in the years leading up to it, not as a standalone event.

By 2030, the market’s primary question shifts from growth potential to structural relevance. At this stage, HBAR Price Prediction is less sensitive to short-term sentiment and more influenced by whether Hedera has secured a durable role in global digital infrastructure.

In a weaker long-term outcome, HBAR Price Prediction reflects persistence without dominance. Hedera continues operating within specific enterprise niches, and HBAR trades as a functional asset with limited speculative appeal. Price stability matters more than expansion in this scenario.

In a base long-term outcome, HBAR Price Prediction assumes that steady adoption and credibility earned over previous years allow HBAR to revisit higher historical valuation zones during favorable market regimes. The price reflects accumulated trust rather than excitement.

In a strong long-term outcome, HBAR Price Prediction aligns with higher valuation ranges, including the $0.50–$0.60 zone discussed earlier, but only if Hedera becomes a widely used settlement, consensus, or event-ordering layer at scale. In this case, price appreciation represents long-term economic throughput rather than a single cycle peak.

The defining characteristic of 2030 is continuity. The valuation reflects what Hedera has proven, not what it promises.

Conclusion: HBAR Price Prediction as a multi-year process

HBAR Price Prediction makes the most sense when it is viewed as a sequence, not a target.

From 2026 through 2029, each year tests a different aspect of Hedera’s viability: survival, maturity, durability, and positioning. By the time 2030 arrives, the outcome is largely determined by whether those earlier phases were navigated successfully.

This is why HBAR Price Prediction should not be reduced to a single number or a single year. The real signal is whether Hedera continues to matter when attention shifts, narratives rotate, and liquidity contracts.

If Hedera demonstrates sustained relevance across multiple market regimes, HBAR naturally earns higher long-term valuation. If it fails to do so, even optimistic price targets lose credibility.

In that sense, HBAR Price Prediction is not about predicting the future. It is about observing which conditions actually materialize — and adjusting expectations accordingly.