[ad_1]

European and American tech stocks are witnessing a sharp decline while Bitcoin breaks through the $30,000 barrier.

As traditional finance (TradFi) behemoths deepen their involvement in cryptos, the market reacts with a bullish sentiment, starkly contrasting with the decline observed in tech stocks on both sides of the Atlantic.

European and American Stocks Tumble

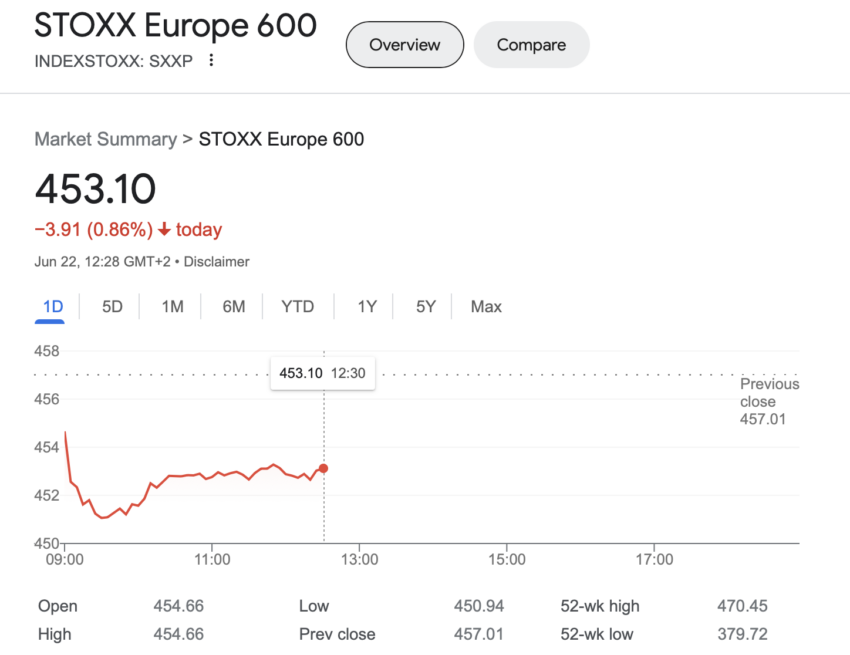

European equities are on a four-day downward streak, the longest since December. It appears to be catalyzed by hawkish cues from central banks and the Bank of England’s interest rates hike of half a percentage point to 5%.

The Stoxx Europe 600 Index has dropped 0.9%, with technology stocks and key sectors like banking, automotive, and travel facing the brunt of the decline.

Across the pond, Wall Street, too, is feeling the burn. The tech-heavy Nasdaq Composite fell 1.2%, recording its third successive session of losses.

Federal Reserve Chair Jerome Powell’s warning about further rate hikes to tackle inflation has caused investors to be increasingly cautious. Subsequently, denting tech stocks as the prospect of long-term growth diminishes.

The recent market turbulence is prompting investors to reassess their previously optimistic forecasts. Expectations of an end to rate increases have been upended as inflation proves tougher to tame than anticipated.

This shift is forcing market participants to contemplate a bleak economic landscape. Especially with the probability of a recession in the first quarter of next year becoming increasingly real.

“The Fed will have to keep rates higher for longer and what this means is that the market cannot expect any cut for 2024, and this will probably accelerate the probability for a recession in the first quarter of next year,” said Alberto Tocchio, portfolio manager at Kairos Partners.

Bitcoin Surpasses the $30,000 Mark

Meanwhile, Bitcoin broke past $30,000 for the second time this year. The world’s largest cryptocurrency by market value has gained over 10% in the past 24 hours.

Significant investment from TradFi players buoys the recent price upswing. BlackRock, Invesco, and WisdomTree, all of whom have filed for spot Bitcoin ETF applications.

The arrival of EDX, a crypto exchange backed by heavyweights like Fidelity Digital Assets, Charles Schwab, and Citadel Securities, has further galvanized this trend. Even the recent regulatory crackdown by the US Securities and Exchange Commission (SEC) on crypto exchanges does not deter these firms from dipping into digital assets.

“We’re experiencing a confluence of events that is shaping up to be bullish for Bitcoin and digital assets more generally. You now have institutions like BlackRock and Fidelity getting into the space in a significant way, and these moves appear not to have been priced in,” said Leo Mizuhara, CEO at Hashnote.

While traditional tech stocks are feeling the pressure from hawkish central bank policies and inflation concerns, Bitcoin is carving out its path, fueled by increased interest from major traditional financial.

The current climate underscores the importance of diversification in investment portfolios. The emphasis falls on the reality that while downturns affect some sectors, others stand ready for growth.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment